TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Tesla Inc Shares

Keep On Delivering!

And Members Are Up 107% Potential Profit,

Using A Weekly Call Option,

After Selling The Rest Of Their Contracts!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profit Of 107%,

After Selling The Rest of

Their Tesla Inc Shares.

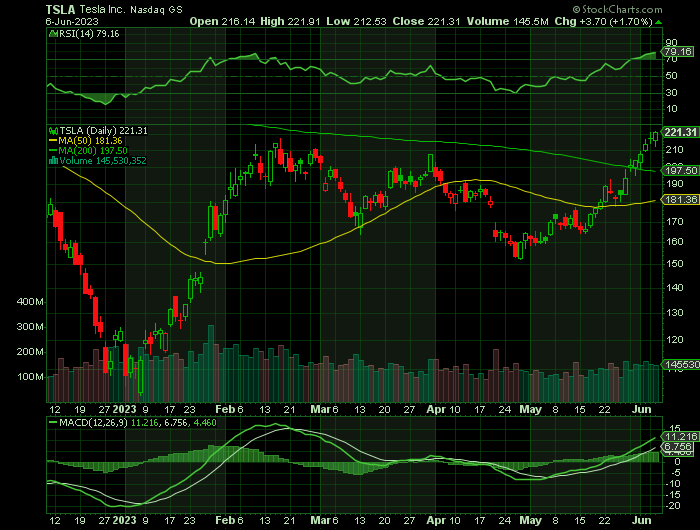

TSLA jumped 1.7% to $217.61 Monday. The stock

cleared the 200-day moving average a week ago.

Tesla stock surged 10.8% to $213.97 last

week.

On Friday, shares jumped 3.1%, running past an official $207.79 buy point

from what's either a cup or a double-bottom base.

Where To Now?

Tesla jumped Monday clearing the 200-day moving average a week ago. Also, Tesla Model 3 vehicles now qualify for $7,500 electric vehicle consumer tax credits.

As well, a trial court properly found that Telsa Inc chief Elon Musk did not push the electric carmaker to overpay for SolarCity in 2016, the Delaware Supreme Court said on Tuesday, ending years of litigation over the $2.6 billion deal.

This set the scene for Weekly Options USA Members to profit by 107%, using a TSLA Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, June 06, 2023

by Ian Harvey

Prelude…..

Tesla Inc (NASDAQ: TSLA)’s stock was one of the biggest beneficiaries of the easy-money policies put in place during the covid pandemic. Between its low in March 2000 and its high in November 2021, Tesla’s stock gained an astounding 1,674%.

However, Tesla Inc shares fell 75% from its peak to its January 2023 low. That tumble likely encouraged many who were betting against Elon Musk by shorting Tesla stock. However, it’s been anything but good news for short-sellers since then, given Tesla’s nearly doubled by mid-February.

More recently, Tesla’s stock has settled into a trading range between $152 and $218. But, last week, the stock closed above its 200-day moving average (DMA) for the first time since September on heavy volume.

Tesla's stock price has recovered its 200-day moving average, potentially paving the way to higher prices.

Why the TESLA Weekly Options Trade was Originally Executed?

The stock market rally had a solid session Thursday. After starting off mixed, the major indexes rebounded and moved higher, though they pared gains near the close. Market breadth was strong. Several stocks made bullish moves while some early earnings losers roared back. Falling Treasury yields and a weaker dollar provided a boost.

Tesla Inc (NASDAQ: TSLA) stock is making bullish moves and is trying to break out. Tesla stock rose 1.8% to 207.52. Intraday, shares hit 209.80, briefly clearing a 207.89 buy point from what's either a cup or double-bottom base. Notably, TSLA stock has advanced on above-average volume for four straight sessions, after few such days in the prior three months.

Shares rose slightly early Friday, signaling a continuation of the breakout attempt.

There had been speculation that Elon Musk would unveil a revamped Model 3 at the Shanghai plant on Thursday, but he did not. Meanwhile, Tesla is increasing discounts on U.S. inventory, choosing not to cut official prices for now.

The TSLA Weekly Options Trade Explained.....

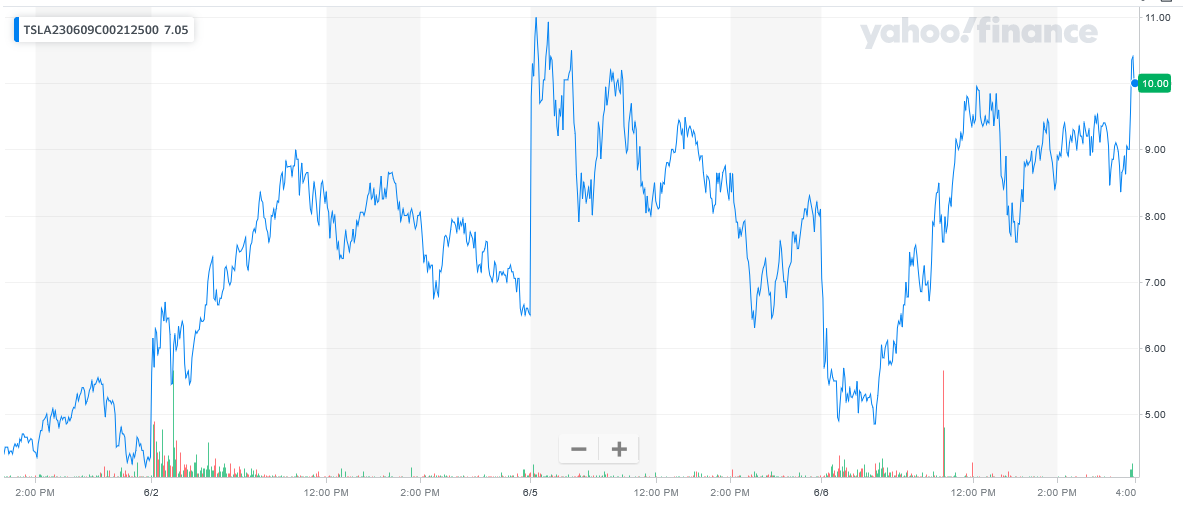

** OPTION TRADE: Buy TSLA JUN 09 2023 212.500 CALLS - price at last close was $4.35 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the TSLA Weekly Options (CALL) Trade on Friday, June 02, 2023, at 9:46, for $5.45.

Sold half the TSLA weekly options contracts on Friday, June 02, 2023, at 11:31 (less than 2 hours), for $9.00; a potential profit of 54%.

Sold Remaining Tesla Inc Shares on Monday, June 05, 2023, for $11.30: a potential profit of 107%.

Stage 1: Total Dollar Profit is $900 - $545 (cost of contract) = $355

Stage 2: Total Dollar Profit is $1,130 - $545 (cost of contract) = $585

Total Potential Profit is $355 + 585 = $940

Holding the remaining TSLA weekly options contracts for further profit next week.

Don’t miss out on further trades – become a member today!

Where To Now For Tesla Inc Shares?

A trial court properly found that Telsa Inc chief Elon Musk did not push the electric carmaker to overpay for SolarCity in 2016, the Delaware Supreme Court said on Tuesday, ending years of litigation over the $2.6 billion deal.

Tesla claims all of its Model 3 vehicle trims are now eligible for the full tax credit under the Inflation Reduction Act (IRA). The Internal Revenue Service verified that claim Tuesday.

The Biden administration said on March 31 that vehicles eligible for the full $7,500 tax credit must have batteries with specific quantities of components manufactured in North America and critical minerals sourced in the U.S. or from certain countries.

Vehicles that meet only one of the critical minerals or battery components requirements are eligible for a $3,750 tax credit. At the time, the base rear-wheel drive Model 3, with its battery from China, did not qualify for the full tax credit.

Tesla stock shrugged off early losses and climbed 1.7% to 221.31 Tuesday. It turned higher just after the IRS confirmed the Model 3 eligibility. TSLA has gained in the past seven sessions. It is up more than 100% above early January lows of 101.81.

Daily trading volume has been above average since last Wednesday, suggesting some investors may be moving off the sidelines. It may also signal that those short Tesla’s shares are buying to cover positions to protect against additional losses. According to NASDAQ data, over 95 million shares were held short in Tesla in mid-May.

For Further Information Read….. “Tesla Shares Jump Into A Buy Zone!”

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from TESLA

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!