TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

UBER Weekly Call Option Up 29%!

More Profit Expected!

Become a Member and Get the Trade.

Uber Technologies Inc (NYSE: UBER) is now in oversold territory and Wall Street analysts are majorly in agreement about the company's ability to report better earnings than they predicted earlier, the stock is due for a turnaround.

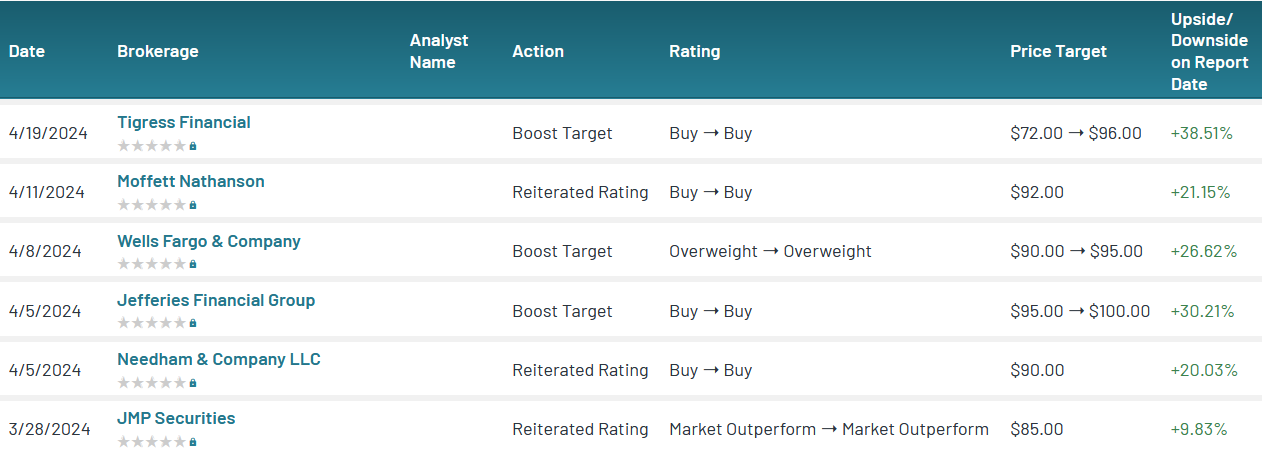

Tigress Financial analyst Ivan Feinseth thinks it can bounce back. On April 19, Feinseth raised his price target for Uber to $96 per share, which implies a gain of about 39% from recent prices.

This set the scene for Weekly Options USA Members to profit by 29% using an UBER Weekly Options trade!

Become a Member Today and get the trade!

Thursday, April 25, 2024

by Ian Harvey

Why the UBER Weekly Options Trade was Originally Executed!

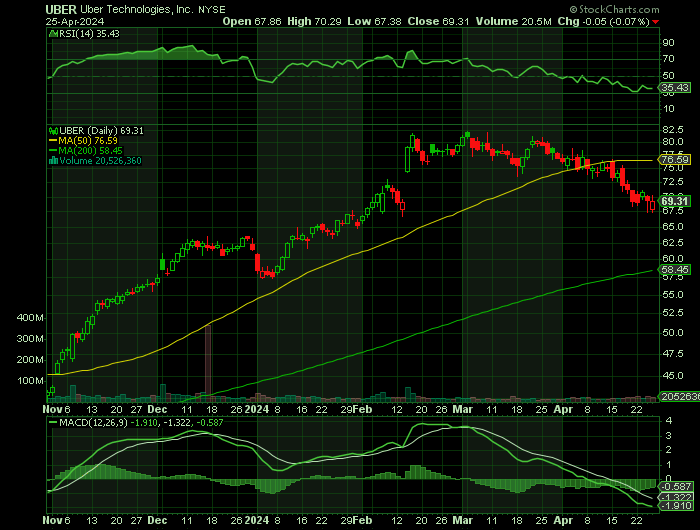

A downtrend has been apparent in Uber Technologies Inc (NYSE: UBER) lately with too much selling pressure. The stock has declined 13.1% over the past four weeks. However, given the fact that it is now in oversold territory and Wall Street analysts are majorly in agreement about the company's ability to report better earnings than they predicted earlier, the stock is due for a turnaround.

Tigress Financial analyst Ivan Feinseth thinks it can bounce back. On April 19, Feinseth raised his price target for Uber to $96 per share, which implies a gain of about 39% from recent prices.

The RSI reading of 29.38 for UBER is an indication that the heavy selling could be in the process of exhausting itself, so the stock could bounce back in a quest for reaching the old equilibrium of supply and demand.

The RSI value is not the only factor that indicates a potential turnaround for the stock in the near term. On the fundamental side, there has been strong agreement among the sell-side analysts covering the stock in raising earnings estimates for the current year. Over the last 30 days, the consensus EPS estimate for UBER has increased 0.6%. And an upward trend in earnings estimate revisions usually translates into price appreciation in the near term.

BECOME A MEMBER AND GET THE TRADE!

About Uber Technologies.....

Uber Technologies Inc. is a San Francisco-based company providing mobility, food and package delivery services and freight transport. Uber operates in approximately 10,500 cities in 72 countries. The company sets fares based on local supply and demand at the time of booking and receives a commission from each booking. The company has 131 million monthly active users and 5.4 million active drivers and couriers worldwide.

Uber was founded in 2009 by Oscar Salazar Gaitan, Travis Kalanick and Garrett Camp and was initially named Ubercab Inc. The idea for Uber came about after Camp and Kalanick spent a pricey $800 hiring a private driver on New Year's Eve, and Camp needed help finding a taxi on a snowy night in Paris. Camp, Oscar Salazar and Conrad Whelan built the prototype for Uber's mobile app, with Kalanick as the chief advisor to the company. Ryan Graves became the first Uber employee in February 2010 and was named CEO in May 2010. In December 2010, Kalanick succeeded Graves as CEO, and Graves became the chief operating officer. Uber's current CEO is Dara Khosrowshahi, who replaced co-founder Travis Kalanick of Uber in August 2017.

Uber debuted in San Francisco in 2011, opening its services and mobile app to the public after beta testing in May 2010. Initially, the application hailed black luxury cars, which cost about 1.5 times as much as a regular taxi. In response to San Francisco's taxi operators' objections, the company changed its name from UberCab to Uber in the same year. Uber's early team consisted of talented individuals from various fields, including a computational neuroscientist and a nuclear physicist who worked on enhancing the accuracy of Uber's car arrival predictions beyond what Google APIs offered.

In the summer of 2012, Uber rolled out UberX. This budget-friendly alternative permitted drivers to use their cars provided they passed background checks and met insurance, registration and vehicle quality standards. UberX expanded to 35 cities within a few months, demonstrating its popularity among cost-conscious riders. In August 2014, Uber extended its services by introducing Uber Eats, a food delivery platform. It also unveiled a carpooling feature in the San Francisco Bay Area, which soon spread to other cities globally, enabling passengers to share rides and save on fares.

Uber has faced legal action in several jurisdictions due to its classification of drivers as gig workers and independent contractors. Ridesharing companies like Uber have disrupted taxicab businesses and allegedly caused increased traffic congestion. Additionally, Uber has been criticized for various unethical practices, such as ignoring local regulations, some of which were revealed by the leak of the Uber Files between 2013 and 2017 under the leadership of Travis Kalanick.

In August 2016, DiDi acquired Uber's business operations in China, and in exchange, Uber obtained an 18% equity stake in DiDi. DiDi also pledged to invest $1 billion in Uber as part of the agreement. Later that year, Uber purchased Ottomotto, a startup specializing in developing autonomous trucks. The acquisition was valued at $625 million, and the founder of Ottomotto, Anthony Levandowski, was previously accused of stealing trade secrets from his former employer, Waymo, to establish the company. In the same year, Uber also bought Geometric Intelligence, the cornerstone of "Uber AI," a department dedicated to exploring and researching AI technologies and machine learning. The Uber AI project disappeared in May 2020.

Despite the controversies, Uber has committed to carbon neutrality globally by 2040, and by 2030, in most countries, rides will move exclusively to electric vehicles. The company has also formed various partnerships and acquisitions, such as with IT Taxi in Italy, Cornershop for grocery delivery and Postmates for alcohol delivery. Uber continues to expand its services and develop new offerings, such as Uber Works, Uber Green and Uber Eats. The company has recently announced plans to become an emission-free platform and is investing in self-driving cars.

BECOME A MEMBER AND GET THE TRADE!

Further Catalysts for the UBER Weekly Options Trade…..

Uber breaks its business into mobility, delivery, and freight. Its mobility platform connects users with transportation, primarily ridesharing services. Its delivery platform connects consumers with food and package delivery services. And its freight platform connects shippers with carriers to provide on-demand logistics services. Uber is the largest ridesharing services provider and the second largest food delivery services provider in the U.S., according to Bloomberg.

Uber benefits from a network effect and cross-platform synergies. The mobility and delivery platforms become more compelling as more consumers and drivers participate. But Uber also has an increasingly large opportunity to promote cross-platform adoption as each ecosystem expands. The company is leaning into that efficient strategy. For instance, 31% of first delivery trips come from the mobility app and 22% of first mobility trips come from the delivery app.

Other Catalysts.....

Uber reported solid results in the fourth quarter. Monthly active platform consumers increased 15% to 150 million. Revenue rose 15% to $9.9 billion, driven by strong growth in mobility and modest growth in delivery, offset by a decline in freight sales. On the bottom line, GAAP net income jumped 128% to $0.66 per diluted share due to disciplined expense management.

Going forward, Uber is well positioned to maintain that momentum. The ridesharing market is forecasted to grow at 16% annually through 2030, while the online food delivery market increases at 19% annually during the same period, according to Grand View Research. That gives Uber a good shot at annual sales growth in the mid-teens. Indeed, Wall Street expects the company to grow sales at 14% annually over the next five years.

Growth Prospects.....

For eight years now, Uber has used rule-based machine learning models to manage pricing and match drivers with riders. The company also uses its proprietary DeepETA AI to predict arrival times.

This is just the tip of the iceberg. In the not-so-distant future, AI could take on a much more important role for Uber by helping it manage a fleet of driverless robotaxis. In the present, though, it looks like the company's network effect is driving profitability.

Uber's size is its most important advantage. Drivers stay active on Uber because it has the most potential customers, and vice versa. In the fourth quarter of 2023, Uber recorded 2.6 billion trips. That's about 2.4

BECOME A MEMBER AND GET THE TRADE!

Analysts.....

According to the issued ratings of 31 analysts in the last year, the consensus rating for Uber Technologies stock is Moderate Buy based on the current 2 hold ratings and 29 buy ratings for UBER. The average twelve-month price prediction for Uber Technologies is $78.94 with a high price target of $100.00 and a low price target of $43.00.

Summary.....

Uber reported free cash flow that soared from $390 million in 2022, to $3.3 billion last year. The mobility and delivery leader has been trading for about 43 times trailing free cash flow.

Uber is trading at a high multiple, but its profit margins are expanding rapidly. For growth-seeking investors with a significant risk tolerance, adding some shares of the stock to a diversified portfolio isn't a bad idea.

Uber Technologies has a quick ratio of 1.19, a current ratio of 1.19 and a debt-to-equity ratio of 0.79. Uber Technologies, Inc. has a 1 year low of $29.22 and a 1 year high of $82.14. The firm has a market capitalization of $147.36 billion, a P/E ratio of 82.33, and a PEG ratio of 1.10 and a beta of 1.36. The business's 50-day moving average price is $76.92 and its 200-day moving average price is $64.12.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from UBER

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!