TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

UPDATED

- Snowflake Provides 181% Profit

Using A Weekly Option!

Snowflake (NYSE: SNOW) is helping many large companies organize their data. Snowflake's cloud-based data warehouses are used to aggregate data from a wide range of computing platforms, then clean it all up so third-party data visualization and analytics applications can easily read it.

Analysts expect 2024 upside from the roll out of new products. A material boost from generative AI projects may wait until 2025, said RBC Capital analyst Matthew Hedberg in a report.

This set the scene for Weekly Options USA Members to profit by 181% using a SNOW Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, March 24, 2024

by Ian Harvey

UPDATED

Snowflake (NYSE: SNOW) is helping many large companies organize their data. Snowflake's cloud-based data warehouses are used to aggregate data from a wide range of computing platforms, then clean it all up so third-party data visualization and analytics applications can easily read it.

Snowflake's silo-busting approach made it a popular pick for large and fragmented organizations, and its recent integration of generative AI tools should make it even easier to process all that data. It aims to generate $10 billion in product revenue by fiscal 2029 (which ends in Jan. 2029), which implies it could grow at a CAGR of 30% from fiscal 2024 to fiscal 2029.

Analysts expect 2024 upside from the roll out of new products. A material boost from generative AI projects may wait until 2025, said RBC Capital analyst Matthew Hedberg in a report.

"We believe a comprehensive data strategy is a precursor to a gen AI strategy," he said. "As such, we believe Snowflake is well positioned given the large amount of customer data on their platform and new gen AI offerings that should help drive incremental workload utilization. That said we expect the more material impact on results is likely to come in 2025 and beyond as the new products go into general availability."

Also, SNOW stock could get a boost from a recent multi-year expansion of its partnership with Amazon Web Services. Both companies will contribute to stepped-up marketing.

Why the Snowflake Weekly Options Trade was Originally Executed!

At the heart of any AI model is data, and ensuring that the right data is plugged into the model is critical for the best results. However, collecting, storing, and processing data isn't always easy, so companies utilize Snowflake Inc (NYSE: SNOW) to aid in this practice.

Snowflake is a clear beneficiary of the AI revolution.

Snowflake, the Data Cloud Company, yesterday announced at NVIDIA GTC an expanded collaboration with NVIDIA that further empowers enterprise customers with an AI platform, bringing together the full-stack NVIDIA accelerated platform with the trusted data foundation and secure AI of Snowflake’s Data Cloud. Together, Snowflake and NVIDIA deliver a secure and formidable combination of infrastructure and compute capabilities designed to unlock and accelerate AI productivity and fuel business transformations across every industry.

"Data is the fuel for AI, making it essential to establishing an effective AI strategy," said Sridhar Ramaswamy, Snowflake CEO. "Our partnership with NVIDIA is delivering a secure, scalable and easy-to-use platform for trusted enterprise data. And we take the complexity out of AI, empowering users of all types, regardless of their technical expertise, to quickly and easily realize the benefits of AI."

Snowflake reported better-than-expected financial results in the fourth quarter. Its customer count increased 22% to 9,437, and its average existing customer spent 31% more with it over the past year. Revenue rose 32% to $775 million, and non-GAAP (adjusted) net income more than doubled to $128 million.

However, management guided for roughly 27% revenue growth in 2024's first quarter, whereas Wall Street analysts, on average, had been expecting 29% growth. To further complicate matters, CEO Frank Slootman announced his retirement, effective immediately. The combination of light guidance and the leadership change sent the stock tumbling by 20%, and shares have continued to slide lower since then.

However, that has created a great buying opportunity for this weekly options trade.

The SNOWFLAKE Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy SNOW APR 26 2024 170.000 CALLS - price at last close was $3.84 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

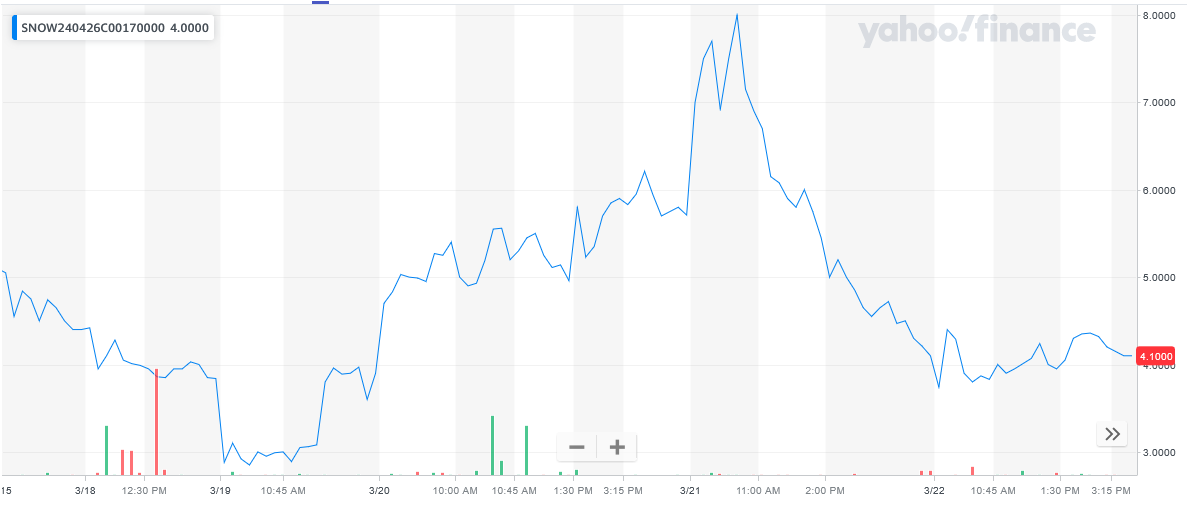

Entered the SNOW Weekly Options (CALL) Trade on Tuesday, March 19, 2024, at 9:53, for $2.85.

Sold half the SNOW weekly options contracts on Tuesday, March 19, 2024, at 2:20, for $3.96; a potential profit of39%.

Sold the remaining half of the SNOW weekly options contracts on Thursday, March 21, 2024 for $8.00; a potential profit of 181%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Snowflake .....

Snowflake Inc. is a cloud-based data storage, computing and analytics company with no official headquarters. The company embraced a non-centralized business model in 2021 but the history is much deeper than that.

The company was founded in 2012 as Snowflake Computing, Inc by a trio of data storage experts who kept it in stealth mode for its 1st 2 years. Snowflake Computing Inc. brought its offerings to the public in 2014 revealing that it already had 80 clients using its services. Services include cloud-based software and hardware applications that are highly scalable and include 3rd-party support to aid businesses with today’s rapidly changing technological landscape.

The company saw rapid growth over the next several years and reached unicorn status in 2017/2018. The company sold itself on the public market in 2020 and caused quite a stir when it did. The company priced its original offering at $75 to $85 per share and wound up listing them at $125 for the IPO. The IPO was oversubscribed and drove the price up to $240 before even the first trade was made. That gave the company a valuation of nearly $3.4 billion making it one of the largest cloud IPOs in history. Snowflake Computing, Inc shortened its name to Snowflake, Inc upon completion of the IPO.

Today, Snowflake Inc operates a cloud-based data platform in the United States and does business internationally. The company's primary product is Data Cloud, a cloud-based suite of tools that allows clients to consolidate data into a single location and facilitates deeper analytical insight and information sharing.

The company believes that data should not be siloed or only available for limited use. On Snowflakes platform, data is governed, which allows users to access 2nd and 3rd party data to gain the deepest insights possible. The platform also operates on the idea of a Data Lake that can be accessed anywhere from anywhere. Among the many benefits of using Snowflake’s one-cloud platform are access, global connectivity, cross-cloud operability and creating new revenue streams for businesses. The platform can be fully automated as well so clients are able “to harness data, not manage it”.

The company initially used Amazon’s AWS cloud services but switched to Microsoft’s Azure and then Google’s cloud which it is currently operating on. This progression has helped it gain its own deep insights and facilitates its ability to provide the best-in-class cross-cloud services on the market.

Security is central to the platform’s success. Not only is data stored in a centralized location and governed in a tiered manner (which keeps each business's IP and most trusted secrets safe) but the platform’s utility allows for state-of-the-art threat detection and some of the quickest response times in the industry.

Snowflake brought in $1.22 billion in revenue for 2022 and employs about 4,000 across its operating footprint. The company counts more than 1300 client partners and has more than 250 PBs of data under storage. The company offers solutions in 6 categories: Advertising, Media & Entertainment; Financial; Retail & CPG; Healthcare & Lifesciences and Marketing Analytics.

Further Catalysts for the SNOW Weekly Options Trade…..

Snowflake is in the data cloud business. It helps customers collect structured, semi-structured, or unstructured data and efficiently store it. Then, clients can utilize it for their internal models, feed the data stream into other programs, or bundle the data package up and sell it on the Snowflake marketplace to other companies that may not have access to that type of data.

Snowflake integrates with all three major cloud companies, making it easy to switch between providers or maintain two contracts so clients can't be locked into unreasonable deals by one provider.

Because Snowflake is a neutral player in the space and only provides the tools to help its clients who want to build AI models, it's a great way to capitalize on the general rise of AI.

Other Catalysts.....

Customers are satisfied with Snowflake's products. In the fourth quarter of fiscal year 2024 (ended Jan. 31), its net revenue retention rate was 131%, meaning existing customers spent $131 for every $100 they spent last year.

Spending expansion is key for software-as-a-service (SaaS) businesses like Snowflake and plays a big part in the company's overall product revenue growth of 33%.

It also has a high net promoter score (NPS) of 67, indicating that customers are extremely satisfied with the product and actively promote it to peers. With the average NPS score of SaaS companies hovering around 41, it's a far better product than your average business produces.

Leadership.....

All signs point to longtime CEO Frank Slootman suddenly retiring following Q4 earnings. Slootman led Snowflake through rapid growth and it’s IPO, but he has been replaced by Sridhar Ramaswamy, who has only been there for just over a year.

However, prior to Snowflake, Sridhar worked at Alphabet, where he led Google's advertising business from $1.5 billion to over $100 billion in revenue during his 15-year tenure. That sounds like someone well qualified to lead Snowflake into its next business phase, and investors should be excited about him taking the reins.

With much of the stock's reaction coming from Slootman's retirement, Snowflake has emerged as a strong AI stock investing candidate.

With fiscal year 2025 (ending Jan. 31, 2025) slated to be strong with 22% product revenue growth, Snowflake remains a great stock to buy. Under Ramaswamy's leadership, investors shouldn't be surprised to watch Snowflake grow from around $2.7 billion in annual revenue to the company's long-term goal of $10 billion by the end of fiscal year 2029 (ending Jan. 31, 2029).

Expansion.....

Expanding on Snowflake and NVIDIA’s previously announced NVIDIA NeMo™ integration, Snowflake customers will soon be able to utilize NVIDIA NeMo Retriever directly on their proprietary data in the Data Cloud, all while maintaining data security, privacy, and governance seamlessly through Snowflake’s built-in capabilities.

NeMo Retriever enhances performance and scalability of chatbot applications and can accelerate time to value for the 400+ enterprises1 already building AI applications with Snowflake Cortex (some features may be in preview), Snowflake's fully managed large language model (LLM) and vector search service. The expanded collaboration will also include the availability of NVIDIA TensorRT™ software to deliver low latency and high throughput for deep learning inference applications to enhance LLM-based search capabilities.

NVIDIA accelerated compute powers several of Snowflake’s AI products, including Snowpark Container Services, as well as…..

- Snowflake Cortex LLM Functions (public preview): With Snowflake Cortex LLM Functions, users with SQL skills can leverage smaller LLMs to cost-effectively address specific tasks, including sentiment analysis, translation, and summarization in seconds. More advanced use cases include the development of AI applications in minutes using performant models from Mistral AI, Meta and more.

- Snowflake Copilot (private preview): Snowflake’s LLM-powered assistant, Snowflake Copilot, brings generative AI to everyday Snowflake coding tasks with natural language. Users can ask questions of their data in plain text, write SQL queries against relevant data sets, refine queries and filter down insights, and more.

- Document AI (private preview): Document AI helps enterprises use LLMs to easily extract content like invoice amounts or contractual terms from documents and fine-tune results using a visual interface and natural language. Customers use Document AI to help their teams reduce manual errors and increase efficiencies with automated document processing.

Advantages.....

Snowflake has another important advantage besides its ability to consolidate workloads. Its platform is cloud agnostic, meaning it runs across all three major public clouds: Amazon Web Services, Microsoft Azure, and Google Cloud. None of those vendors offer the same flexibility, which gives Snowflake an advantage for two reasons. First, Snowflake's clients can easily analyze data across multiple cloud environments. Second, they can switch cloud providers without interrupting their ability to analyze data.

That combination of workload consolidation and cloud-agnostic software is clearly resonating with customers. Forrester Research recently recognized Snowflake as a leader in cloud data warehousing solutions, citing its unmatched innovation as a key strength. Additionally, the company earned a net promoter score of 72 in 2022, more than triple the average score of 21 among competing cloud vendors. Finally, Snowflake has consistently reported exceptional net revenue retention rates showing that its established customers are consistently spending more with the company over time.

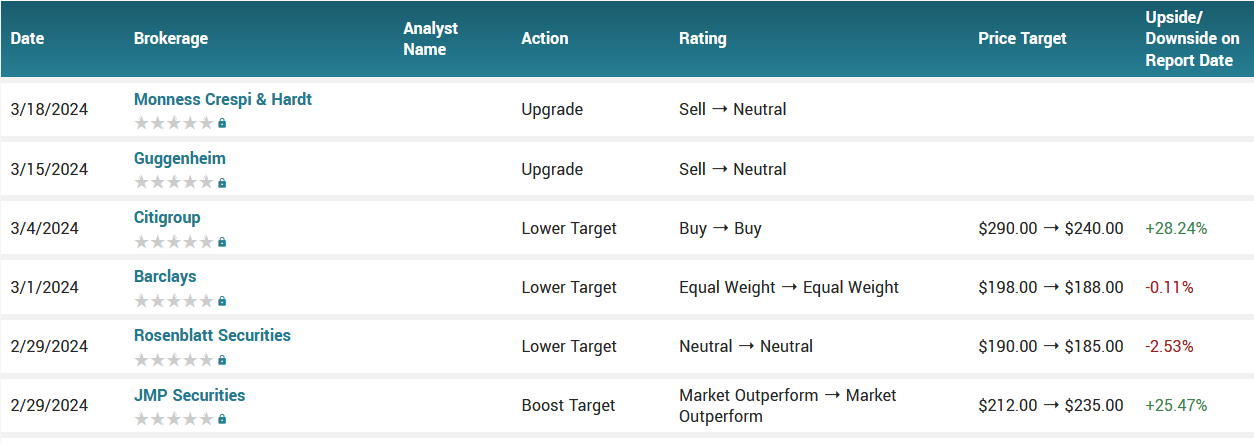

Analysts.....

Keith Weiss at Morgan Stanley still sees plenty of potential upside for Snowflake (NYSE: SNOW) shareholders in the next 12 months. His bull-case target of $330 per share implies an upside of 103% from the current price of $162 per share.

According to the issued ratings of 31 analysts in the last year, the consensus rating for Snowflake stock is Moderate Buy based on the current 1 sell rating, 10 hold ratings and 20 buy ratings for SNOW. The average twelve-month price prediction for Snowflake is $204.85 with a high price target of $250.00 and a low price target of $105.00.

Summary.....

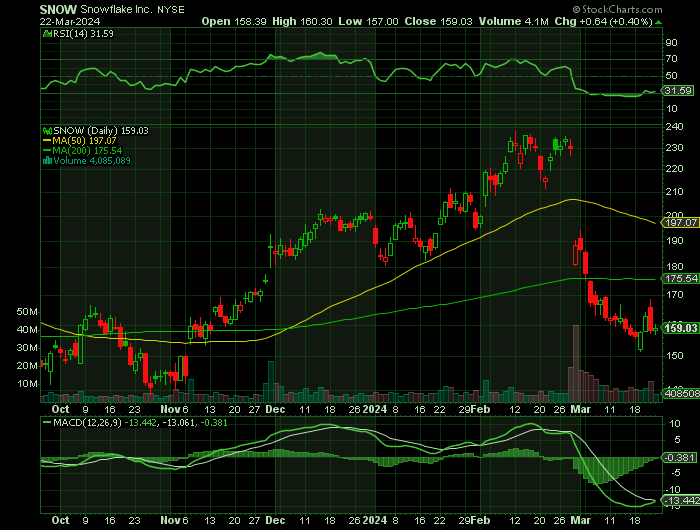

Shares of SNOW traded down $0.66 during trading hours on Monday, hitting $156.31. The stock had a trading volume of 7,101,676 shares, compared to its average volume of 7,241,321. The firm has a market capitalization of $51.47 billion, a P/E ratio of -61.30 and a beta of 0.94. Snowflake Inc. has a 1-year low of $131.62 and a 1-year high of $237.72. The firm has a 50 day simple moving average of $200.62 and a 200-day simple moving average of $179.58.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SNOWFLAKE

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%! -

Palantir Future Looks Promising!

Palantir Future Looks Promising! Weekly Options Members Profit Up 102%! As of 2024, Palantir has seen a significant uptick in its stock performance, with a remarkable 114% increase year-to-date.