TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Twitter – Using a Call or Put Option For Profit?

Members of “Weekly

Options USA,” Using A Weekly Option,

Already Make 24%

Potential Profit On The Day!

More is likely - Join

Us and GET THE TRADEs!

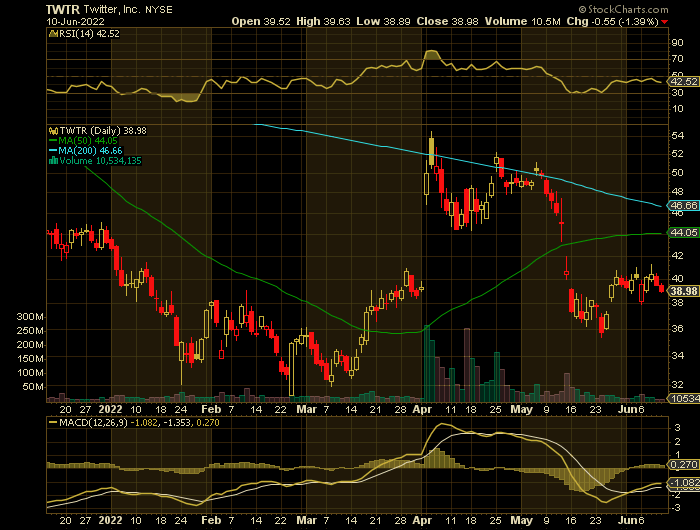

For a company that’s supposed to be bought out, Twitter stock surely doesn’t trade like that’s the case.

In fact, TWTR stock is 26.5% below its deal price. Currently trading below $40, the stock is below the pre-takeover rumors that sent it bursting higher in April.

Where is it headed now?

Join Us And Get The Trades – become a member today!

Sunday, June 12, 2022

Prelude.....

Elon Musk threatened Monday to terminate his $44 billion plan to buy Twitter Inc. (NYSE:TWTR), accusing management of failing to comply with his request for data on the number of users and fake accounts on the social media platform. Twitter stock dropped.

Tesla stock has plummeted more than 35% since Musk disclosed his interest in buying Twitter in early April. The drop also comes amid a stock market roiled by a global downturn. Twitter stock is down 20% in the same period.

According to reports, Musk believes that Twitter was in a “clear material breach” of its obligations. In this case, Musk can terminate the deal.

Elon Musk has previously put the deal on hold “pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users”.

As the recent reports indicate, Musk did not receive such details from Twitter, so the deal is in danger. Not surprisingly, traders rushed to sell Twitter stock at the opening.

Musk believes he overpaid for Twitter and wants to renegotiate his offer of $54.20 a share. He also intends to use that disagreement to give him the right to walk away from the deal without having to pay a $1 billion breakup fee.

On June 8, Twitter gave Musk access to its entire “firehose,” a stream of tweets and metadata about them that encompasses the 500 million tweets per day.

The Reasoning Behind The Twitter Recommendation....

Musk Deal and Bot Problem.....

Elon Musk formally and forcefully revived his assertion that Twitter Inc. has a serious bot problem, and threatened to walk away from his deal to buy the company if the social network doesn’t do more to prove its users are real people.

Last month, Musk said he was putting the deal “on hold” until the social media giant can prove bots make up fewer than 5% of its users, as the company has stated in public filings. Musk has estimated that fake accounts make up at least 20% of all users.

In a filing Monday, Musk sharply disagreed with Twitter’s assessment on bots.

“Twitter’s latest offer to simply provide additional details regarding the company’s own testing methodologies, whether through written materials or verbal explanations, is tantamount to refusing Mr. Musk’s data requests,” Musk’s lawyer wrote in a letter to Twitter’s top lawyer, Vijaya Gadde. “Twitter’s effort to characterize it otherwise is merely an attempt to obfuscate and confuse the issue. Mr. Musk has made it clear that he does not believe the company’s lax testing methodologies are adequate so he must conduct his own analysis. The data he has requested is necessary to do so.”

Musk believes the company’s resistance to provide more information is a “clear material breach of Twitter’s obligations under the merger agreement and Mr. Musk reserves all rights resulting therefrom, including his right not to consummate the transaction and his right to terminate the merger agreement.”

The

near-term dynamics of Twitter stock depend on the market’s perception of the

likelihood of the deal with Musk. Traders will ignore financial projections and

focus on the fate of the deal.

The key

question is whether Elon Musk still wants to buy Twitter and is using the

fake/spam accounts topic to get a better price. Another important factor is

whether Twitter itself wants to be sold, as the company is not actively

engaging with Musk.

Most likely,

the stock will remain extremely volatile in the upcoming trading sessions. The

probability of the deal has decreased in recent weeks.

Texas AG

Investigates Twitter.....

Texas's

Attorney General, Ken Paxton, has launched an investigation of Twitter over

concerns of "potentially false" reports related to the number of bots

and other fake accounts on the social network. In a press release Monday,

Paxton claims inauthentic accounts may be helping to "inflate the

value" of Twitter — thus he intends to pursue the investigation under the

state's Deceptive Trade Practices Act, which protects against misleading

advertisers, businesses and everyday users.

Paxton's

office is pursuing the case just as Tesla CEO Elon Musk is seemingly attempting

to scuttle his own bid to purchase Twitter. Musk has, for several weeks, been

suggesting the platform's bot numbers may be far greater than its current

leadership are reporting.

Twitter has

been ordered to provide unredacted documents detailing the company's active

user counts since 2017, the volume of "inauthentic" accounts over

that period and the methods used to calculate the ratio of fake accounts. It

also has to outline its advertising model, including the revenue it generates

in Texas.

Debt Financing.....

The proposed takeover includes a $1 billion breakup fee for each party, but Musk can’t just walk away by paying the charge. The merger agreement includes a specific performance provision that allows Twitter to force Musk to consummate the deal, according to the original filing. That could mean that, should the deal end up in court, Twitter might secure an order obligating Musk to complete the merger rather than winning monetary compensation for any violations of it.

Musk’s lawyer, Mike Ringler of Skadden, Arps, Slate, Meagher & Flom, said Twitter must cooperate by providing the data requested so that Musk can secure the debt financing necessary to consummate the deal.

That claim is also complicated by the fact that numerous financial institutions have handed Musk commitment letters for debt financing, said Quinn.

Summary.....

Twitter’s shares slumped 1.49% on Monday, suggesting increased skepticism that Musk will finalize his $54.20-a-share offer and further widening the gap between the market’s expectations and the billionaire’s price. The shares have barely -- and only briefly -- surpassed $50 since Musk sprung his buyout plan on April 14. The deal came together at breakneck speed in part because Musk waived the chance to look at Twitter’s finances beyond what was publicly available.

Conclusion.....

For a company that’s supposed to be bought out, Twitter stock surely doesn’t trade like that’s the case.

In fact, TWTR stock is 26.5% below its deal price. Currently trading below $40, the stock is below the pre-takeover rumors that sent it bursting higher in April.

It is argued that Musk may walk from the deal over the misstated user numbers and concerns on how many users are actually bots.

Further, Musk has leverage. If he walks and has to eat the $1 billion breakup fee, he could always come back and make another offer knowing that TWTR stock will crater if he walks from the deal.

Therefore…..

For answers, join us here at Stock options Made Easy, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Micron Technology MU

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!