TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Toll Brothers Weekly Options Trade Provides 112% Potential Profit!

Members of “Weekly Options USA,” Using A Weekly Call Option, Are Up 112%

Due To TOL Cutting Its Deliveries Outlook!

More to come?

Join

Us and GET FUTURE TRADEs!

Toll Brothers shares fell after the homebuilder cut its deliveries outlook as the housing market cools.

Now, analysts covering the stock delivered a dose of negativity to shareholders by making a substantial revision to their statutory forecasts for next year.

As well, Goldman Sachs Chief Economist Jan Hatzius asserted that further housing pressure is likely, writing in a new note ominously titled: "Housing Downturn: Further to Fall."

This set the scene for Weekly Options USA Members to profit by 112% using a Weekly Put Option!

Join Us And Get The Trades – become a member today!

Thursday, September 01, 2022

by Ian Harvey

Why the Profit on Toll Brothers Stock?

Toll Brothers Inc (NYSE: TOL) shares fell after the homebuilder cut its deliveries outlook as the housing market cools. Toll Brothers expects to deliver between 10,000 and 10,300 homes in FY 2022, noting ‘continued labor shortages and supply chain disruptions, as well as a softer demand environment.’

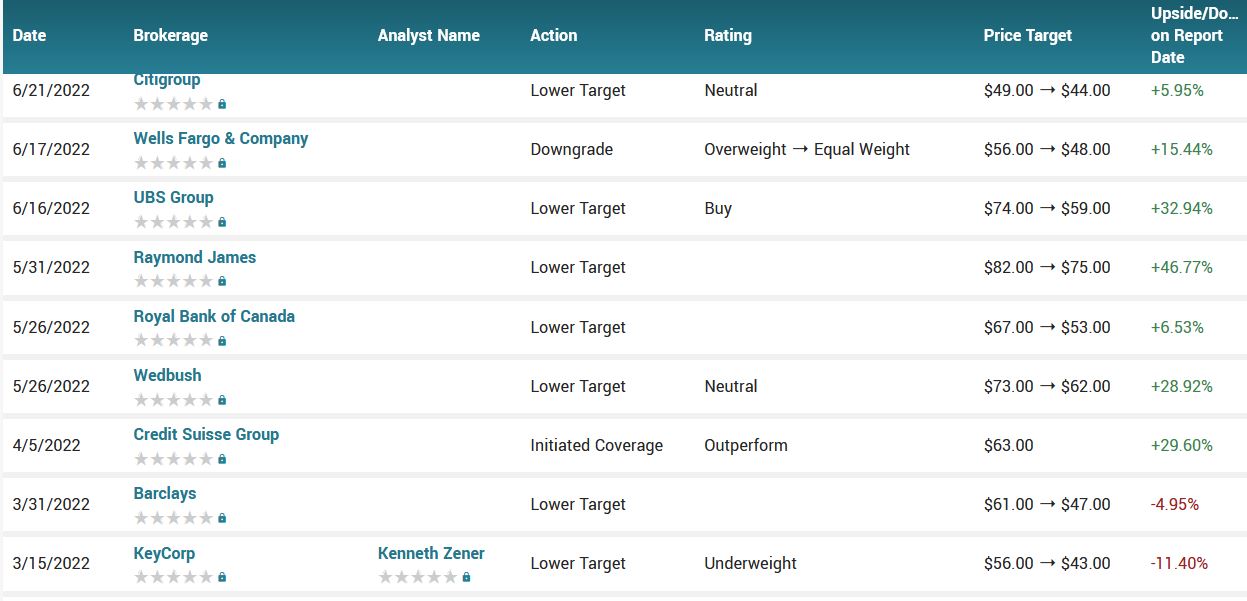

The analysts covering Toll Brothers delivered a dose of negativity to shareholders by making a substantial revision to their statutory forecasts for next year. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Toll Brothers. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market.

Also, rising interest rates are thwarting the U.S. housing market's momentum, hammering many stocks tied to the fortunes in the sector.

Goldman Sachs Chief Economist Jan Hatzius asserted that further housing pressure is likely, writing in a new note ominously titled: "Housing Downturn: Further to Fall."

The Profits Explained.....

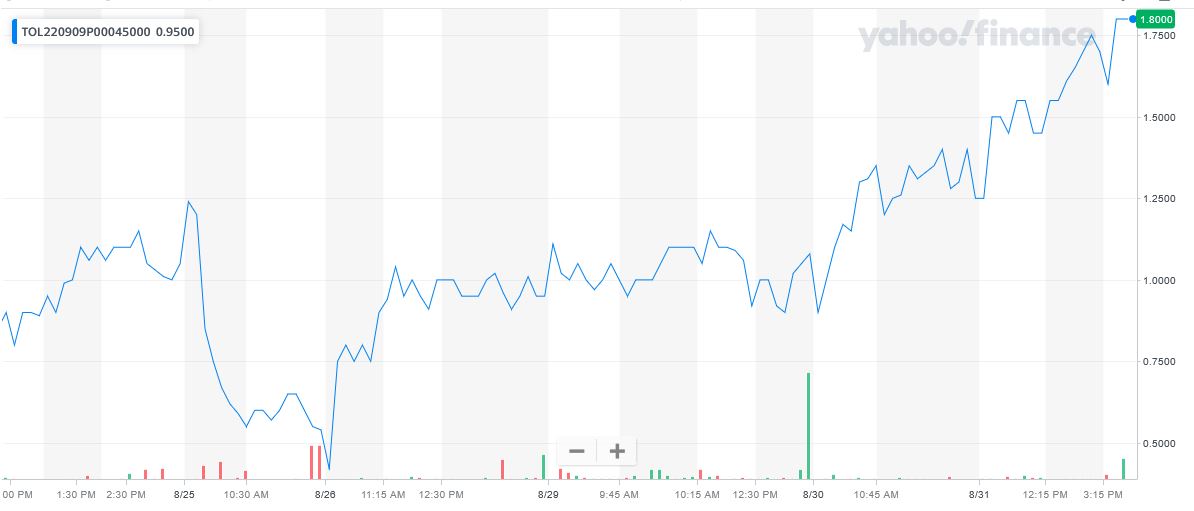

Entered the Toll Brothers stock trade on Wednesday, August 24, 2022 at $0.85.

Exited the trade Wednesday, August 31 for $1.80, for a potential profit of 112%.

Don’t miss out on further trades – become a member today!

Why the Initial Weekly Options put Trade on

TOLL BROTHERS Stock.....

Prelude.....

Toll Brothers came out with quarterly earnings of $2.35 per share, beating the Consensus Estimate of $2.30 per share. This compares to earnings of $1.87 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 2.17%. A quarter ago, it was expected that this home builder would post earnings of $1.46 per share when it actually produced earnings of $1.85, delivering a surprise of 26.71%.

Over the last four quarters, the company has surpassed consensus EPS estimates four times.

However, for the three months through July, signed purchase contracts tumbled 60% from a year earlier to 1,266, according to a statement Tuesday. Analysts were expecting 2,568. The company said it expects to deliver 10,000 to 10,300 homes in its full fiscal year, down from a previous estimate of 11,000 to 11,500 homes.

After a pandemic sales rush, US builders are facing plummeting demand, with purchases of new homes in July falling to the slowest pace since 2016, according to the latest government data. The slump is pushing many companies to offer discounts and other buyer incentives to avoid a pileup of inventory.

Toll’s customers are mostly move-up buyers who can afford houses selling at an average price of about $1 million. Still, mortgage rates that have almost doubled since the start of the year have cut into their purchasing power, while slowing sales of existing homes have made it harder for potential buyers to trade up.

For Toll, the full impact of the slowdown is likely to stretch into 2023 because the company’s homes take longer to build, Bloomberg Industries analyst Drew Reading said after the results were announced.

“The move-up market will continue to face unique challenges as current homeowners are less inclined to trade up due to massive home-price gains and the likelihood they carry a significantly lower rate on their current mortgage,” Reading said in an email. “The higher end of the market also tends to be more discretionary, which means ongoing volatility in the stock market could remain an overhang.”

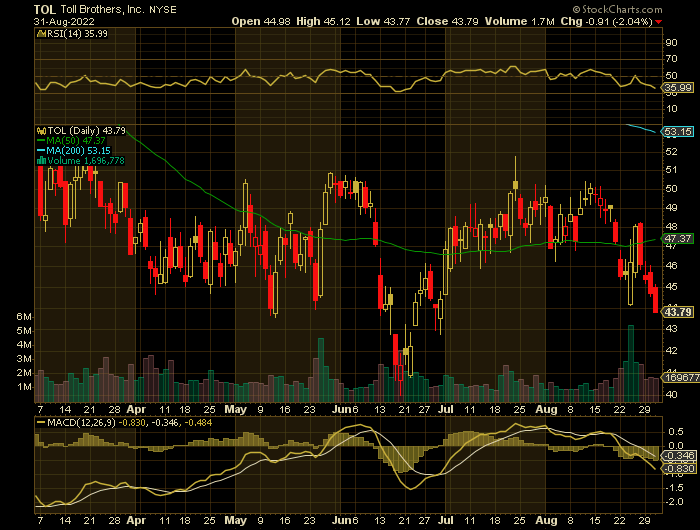

Toll Brothers shares have lost about 37.1% since the beginning of the year versus the S&P 500's decline of -13.2%.

About Toll Brothers.....

Toll Brothers, Inc., together with its subsidiaries, designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

The company operates in two segments, Traditional Home Building and City Living. It also designs, builds, markets, and sells condominiums through Toll Brothers City Living.

In addition, the company develops, owns, and operates golf courses and country clubs; develops and sells land; and develops, operates, and rents apartments, as well as provides various interior fit-out options, such as flooring, wall tile, plumbing, cabinets, fixtures, appliances, lighting, and home-automation and security technologies.

Further, it owns and operates architectural, engineering, mortgage, title, insurance, smart home technology, landscaping, lumber distribution, house component assembly, and manufacturing operations.

The company serves move-up, empty-nester, active-adult, and second-home buyers. It has a strategic partnership with Equity Residential to develop new rental apartment communities in the United States markets.

The company was founded in 1967 and is headquartered in Fort Washington, Pennsylvania.

Further Catalysts for the TOL Weekly Options Trade…..

Further Problems.....

The company said it was also hampered in its fiscal third quarter by “unforeseen delays” with municipal inspectors, continued labor shortages and supply-chain disruptions.

As the quarter progressed, “we saw a significant decline in demand as the combined impact of sharply rising mortgage rates, higher home prices, stock market volatility and macroeconomic uncertainty caused many prospective buyers to step to the sidelines,” Chief Executive Officer Douglas Yearley said in the statement. “However, in more recent weeks, we have seen signs of increased demand as sentiment are improving and buyers are returning to the market.”

The company reported an adjusted home sales gross margin of 27.9%, compared with 25.6% a year earlier. That helped boost earnings per share to $2.35 from $1.87 a year earlier, beating the consensus estimate of $2.31.

Analysts.....

According to the issued ratings of 12 analysts in the last year, the consensus rating for Toll Brothers stock is Hold based on the current 3 sell ratings, 5 hold ratings and 4 buy ratings for TOL. The average twelve-month price prediction for Toll Brothers is $55.42 with a high price target of $75.00 and a low price target of $43.00.

Summary.....

TOL has a fifty day moving average price of $47.08 and a two-hundred day moving average price of $49.18. The stock has a market cap of $5.75 billion, a price-to-earnings ratio of 6.27, a PEG ratio of 0.91 and a beta of 1.47. The company has a quick ratio of 0.62, a current ratio of 5.01 and a debt-to-equity ratio of 0.61. Toll Brothers, Inc. has a 1-year low of $40.19 and a 1-year high of $75.61.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Toll Brothers

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!