TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

visa Weekly Option Provides 23% Profit!

More is expected!

Visa is slowly but surely leveraging its innovation to win this business. Analysts are calling for sales growth of more than 10% this fiscal year as well as next, with earnings expected to grow at an even faster clip.

And now, Visa has trounced analyst revenue predictions. Revenue for the quarter was definitely $8.8 billion, a 10% increase year over year. And GAAP profits were up even more -- 12%.

This top financial enterprise has been a huge winner over the past decade, producing a total return of 488%.

This set the scene for Weekly Options USA Members to profit by 23% using a Visa Options Trade!

Join Us And Get The Trades – become a member today!

Wednesday, April 24, 2024

by Ian Harvey

UPDATE

Shares of credit card giant Visa Inc (NYSE: V) jumped more than 3% in early trading this morning after reporting stronger than expected fiscal Q2 2024 earnings -- and much better than expected revenue.

Heading into the quarter, analysts forecast Visa would earn $2.29 per share on $8.1 billion in revenue. In fact, Visa earned $2.51 per share on $8.8 billion in sales.

The company reported that payments volume rose 8% for the quarter, processed transactions increased 11%, and cross-border payments volume grew 16%, which CEO Ryan McInerney attributed to "stable" consumer spending.

Visa guided low double-digit net revenue growth for the third quarter and operating expense growth in the low teens. Visa forecasts Q3 earnings growth at the "high end" of a low double-digit gain. FactSet predicts third-quarter earnings will rise 12% to $2.42 per share adjusted on 9.9% net revenue growth.

Visa trounced analyst revenue predictions. Revenue for the quarter was definitely $8.8 billion, a 10% increase year over year. And GAAP profits were up even more -- 12%.

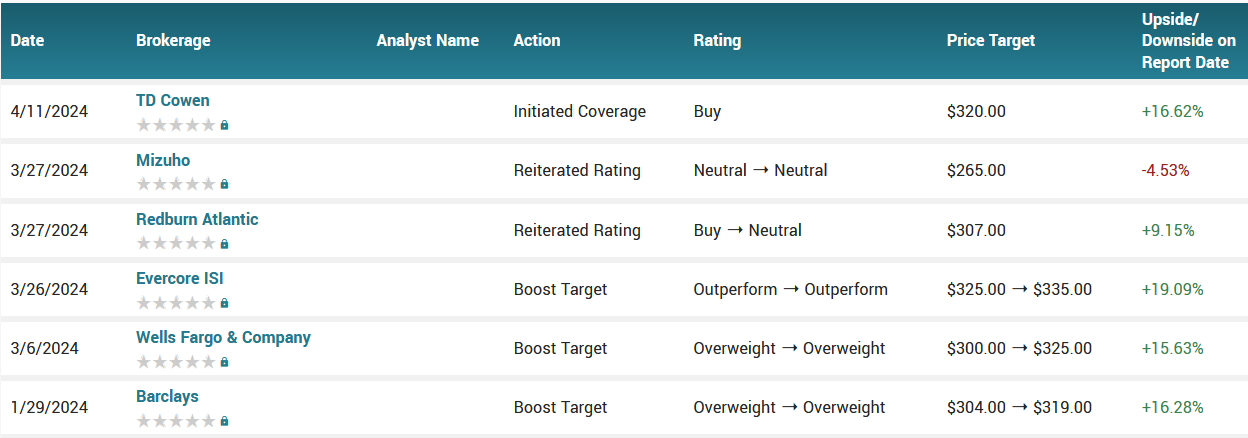

As well analysts raised their targets.....

- RBC Capital noted Visa's strong performance despite plenty of moving parts throughout the quarter including bad weather, the leap year and the timing of Easter. RBC Capital said the quarter illustrates the durability of Visa's business model while the 2024 guidance implies acceleration in back half of the year. The firm raised its price target to $315 from $309 and maintained an outperform rating on the shares.

- UBS predicts 11% to 12% organic net revenue growth for the year on a currency-neutral basis, based on Q1 and Q2 performance. The firm lifted its price target on V stock to $325 from $315 and kept a buy rating on shares.

- Wedbush on Wednesday also raised its price target on Visa to $300 from $280. The firm maintained an outperform rating on the stock.

Why the Visa Weekly Options Trade was Originally Executed!

Visa Inc (NYSE: V) is a well-known household name. The company helps the holders of more than 4 billion of its credit and debit cards purchase on the order of $15 trillion worth of goods and services every year at more than 130 million different vendors. Those numbers easily make it the world's biggest payment card middleman.

The company operates a handful of independently run (including of one another) innovation centers all over the world in an effort to meet more merchant and consumer needs. One example of this innovation is Visa's artificial intelligence-powered business-to-business travel assistant, which can help users optimize trips, create an itinerary, suggest entertainment, serve as a concierge, and of course, pay for it all.

At the same time, while cards have already displaced a great deal of cash, there's still plenty of cash being used to pay for goods and services that Visa could still displace. The U.S. Federal Reserve reports that 18% of 2022's purchases made within the United States were paid for with cash, while another 13% were completed as an ACH (direct bank link) transaction; "other" made up another 9% of these purchases. All of that could eventually become card-based. The same dynamic, of course, applies overseas as well.

The thing is Visa is slowly but surely leveraging its innovation to win this business. Analysts are calling for sales growth of more than 10% this fiscal year as well as next, with earnings expected to grow at an even faster clip.

This top financial enterprise has been a huge winner over the past decade, producing a total return of 488%.

The Visa Weekly Options Potential Profit Explained.....

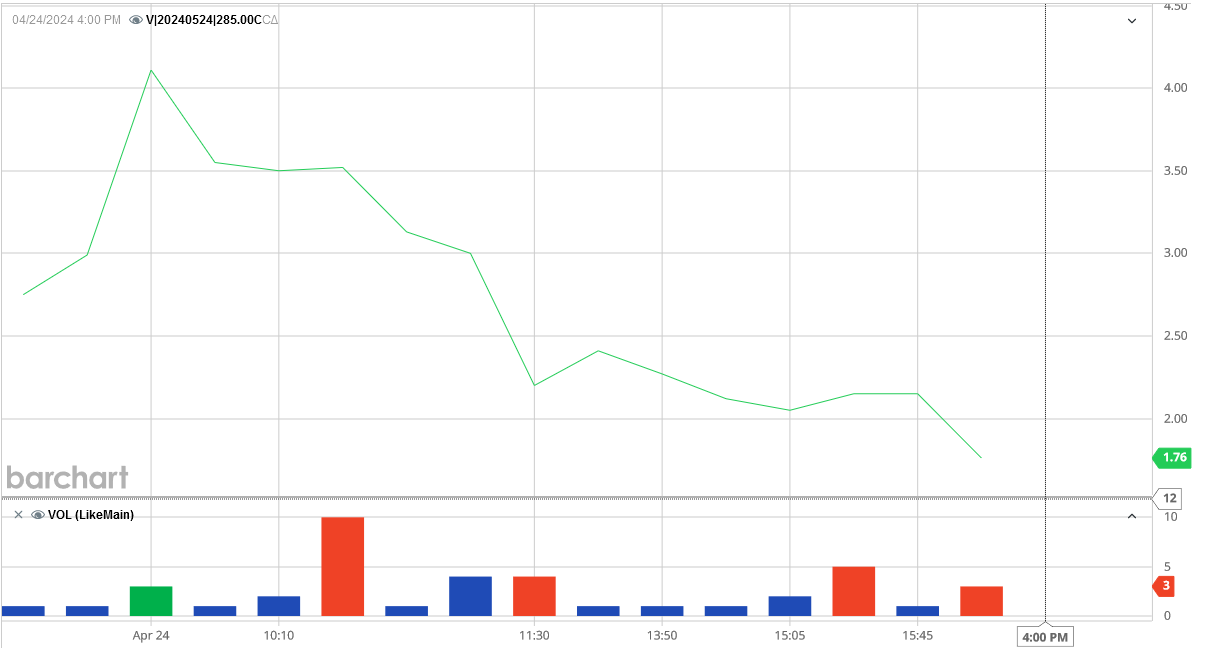

** OPTION TRADE: Buy V MAY 24 2024 285.000 CALLS - price at last close was $4.75 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the V Weekly Options (CALL) Trade on Monday, April 15, 2024 for $3.35.

Sold HALF the DVN weekly options contracts on Wednesday, April 24, 2024 for $4.12; a potential profit of 23%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About VISA……

Visa Inc. is a US-based multinational financial services company formed from a consortium of US banks. It is the 2nd largest payment processor globally and the leading payment processor outside China. Its market share in 2021 was roughly 50% of global transaction volume x-China. Transactions are processed in 1 of 4 hardened data centers in key regions worldwide. The data centers are hardened against internal and external attacks, both physical and digital, and can operate independently of each, providing ample redundancy for the system. As of 2022, the company can process more than 30,000 transactions per second, making it the most viable solution for most use-case scenarios.

Visa Inc. was founded in 1958 by Bank of America as the BankAmericard Credit Card network. Not only is the card itself of historical importance, but how it was launched is also. Bank of America launched the program with the first mass mailing of unsolicited credit cards, changing the nature of the entire consumer credit market. At the time, consumers often had several credit accounts with local merchants, which was cumbersome for financial record-keeping; by introducing a consumer-friendly credit card, Bank of America unified merchant credit accounts into one billing statement.

The BankAmericard network was so popular, and to compete again with the then-number 1 MasterCard, Bank of America opened use to other financial institutions. By 1970 Bank of America had relinquished direct control of the institution allowing a consortium of financial institutions to operate the company. It was rebranded as Visa in 1976 and grew to become the dominant payment processing network in the decades since.

Visa Inc is not a card issuer; it does not extend credit to consumers and does not set rates or fees for consumers. It is in business to provide electronic funds transfers services or EFT to financial institutions, banks, government and businesses. Entities needing financial payment processing infrastructure can enroll in VisaNet and issue Visa-branded cards and services to their clients and customers.

Visa operated as four separate entities serving different regions of the globe until restructuring in 2006. The restructuring resulted in the merger of 3 of the four assets into Visa Inc, leaving Visa Europe as a stand-alone entity. The new Visa Inc held its IPO in 2007, selling half of its shares, raising nearly $18 billion or almost double the targeted amount. Visa Europe was later acquired by Visa Inc, forming the unified company traded today.

Visa employs more than 26,500 individuals globally and brought in roughly $15 billion in revenue for fiscal 2021. The company has more than 3.9 billion active cards out globally; it has processed more than 255 billion transactions and is used by more than 80 million merchant locations. As a forward-thinking company, Visa is also engaged to some degree with the cryptocurrency markets and has partnerships with Coinbase and Crypto.com, among others.

The Major Catalysts for the VISA Weekly Options Trade…..

One reason Visa looks like a stress-free stock purchase is its business model. Investors are surely familiar with traditional banking entities like JPMorgan Chase and Bank of America. At a high level, these financial institutions take in deposits and lend money to consumers, sometimes via credit cards.

Those unsecured loans create default risk, which requires banks to set aside lots of capital to cover potential loan losses. During economic slowdowns and recessions, those losses can surge. The result is that these banks experience bouts of cyclicality that track the changes in the economy and interest rates.

Visa is less of a financial institution and more of a technology and communications firm. It provides the infrastructure that allows merchants' banks and consumers' banks to interact with each other to facilitate transaction processing. That's a much less risky business model.

Other Catalysts.....

This company doesn't earn interest income because it doesn't lend money. Instead, Visa collects a tiny fee each time one of the 4.3 billion Visa-branded cards active now is used as a method of payment. These assessments are usually less than 0.15% of the transaction's dollar amount.

But given that Visa handled a whopping $15 trillion of payment volume in its fiscal 2023, those fees add up to a financially lucrative enterprise. Its operating margin has hovered above 60% in the past five years, which is truly remarkable. It would be a difficult task to find companies more profitable than this one.

Additionally, Visa's technology is largely already built out, so its capital investment requirements are minimal. In its fiscal 2024 first quarter, which ended Dec. 31, the business spent just $267 million on capital expenditures -- 3% of its revenue during the period.

Thanks to its asset-light model, Visa generates tremendous amounts of free cash flow.

Growth Prospects.....

Despite being a long-established company with a $553 billion market cap, Visa still has sizable growth prospects. The consensus estimate among Wall Street analysts is that its revenue will grow at a compound annual rate of more than 10% over its next three fiscal years.

A key driver of these gains will be the ongoing secular shift from cash- and paper-based transactions to cashless means of payment. There is still plenty of room even in developed economies for card-based transactions' market share to grow. In emerging markets, the opportunity is even larger.

Huge growth prospects attract competitive forces. In Visa's case, it has had to deal with the rise of various fintech companies trying to encroach on its turf. There's also the possibility that cryptocurrencies and blockchain technology could become bigger presences in the payments landscape.

However, Visa has continued to post strong volume, sales, and earnings growth even as these perceived threats to its model have expanded. The company's durability is another reason it would be a stress-free blue-chip stock to buy right now.

Moving Ahead…..

Visa reported cross-border volume that rose 16% year over year in the company's fiscal 2024 first quarter that ended Dec. 31, 2023. That helped push adjusted earnings 8% higher year over year. Share repurchases allowed fiscal first-quarter earnings per share to rise by 11% year over year.

Analysts.....

TD Cowen's Bryan Bergin recently initiated coverage of Visa with a buy rating and a $320 price target.

Bergin's target implies a gain from the current price of about 16% over the next 12 months, and it is higher than most of his peers. Given the recent pace of growth we've seen from the world's largest global payment network, it's not an unreasonable stock price appreciation expectation.

According to the issued ratings of 23 analysts in the last year, the consensus rating for Visa stock is Moderate Buy based on the current 5 hold ratings and 18 buy ratings for V. The average twelve-month price prediction for Visa is $296.87 with a high price target of $335.00 and a low price target of $252.00.

Summary.....

Visa has grown earnings per share by 298% over the past decade and international markets and cross-border transactions give Visa room to grow. The stock has been trading for just 27.8 times forward earnings expectations. This isn't an unreasonable price to pay for a stock likely to continue growing earnings by a high single-digit percentage over the long run.

As the largest of just four card-based global payment networks expect continued earnings growth from Visa for at least another decade.

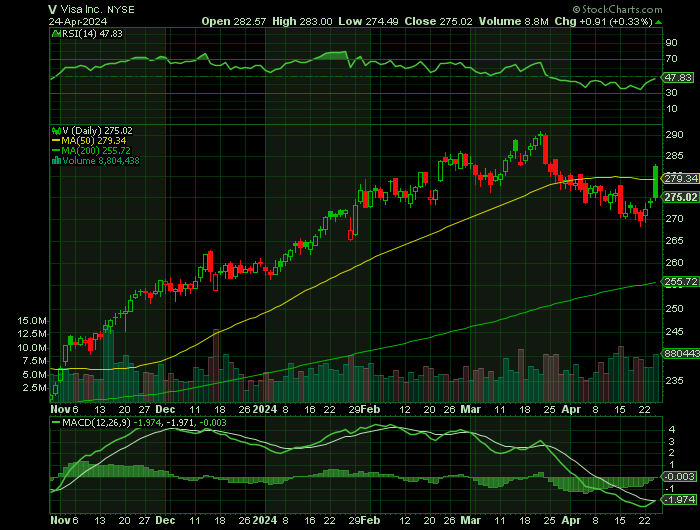

Shares of Visa opened at $275.96 on Monday. The stock has a market cap of $506.80 billion, a PE ratio of 31.76, a PEG ratio of 1.91 and a beta of 0.96. The company's fifty day moving average is $280.13 and its 200 day moving average is $261.92. Visa Inc. has a 52 week low of $216.14 and a 52 week high of $290.96. The company has a quick ratio of 1.45, a current ratio of 1.45 and a debt-to-equity ratio of 0.54.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from VISA

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!