TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Tesla Shares Jump

Into A Buy Zone!

And Members Are Up 65% Potential Profit,

In Less Than 2 Hours,

Using A Weekly Call Option!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profit Of 65%,

In Less Than 2 Hours, After

Tesla Shares Make Bullish Move And Starts To Break Out.

Tesla Has About 50% Of The U.S. Ev Market

And 20% In Europe.

And In The First Quarter Of This Year, Its Model Y Was The

Best-Selling Vehicle

In Both Markets (Excluding Pickup Trucks).

Where To Now?

Tesla shares are firmly positioned in the growing field of artificial intelligence from the carmaker's inception. As Tesla stock approaches a new buy zone an opportunity for a Weekly Options Call trade presents itself.

This set the scene for Weekly Options USA Members to profit by 65%, in less Than 2 Hours, using a TSLA Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, June 02, 2023

by Ian Harvey

Prelude…..

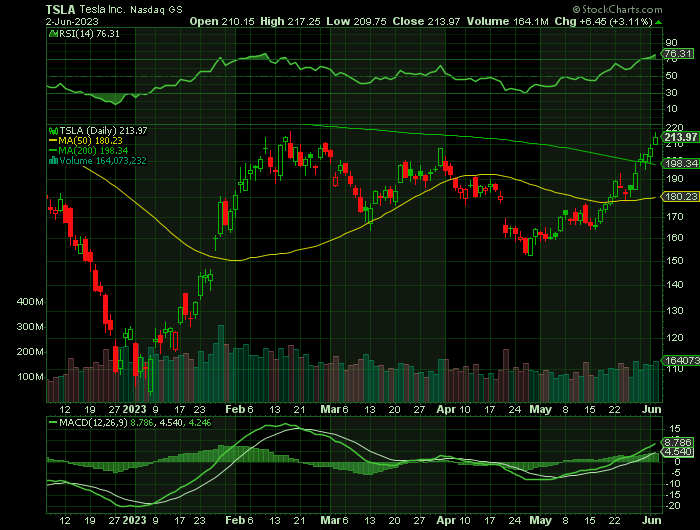

Tesla Inc (NASDAQ: TSLA) stock boomed in early 2023 after a terrible 2022. After consolidating for several months, TSLA has broken out into a buy zone.

Tesla deliveries in the first quarter hit a record 422,875, up 36% vs. a year earlier. But they only rose 4% vs. the fourth quarter, despite big Tesla price cuts and U.S. EV tax credits.

The oft-delayed Cybertruck is expected to begin early production sometime this summer. That will be the EV maker's first new vehicle since the Model Y launched in early 2020.

Tesla production capacity continues to ramp up its Berlin and Austin plants after significantly expanding its mammoth Shanghai factory last year.

Tesla has its own Supercharger network in its markets. That's especially important in the U.S. and countries like Australia, where third-party charging facilities are limited.

Tesla stock plunged 65% in 2022. Shares are now up 73.7% in 2023.

Tesla stock has a market cap of $678.2 billion as of June 2, off its peak valuation above $1 trillion but well above early January lows. That's far above BYD's $85.9 billion.

Why the TESLA Weekly Options Trade was Executed?

The stock market rally had a solid session Thursday. After starting off mixed, the major indexes rebounded and moved higher, though they pared gains near the close. Market breadth was strong. Several stocks made bullish moves while some early earnings losers roared back. Falling Treasury yields and a weaker dollar provided a boost.

Tesla Inc (NASDAQ: TSLA) stock is making bullish moves and is trying to break out. Tesla stock rose 1.8% to 207.52. Intraday, shares hit 209.80, briefly clearing a 207.89 buy point from what's either a cup or double-bottom base. Notably, TSLA stock has advanced on above-average volume for four straight sessions, after few such days in the prior three months.

Shares rose slightly early Friday, signaling a continuation of the breakout attempt.

There had been speculation that Elon Musk would unveil a revamped Model 3 at the Shanghai plant on Thursday, but he did not. Meanwhile, Tesla is increasing discounts on U.S. inventory, choosing not to cut official prices for now.

The TSLA Weekly Options Trade Explained.....

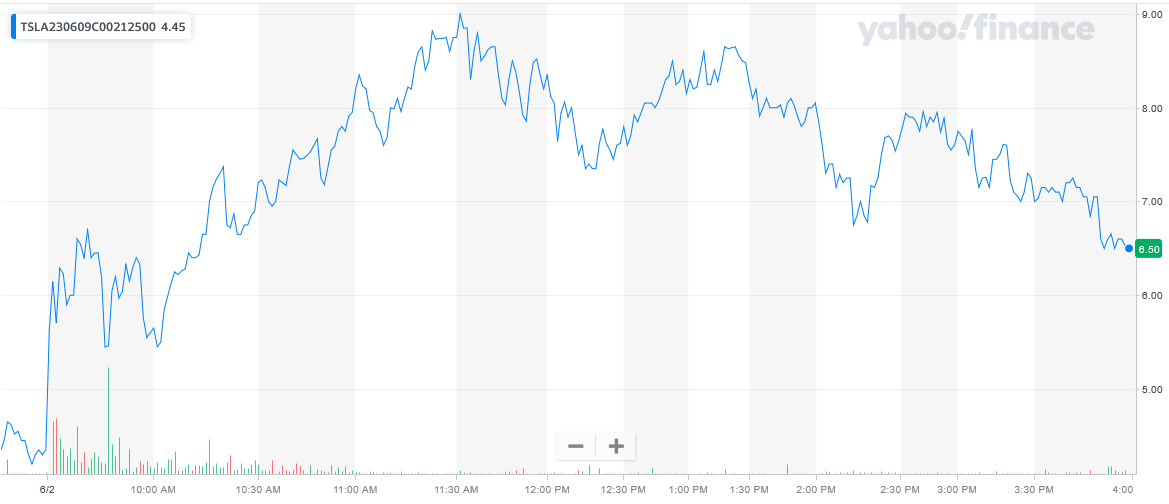

** OPTION TRADE: Buy TSLA JUN 09 2023 212.500 CALLS - price at last close was $4.35 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the TSLA Weekly Options (CALL) Trade on Friday, June 02, 2023, at 9:46, for $5.45.

Sold half the TSLA weekly options contracts on Friday, June 02, 2023, at 11:31 (less than 2 hours), for $9.00; a potential profit of 54%.

Total Dollar Profit is $900 - $545 (cost of contract) = $355

Holding the remaining TSLA weekly options contracts for further profit next week.

Don’t miss out on further trades – become a member today!

About Tesla.....

Tesla, Inc. is the world's leading manufacturer of electric vehicles. With more than 26% of the market share in 2022, the company's leadership position is all but assured for the coming decade if not longer. While specifically an EV manufacturer, however, the company is also engaged in many related and unrelated ventures that could produce significant results for shareholders.

Tesla, Inc. was first incorporated in 2003 in California as Tesla Motors, Inc but later changed its name. Founded by Martin Eberhard and Marc Terpening, Elon Musk became the company's largest shareholder in 2006 and then its CEO in 2008. Tesla went public via IPO in 2010 making it the first American automobile company to do so since Ford back in 1956. The company reached a half million in annual vehicle sales in 2020 and crossed over the 1 million mark in 2022.

Under Musk's guidance, the company was reborn and moved away from the high-end sports-car segment and into a line of cars geared toward a larger audience. The first model, the Roadster, was soon eclipsed by the Model S which is the top-selling plug-in EV car to this day. Follow-on models include the Model X SUV in 2015, the Model 3 sedan in 2017, and the Model Y crossover in 2020.

Tesla, Inc.'s name change came in 2017 shortly after then and current CEO Elon Musk agreed to acquire SolarCity and expand the company's product line. Tesla is now headquartered in Austin, Texas, and operates global manufacturing capacity through a network of Gigafactories. The company has 5 Gigafactories in key locations around the world with a 6th planned. The Gigafactories are noteworthy for multiple reasons including their size, end-to-end production capability, and non-reliance on grid-supplied power.

Further Catalysts for the TESLA Weekly Options Trade…..

Tesla has about 50% of the U.S. EV market and 20% in Europe. And in the first quarter of this year, its Model Y was the best-selling vehicle in both markets (excluding pickup trucks). While competition is certainly heating up in the EV space, Tesla is unlikely to be toppled soon, thanks to its manufacturing dominance.

Tesla's vehicle production rose 44% year over year in the first quarter to 440,000, and its deliveries jumped 35% to more than 422,000. Contrast that with some of Tesla's newest EV rivals, Rivian and Lucid, which are struggling to ramp up their manufacturing.

According to an International Energy Agency report, EV sales are forecast to account for 60% of all new vehicles sold by 2030, and Tesla is already in full production mode. The company has years of EV manufacturing under its belt, while smaller competitors are stumbling and prominent auto manufacturers are trying to find their footing.

Other Positive Catalysts.....

1. Price Cuts Sparking Demand.....

Over the years, Tesla CEO Elon Musk has often said that the EV maker has a supply problem, not a demand problem. However, in early 2023, Musk boldly cut prices to counter rising interest rates that are driving financing costs higher, compete with rivals, and allow several models to be eligible for the hefty $7,500 tax rebates for electric vehicles. (Allowed on EVs under 55,000 and electric SUVs and trucks under $80,000).

2. Stock Repurchase Plan.....

Apple is the best example of using buybacks to its advantage. AAPL has the most aggressive share repurchase plan on Wall Street, and the success of the strategy is undeniable. Stock buybacks increase earnings per share (The total number of shares outstanding decreases), create a favorable imbalance between supply and demand (Publics supply of shares is lower), and imply that the stock is undervalued and that it expects future growth. In Tesla’s recent earnings calls, Elon Musk suggested that the company would do a “meaningful buyback” in the fourth quarter of 2023.

3. A Hummer Replacement.....

In the early 2000s, General Motors saw a wave of success with its best-selling Hummer SUV. The eccentric army truck became popular with people from all walks of life who wanted to stand out on the roads. However, during the 2008 financial crisis, the viability of the Hummer came into question. Not only was the economy working against it, but sky-high oil prices also made its gas-guzzling nature unattractive, and the green movement in the United States was beginning and consumers were looking to decrease their carbon emissions.

Later this year, Tesla will launch its “Hummer killer,” the obnoxious-looking Cybertruck. The Cybertruck SUV is unlikely to run into the same issues the Hummer did for two reasons. First, unlike in 2008, 2023’s economy is not on the brink of collapse. If you use the Tesla Model Y SUV sales as a precedent, consumers are not only attracted to EVs, but also willing to pay a premium. Second, because the Cybertruck is fully electric, it will attract environmentally conscious consumers.

4. Full Self-Driving (FSD) Deployment.....

Tesla continues to refine and improve its AI-powered self-driving program. Already, FSD is much safer than the average driver on the road. In a recent interview, Musk seemed very bullish on FSD’s potential, saying “Tesla will have a Chat-GPT moment later this year.” Musk should know – he was the brains and investment behind Open AI’s Chat-GPT.

5. Electrifying “Non-Automotive” Growth.....

Over the last few years, Tesla’s energy generation and storage revenues have been growing at a CAGR of 47%. Tesla’s “Megapack” deployment is expected to rocket higher by 135% in 2023.

Analysts.....

According to the issued ratings of 36 analysts in the last year, the consensus rating for Tesla stock is Hold based on the current 4 sell ratings, 15 hold ratings and 17 buy ratings for TSLA. The average twelve-month price prediction for Tesla is $204.33 with a high price target of $366.67 and a low price target of $33.33.

Summary.....

Over the years, Tesla has shifted from developing niche products for affluent buyers to making affordable electric vehicles for the masses. Though there have been many naysayers along the way, shares have increased by more than 12,000%. Despite a brutal correction in 2022, the EV maker has delivered positive earnings surprises in nine straight quarters, and shares have begun to recover as a result.

Shares of TSLA traded up $2.72 during mid-day trading on Thursday, reaching $206.65. 97,639,907 shares of the company’s stock were exchanged, compared to its average volume of 154,948,453. The company has a debt-to-equity ratio of 0.03, a current ratio of 1.57 and a quick ratio of 1.04. The stock has a market capitalization of $654.98 billion, a PE ratio of 59.98, a price-to-earnings-growth ratio of 2.70 and a beta of 2.00. The business’s fifty day simple moving average is $179.36 and its 200-day simple moving average is $171.99. Tesla, Inc. has a 52-week low of $101.81 and a 52-week high of $314.67.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from TESLA

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!