TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Uber Technologies Provides Profit With Quick Trades!

And Members Make Quick

Potential Profits, 18% and 19.5%,

By Buying and Selling Weekly Call Options!

Members of “Weekly Options USA,” Using A Weekly Call Option,

Make Potential Profits Of 18% and 19.5%,

As Uber

Technologies On A Steady Uptrend Which Started

Long Before The Technology Stock

Mania Pushed By NVIDIA.

Where To Now?

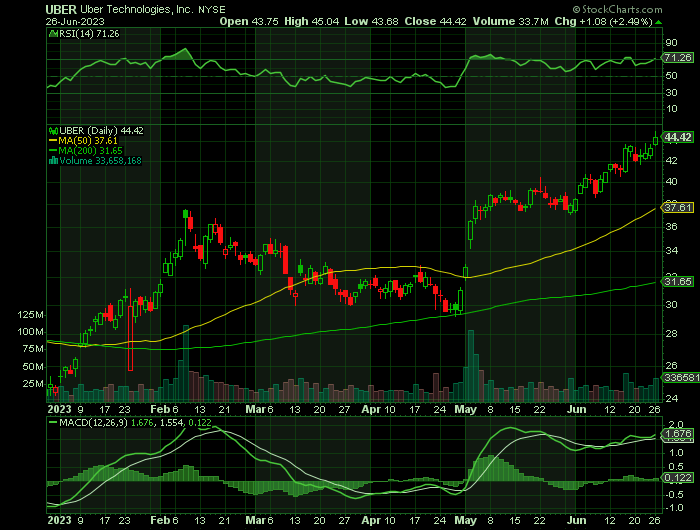

Uber Technologies shares have put in an excellent showing this year, up by 75% so far, a trend that continued following the release of the company’s Q1 results in early May.

This set the scene for Weekly Options USA Members to profit by Make Potential Profits Of 18% and 19.5%, using UBER Weekly Options trades!

Join Us And Get The Trades – become a member today!

Monday, June 26, 2023

by Ian Harvey

Why the UBER Weekly Options Trade was Executed?…..

Shares of Uber Technologies Inc (NYSE: UBER) have been on a steady uptrend which started long before the technology stock mania pushed by NVIDIA and its quarterly announcements toward the aggressive growth.

Uber's rise is founded on solid fundamental developments.

Uber's CEO realized the turning tides of the market as the FED began its path to hiking interest rates to combat the levels of rampant inflation felt throughout 2022. The executive released a memo with a specific message pointing to cost reduction, tighter hiring criteria, and an ultimate focus on improving the company's free cash flow situation.

Nearly a year after the memo, markets prefer businesses with a robust and sustainable base for free cash flow generation rather than a promise to grow at excessive levels.

As well, some investors - and analysts - may be underestimating Uber's usage of artificial intelligence.

UBER shares have put in an excellent showing this year, up by 75% so far, a trend that continued following the release of the company’s Q1 results in early May. Gross Bookings increased by 19% year-over-year to $31.4 billion while revenue rose by 27.5% y/y to $8.8 billion, while beating the Street’s call by $90 million.

Uber Technologies closed at $43.34 on Friday, marking a +1.24% move from the prior day. The stock outpaced the S&P 500's daily loss of 0.77%. Elsewhere, the Dow lost 0.65%, while the tech-heavy Nasdaq lost 2.23%.

Prior to Friday's trading, shares of the ride-hailing company had gained 12.81% over the past month. This has outpaced the Computer and Technology sector's gain of 6.75% and the S&P 500's gain of 4.66% in that time.

The UBER Weekly Options Trade Explained.....

** OPTION TRADE: Buy UBER JUL 28 2023 44.000 CALLS - price at last close was $1.63 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the UBER Weekly Options (CALL) Trade on Monday, June 26, 2023, at 9:38, for $2.11.

Sold the UBER weekly options contracts on Monday, June 26, 2023, at 9:59, for $2.50; a potential profit of 18%.

Re-entered the UBER Weekly Options (CALL) Trade on Monday, June 26, 2023, at 12:54, for $2.05.

Re-sold the UBER weekly options contracts on Monday, June 26, 2023, at 3:27, for $2.45; a potential profit of 19.50%.

Re-bought the UBER Weekly Options (CALL) Trade on Monday, June 26, 2023, at 3:50, for $2.11.

Don’t miss out on further trades – become a member today!

About Uber Technologies.....

Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. It connects consumers with independent providers of ride services for ridesharing services; and connects riders and other consumers with restaurants, grocers, and other stores with delivery service providers for meal preparation, grocery, and other delivery services.

The company operates through three segments: Mobility, Delivery, and Freight. The Mobility segment provides products that connect consumers with mobility drivers who provide rides in a range of vehicles, such as cars, auto rickshaws, motorbikes, minibuses, or taxis. It also offers financial partnerships, transit, and vehicle solutions offerings. The Delivery segment allows consumers to search for and discover local restaurants, order a meal, and either pick-up at the restaurant or have the meal delivered; and offers grocery, alcohol, and convenience store delivery, as well as select other goods. The Freight segment connects carriers with shippers on the company's platform and enable carriers upfront, transparent pricing, and the ability to book a shipment, as well as transportation management and other logistics services offerings.

The company was formerly known as Ubercab, Inc. and changed its name to Uber Technologies, Inc. in February 2011. Uber Technologies, Inc. was founded in 2009 and is headquartered in San Francisco, California.

Further Catalysts for the UBER Weekly Options Trade…..

Uber reported its first quarter 2023 earnings results, which continued the company's year-long stock price rally. Posting a 19% yearly advance in gross bookings and earning a record free cash flow of $549 million, the CEO's focus on turning the Uber brand into one that could blow past any valuation expectations is working.

In Uber's first quarter 2023 cash flow statement, investors can find a 'Stock-based compensation' expense for $470 million, a good chunk of the company's earning power. This expense is compensation packaged as stock options.

Other Catalysts.....

Uber investors face more than a valuation gap, as the markets ultimately realize that the company is just as entrenched in the growth of A.I. enhancements as other companies. Additionally, on a fundamental basis, management is still engineering new ways to increase the company's free cash flow generative power. Initially, it may have been a shock.

Still, investors can expect the company to generate up to $1 billion from its new ventures in sponsoring advertisements. These ancillary venues to capitalize on revenue generation may be the start of something bigger.

An initial $1 billion target may pale compared to Uber's excess of $30 billion in revenue. However, it showcases the market share entrenchment that the company has achieved.

Moving Forward.....

A resulting stance, which translates into a near monopoly position, may lead Uber into other pockets of additional revenue-generation niches.

These trends may be more evident by looking at Uber's expansion within its health business, which has now expanded its delivery selection by adding groceries and OTC (over-the-counter) products.

As more users value the convenience delivered by the platform, other industries may ask Uber to deliver their products rather than the company knocking on producers' doors to land a delivery agreement. Uber analyst ratings may fall on the conservative side of the spectrum, as they may not yet reflect the tailwinds at play, which will aid the CEO's mission to expand free cash flows.

Robotaxi.....

Uber's ride-hailing segment has once again become the company's leading source of revenue. The ride-hailing industry as a whole is also entering a new era thanks to the dawn of the autonomous robotaxi. Last year Uber signed a 10-year deal with Motional, which is a joint venture between South Korean car manufacturer Hyundai and mobility technology company Aptiv (APTV -1.22%).

Uber brings its 130 million monthly users to the partnership, Hyundai brings its Ioniq 5 electric vehicle, and Aptiv is contributing its self-driving technology, which can operate entirely independent of human assistance. Together, the companies could create the largest autonomous ride-hailing network in the world.

The financial estimates for this emerging industry are already mind-boggling. Cathie Wood's Ark Investment Management says autonomous ride-hailing companies could generate $4 trillion in annual revenue as soon as 2027, and since Uber already has a 75% market share in the U.S. ride-hailing industry, its opportunity is enormous.

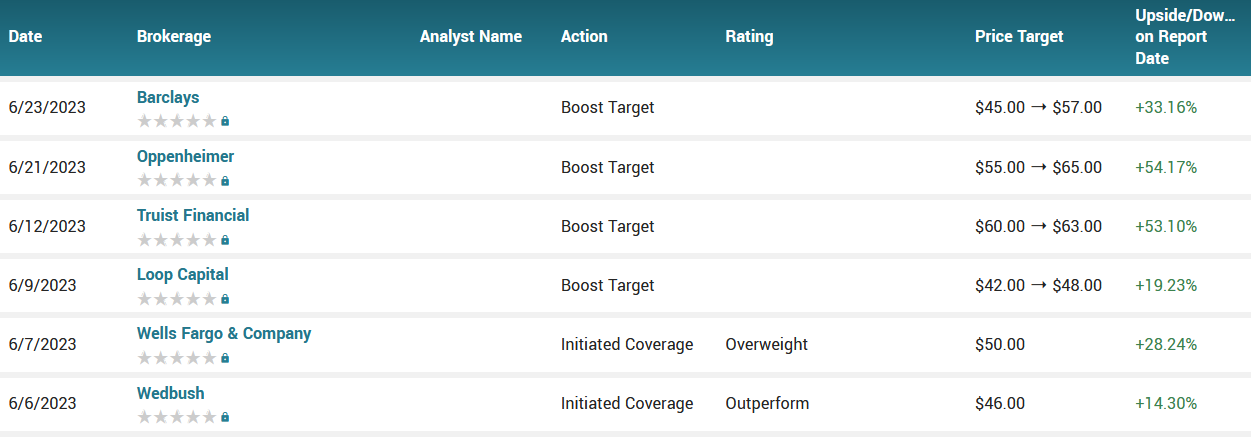

Analysts.....

Uber Technologies had its target price hoisted by Barclays from $45.00 to $57.00 in a research report sent to investors on Friday morning.

Uber had its price target lifted by investment analysts at Oppenheimer from $55.00 to $65.00 in a report issued on Wednesday. Oppenheimer’s price objective suggests a potential upside of 51.85% from the stock’s previous close.

Oppenheimer’s analyst, Jason Helfstein, notes the strong year-to-date performance, but touts Uber as still being a “top large-cap pick” and thinks there are strong catalysts ahead.

“We believe UBER will continue to benefit from a spending shift from goods to services normalizing, exposure to the strongest consumer categories, and return-to-work tailwinds,” Helfstein explained. “Shares stand to benefit from impending S&P 500 inclusion as soon as December. We expect Uber will be eligible to enter the index this December after reporting expected GAAP profitability in 3Q23, bringing TTM GAAP net income positive. Index inclusion generally increases demand for a stock, forcing mutual and index fund buying.”

According to the issued ratings of 28 analysts in the last year, the consensus rating for Uber Technologies stock is Moderate Buy based on the current 1 hold rating and 27 buy ratings for UBER. The average twelve-month price prediction for Uber Technologies is $49.81 with a high price target of $70.00 and a low price target of $32.00.

Summary.....

Uber's business has been on a roller-coaster ride over the past few years. Its ride-hailing segment entered 2020 with record momentum, which was quickly derailed when the pandemic struck. The company pivoted to focus on food delivery which boomed throughout 2020 and 2021, and is still a key driver of revenue today.

Uber Technologies’s fifty day moving average is $37.74 and its two-hundred day moving average is $32.94. The company has a market capitalization of $87.75 billion, a PE ratio of -25.06, a price-to-earnings-growth ratio of 19.55 and a beta of 1.19. The company has a quick ratio of 1.06, a current ratio of 1.06 and a debt-to-equity ratio of 1.12. Uber Technologies, Inc. has a 52 week low of $19.90 and a 52 week high of $43.87.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from UBER

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!