TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Under Armour Inc Falls After Earnings!

and, “Weekly Options USA” Members Exit Before Earnings

And, are Up 57%

Using A Weekly call Option!

Sunday, February 13, 2022

by Ian Harvey

Under Armour Inc reported earnings on Friday with net income for the quarter ended Dec. 31 of $110 million, or 23 cents a share, compared with $184.5 million, or 40 cents a share, a year earlier.

But, “Weekly Options USA” Members were advised to exit before earnings if there was sufficient profit!

On Thursday the trade was up 57% using a weekly call option!

Don’t miss out on further trades – become a member today!

Under Armour Inc Class A (NYSE: UAA)

Under Armour Inc, the Baltimore-based active wear brand reported net income for the quarter ended Dec. 31 of $110 million, or 23 cents a share, compared with $184.5 million, or 40 cents a share, a year earlier. There were $14 million in restructuring and impairment charges in the quarter, so excluding onetime items; it earned 14 cents a share, beating analysts’ estimates of 7 cents.

Sales overall rose 9 percent to $1.5 billion, which the company attributed to a “solid performance” in its owned and operated stores and a 4 percent growth in e-commerce, which represented 42 percent of its total direct-to-consumer business during the quarter.

The company saw strong demand for its products, while higher prices for hoodies and leggings offset some pandemic-related supply chain disruptions. However, the company noted profit margins may shrink in the current quarter due to freight costs.

The shares of Under Armour Inc were down 8.9% at $18.22 Friday morning.

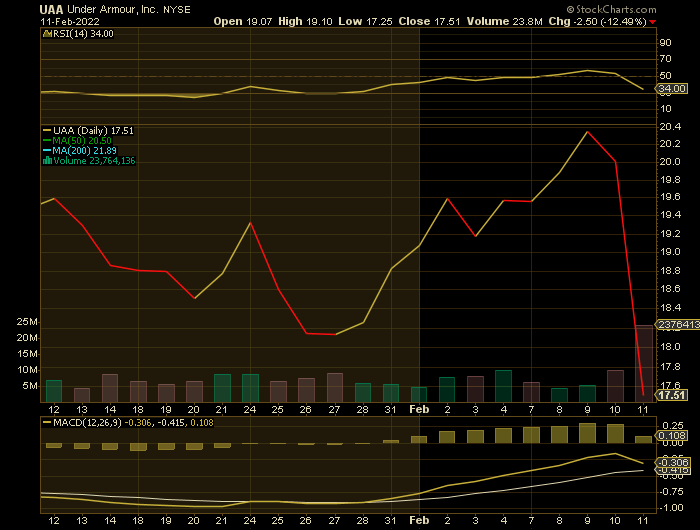

The stock closed Friday trading down at $17.51, (- $2.50 or -12.49%).

Read the article.... .“Under Armour Earnings Expectations!”

Members Profits on the Under Armour Inc Trade.....

Weekly Options USA Members entered this trade on Monday, February 07, 2022 for approximately $0.89; and on Thursday the price was at $1.40.

This Under Armour Inc Options Call trade provided a potential profit of 57%.

CLICK HERE to join in future profit.

About Under Armour Inc .....

Under

Armour, Inc. engages in the development, marketing, and distribution of branded

performance apparel, footwear, and accessories for men, women, and youth.

It operates

through the following segments: North America, EMEA, Asia-Pacific, Latin

America, and Connected Fitness. The North America segment comprises of U.S. and

Canada. The Connected Fitness segment offers digital fitness subscriptions,

along with digital advertising through its MapMyFitness, MyFitnessPal, and

Endomondo. applications.

The company was founded by Kevin A. Plank in 1996 and is headquartered in Baltimore, MD.

The Main Reasons for Under Armour Inc Fall.....

Under Armour Inc fell the most in almost two years after saying supply-chain disruptions will have “material impacts” on the spring-summer season and potentially beyond.

Reductions in orders as a result of these constraints will lower revenue by about 10 percentage points in the current quarter, the athletic-wear company said on Friday. At the same time, gross margin is projected to fall two percentage points from a year ago due to higher freight expenses and expectations for greater sales of less-profitable products.

Under Armour Inc has been using costly air freight to circumvent bottlenecks and has been pulling back from some wholesale partners to focus on higher-quality sales. On Friday, the company said it expects supply-chain issues will continue to pressure financial results for two more quarters after the current one, or through the end of September.

“We believe these Covid-related supply chain pressures are just a temporary speed bump on our road to continued profitable growth over the long term,” Chief Financial Officer David Bergman said on a conference call with analysts.

For the current quarter, Under Armour sees earnings of 2 cents to 3 cents a share. That would be down from 17 cents a year ago. The company sees revenue growing at a mid-single-digit rate, up from a prior forecast for growth in the low-single digits.

Frisk said management is being cautious in expecting logistics woes to linger as the global supply chain has “twisted upon itself.”

“It is truly systemic,” he said in an interview. “And when those things happen, it takes a while to unravel all of it.”

Summary.....

Under Armour Inc stock had been slowly moving higher since a January 28 annual low of $17.52, though this rally was rejected by the 50-day moving average during Friday's session.

Year-over-year, UAA is down 20.5%.

Therefore…..

Taking profit before the earnings, when in decent profit, certainly paid off!

We Have Had A Successful Under Armour Inc Trade With A Call Option!

What Further Under Armour Inc Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!