TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Turn $850 Into

$1,400 In 4.5 Hours

Using Spotify

Weekly Options!

Spotify Technology SA (NYSE: SPOT) is a premier digital music service providing music enthusiasts instant access to a vast music library.

Spotify stock rose Tuesday after social media firm TikTok announced that it is ending its rival subscription streaming music service.

Also, on Tuesday, CFRA Research analyst Kenneth Leon reiterated his buy rating on Spotify stock and raised his price target to $425 from $375.

This set the scene for Weekly Options USA Members to profit by 65% using a SPOT Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, September 25, 2024

by Ian Harvey

UPDATE

Spotify Technology SA (NYSE: SPOT) is the world's largest music streaming platform with an estimated market share of 31.7%.

Spotify stock rose Tuesday after social media firm TikTok announced that it is ending its rival subscription streaming music service.

Now, TikTok has opted to partner with external music streaming services such as Spotify, Apple's Apple Music and Amazon.com's Amazon Music.

Also, on Tuesday, CFRA Research analyst Kenneth Leon reiterated his buy rating on Spotify stock and raised his price target to $425 from $375.

As well, Spotify has expanded the availability of its AI Playlist tool to the U.S., Canada, Ireland, and New Zealand after initially launching it for Premium subscribers in the U.K. and Australia.

According to Spotify, the AI feature has been successful in the U.K. and Australia, with subscribers creating "millions of playlists that they keep coming back to," the company wrote in Tuesday’s blog post.

Spotify is arguably the industry's leading innovator. It has deployed AI-powered algorithms in its recommendation engine for years to ensure users see the most relevant content to keep them engaged, but the company has also rolled out a number of new AI features lately.

Spotify stock is currently trading in line with its all-time high from 2021, but its price-to-sales ratio is just 4.7, which is 28% below its peak of 6.5 (because the company has grown its revenue significantly since 2021). Considering its long-term forecasts, the stock still has upside potential heading into next year and beyond.

The SPOTIFY Weekly Options Potential Profit Explained.....

** PROPOSED OPTION TRADE: Buy SPOT OCT 11 2024 375.000 CALLS - price at last close was $7.70 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the SPOT Weekly Options (CALL) Trade on Tuesday, September 24, 2024, at 9:40 for $8.50.

Sold half the SPOT Weekly Options contracts on Tuesday, September 24, 2024, at 2:05pm for $14.00; a potential profit of65%.

Holding remaining contracts for further profit.

Don’t miss out on further trades – become a member today!

Why the SPOTIFY Weekly Options Trade was Originally Executed!

Trade Analysis

Current Situation

Spotify Technology SA (NYSE: SPOT) is a premier digital music service providing music enthusiasts instant access to a vast music library. Operating through both Premium and Ad-Supported segments, Spotify offers high-quality streaming of music and podcasts without commercial interruptions. Its extensive device compatibility makes it accessible on computers, tablets, mobile devices, and even through home entertainment systems.

Spotify's stock has shown significant upward movement, entering a buy zone from a 359.38 buy point, with its relative strength line reaching new highs. This bullish trend is supported by a robust 8.1% rally last week. The company's solid earnings performance and a year-to-date increase of nearly 97% position it for further growth.

Recently, an analyst from Pivotal Research Group raised his price target on Spotify to $510, the highest on Wall Street, reaffirming a buy rating. This adjustment reflects growing confidence in Spotify's market position and its ability to outperform in the competitive music streaming industry.

Key Insights from Earnings Call

During Spotify's 2022 Investor Day, significant insights were shared about the strategic direction of the company. Tony Jebara, VP of engineering and head of machine learning, discussed the company's approach to evaluating the lifetime value of individual podcasts against their acquisition and promotion costs. This methodical approach to content investment highlights Spotify's focus on profitability and strategic content renewal.

The departure of high-profile podcast 'Call Her Daddy' illustrates Spotify's disciplined strategy in content management, focusing on renewing shows that demonstrate a strong return on investment.

Catalysts for the Trade

- Robust Subscriber Growth: Spotify has demonstrated a consistent ability to grow its subscriber base, achieving a 15% compound annual growth rate in premium subscribers between 2020 and 2023.

- Strategic Price Adjustments: Recent price hikes have bolstered Spotify's revenue without deterring subscriber growth, indicating strong market demand and customer loyalty.

- Competitive Positioning: Despite intense competition from major players like Apple and Amazon, Spotify continues to hold a significant share of the market, supported by its innovative product offerings and strategic partnerships.

Further Catalysts

Spotify's stock recently achieved a record high after a 10-day rally, underscoring its strong market performance and investor confidence. This momentum is expected to continue as analysts project further growth in subscriber numbers and market share.

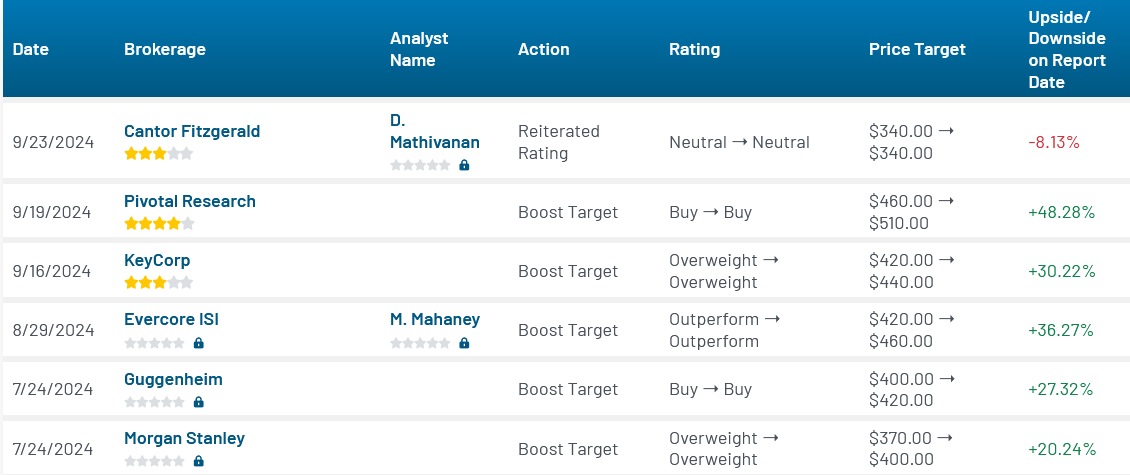

Analysts remain optimistic about Spotify's growth potential, with several raising their price targets and maintaining buy ratings. This collective positive sentiment from the financial community further supports the bullish outlook for Spotify's stock.

Analyst Reactions

Recent analyses by Wall Street experts have been overwhelmingly positive, with Spotify receiving upgrades and increased price targets. For instance, KeyBanc Capital Markets analyst Justin Patterson recently highlighted Spotify's potential to outpace industry growth, supported by innovations like audiobooks which could drive pricing power and subscriber growth.

Company Overview

Founded in April 2006 by Daniel Ek and Martin Lorentzon, Spotify Technology SA is headquartered in Luxembourg. The company has revolutionized the music streaming industry with its dual offering of a premium subscription model and an ad-supported service, catering to a wide range of consumer preferences.

The company's strategic focus on high-quality audio content, extensive device compatibility, and user-friendly interface has enabled it to maintain a strong competitive position in the global market.

Technical Analysis

- Market Capitalization: Approximately $68.71 billion

- PE Ratio: Currently negative, indicating potential for future profitability

- Beta: 1.57, suggesting higher market volatility

- 52-Week Low: $145.76

- 52-Week High: $371.11

- Fifty-Day SMA: $332.83

- Two-Hundred-Day SMA: $308.36

Summary

Spotify Technology SA presents a compelling investment opportunity in the dynamic music streaming sector. The company's strong subscriber growth, strategic price adjustments, and robust market positioning underpin its potential for continued stock appreciation. The current market dynamics and positive analyst sentiment create a favorable environment for potential gains.

Trade Execution

Consider placing a buy order for SPOT OCT 11 2024 375.000 CALLS, with a premium of $7.70. Adjust your sell point and stop loss according to your risk tolerance.

Disclaimer

This trade suggestion is based on the current market analysis and is not a guaranteed success. Always consider your risk tolerance and consult with a financial advisor if necessary.