TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Volatility

Provides 65% Profit, In An Hour,

Using A DWAC Weekly Call

Option!

This trade was based on the volatility that had been experienced in the previous two days.

After Donald Trump's decisive win in the Iowa caucus and two opponents dropping out and endorsing him – Vivek Ramaswamy and Ron Desantis – it’s becoming clear who the Republican nominee will be. All the while, one stock has seen a strong rally on Trump’s chances to make his return to the White House, and it could continue higher following the New Hampshire primary, where Trump is the hands-down favorite.

However, the price didn’t continue to move back up but instead, by the time the market opened, had begun to fall.

Due to the volatility that had been displayed in the prior two sessions, it was a case of buying and then exiting as quickly as possible with a decent profit!

This set the scene for Weekly Options USA Members to profit by 65%, in about an hour, using a DWAC Options trade!

Join Us And Get The Trades – become a member today!

Friday, January 26, 2024

by Ian Harvey

This trade was based on the volatility that had been experienced in the previous two days, as can be read below.

However, the price didn’t continue to move back up but instead, by the time the market opened, had begun to fall. This is where the difficulty sets in – when to buy into the trade – or not at all. Buying the bottom of the dip is always a problem – has it reached the bottom? Or will it continue downwards?

In this case, due to the volatility that had been displayed in the prior two sessions, it was a case of buying and then exiting as quickly as possible with a decent profit!

This was not a situation where you waited for the stock to continue upwards. And thankfully, it was a wise decision to exit early as the stock reversed again and continued to spiral for the next two trading sessions.

It is very likely that this volatility will continue and anyone that is still holding may still see the stock price reverse in the near future and may be in a position to profit.

Why the Digital World Acquisition Weekly Options Trade was Originally Executed!

After Donald Trump's decisive win in the Iowa caucus and two opponents dropping out and endorsing him – Vivek Ramaswamy and Ron Desantis – it’s becoming clear who the Republican nominee will be. All the while, one stock has seen a strong rally on Trump’s chances to make his return to the White House, and it could continue higher following the New Hampshire primary, where Trump is the hands-down favorite.

Options volume in the Digital World Acquisition Corp (NASDAQ: DWAC) stock has soared in the past two sessions, with a record number of contracts having already changed hands this week. Meanwhile, shares of the firm — a blank-check company seeking to take Donald Trump’s social media firm public — have jumped as much as 100% since Monday morning.

Amid the frenzy, a $100 call option expiring on Friday traded 13,200 times by 2:43 p.m. in New York, making it the most popular contract in the session. For that option to be worth anything, the stock needs to rally some 92% by the end of the week.

The call traded in small chunks throughout the session, for as little as 42 cents and as much as $3.03 each. Online, retail traders buzzed about Digital World Acquisition, making it among the most-discussed stocks on WallStreetBets and chatroom StockTwits on Tuesday.

According to Danny Kirsch, head of options at Piper Sandler & Co., it appears that the market push has been mostly from traders who have been bidding for the options, potentially positioning for a further rally.

“Buying calls that expire in 3 days that are 100% out of the money is unusual but this stock also up 80% the past 2 days,” he said. “It seems like speculative buying or playing for a further squeeze — perhaps Trump having a blowout win in New Hampshire further pushing up the stock tomorrow.”

The Digital World Acquisition Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy DWAC FEB 09 2024 55.000 CALLS - price at last close was $8.50 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

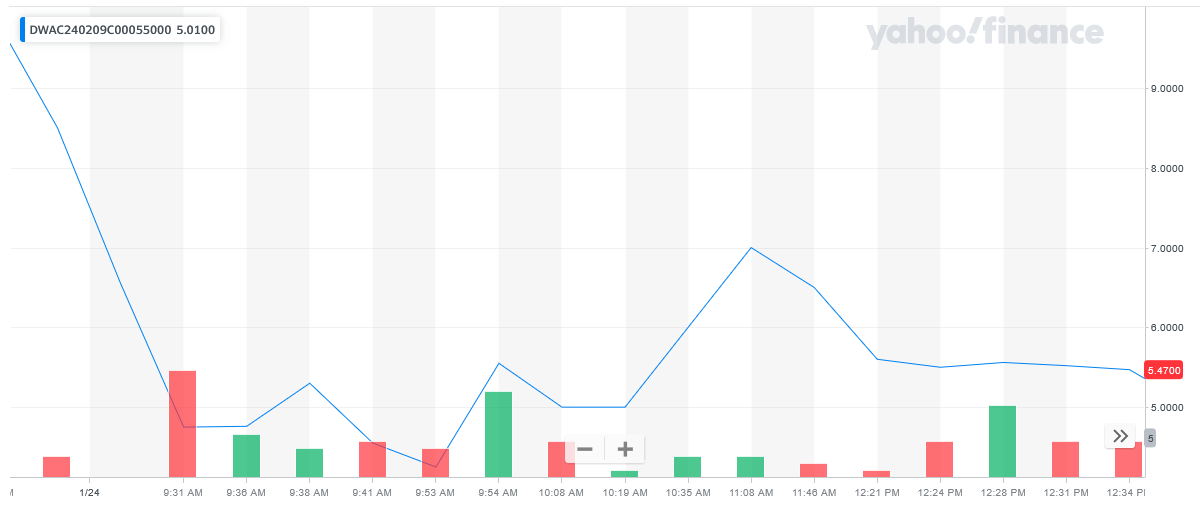

Entered the DWAC Weekly Options (CALL) Trade on Wednesday, January 24, 2024, at 9:53, for $4.25.

Sold the DWAC weekly options contracts on Wednesday, January 24, 2024, at 11:08, for $7.00; a potential profit of65%.

Don’t miss out on further trades – become a member today!

About Digital World Acquisition.....

Digital World Acquisition Corp. is a blank check company. It intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or related business combination with one or more businesses. Digital World Acquisition Corp. is based in Miami, Florida.

Further Catalysts for the AI Weekly Options Trade…..

Digital World’s stock has surged over 175% since Trump’s win in Iowa, including a rally of over 88% yesterday. While the valuation of the combined company may be getting a bit rich, there’s no telling where traders could take it going forward, especially if the merger with Truth Social closes.

Other Catalysts.....

DWAC’s stock rose by 2.13% to $50.75, with a high of $58.72 and a low of $40.13, and a 52-week range of $12.34 to $58.72. The company, linked to former President Donald Trump, saw its stocks surge following his advancement in the Republican presidential nomination, reminiscent of the meme-stock saga. It should be noted that Trump has won the New Hampshire primary in which he went heads on against opponent Nikki Haley, a former governor and an erstwhile ambassador to the United Nations.

Summary.....

Digital World Acquisition stock has soared as much as 239% since former President Donald Trump won the Iowa caucus last week.

The SPAC saw its stock price soar from about $17 last week before the Iowa caucus results to as high as $58.66 on Tuesday, as it is looking increasingly likely that Trump will secure the Republican Party's 2024 nomination for president.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

Digital World Acquisition

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!