TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Wells Fargo & Co Earnings

Wednesday, January 12, 2022

Wells Fargo reports earnings on Friday, January 14, 2022; and Wall Street expects a year-over-year increase in earnings on higher revenues.

Members are already up 35% after executing a weekly options trade Monday!

expectations for WELLS FARGO Earnings

Wall Street

expects a year-over-year increase in earnings on higher revenues when Wells

Fargo reports earnings at approximately 7:00 AM ET on Friday, January 14, 2022.

The

consensus earnings estimate is $1.09 per share on revenue of $18.38 billion;

but the Whisper number is higher at $1.20 per share.

Consensus

estimates are for year-over-year earnings growth of 70.31% with revenue

decreasing by 3.87%.

Overall earnings estimates have been revised higher since the company's last earnings release.

For the last reported quarter, it was expected that Wells Fargo would post earnings of $1.03 per share when it actually produced earnings of $1.17, delivering a surprise of +13.59%.

Over the last four quarters, the company has beaten consensus EPS estimates four times.

Prelude.....

While the near-zero interest-rate environment remains unchanged for now, the banking sector has witnessed a steady recovery on the back of increasing financial transactions and capital market activities. Moreover, Goldman Sachs (GS) expects the Federal Reserve to raise interest rates four times this year, one more than the previous forecast due to persistently high inflation and a labor market near full employment. In addition, the central bank is expected to reduce its bond holdings soon, which should help the banking companies expand their interest margin. According to Globe Newswire, the global financial services market is expected to grow at a CAGR of 6% by 2025.

One of the leading financial services companies, Wells Fargo & Co (NYSE:WFC), provides diversified banking, investment, mortgage products and services, and consumer and commercial finance. It operates through four segments: consumer banking and lending, commercial banking, corporate and investment banking, and wealth and investment management.

WFC has gained 9% over the past month. Also, WFC has gained 26.2% over the past six months.

Influencing Factors for WELLS FARGO Earnings

Turnaround Story.....

Analysts expect the U.S. central bank to lift a damaging asset cap that has curtailed growth at the lender amid signs of rising interest rates.

Wells Fargo, primarily focused on the lending business, has reined in costs as it grapples with the aftermath of a sales practices scandal that first came to light in 2016 and forced the Federal Reserve to cap its assets at $1.95 trillion.

The asset cap has restricted the loan and deposit growth needed to boost interest income and cover costs at the country's fourth-largest lender, while rival balance sheets have swelled.

It remains unclear how much longer the cap would stay in place, but recent brokerage action has been bullish, with Barclays last week saying it expects the lender to benefit from "substantial progress" on its regulatory issues and cost cuts.

"That balancing act - cutting expenses while maintaining service, controlling risk and avoiding adverse publicity - is not an easy task. But for now, they appear once again to be on plan," said Rick Meckler, partner at Cherry Lane Investments in New Vernon, New Jersey.

"Investors are hoping that new management has finally put the recent scandals behind them and can rehabilitate what was once a premier banking brand."

Higher Interest Rate Environment.....

The Fed

officials are highly concerned about the “elevated levels of inflation” and the

tighter job market. The officials are ready to get more aggressive in dialing

back the ultra-easy monetary policies, which were introduced in March 2020 to

support the U.S. economy from COVID-19 related slowdown.

This will mean a faster-than-previously expected increase in interest rates and

a reduction in the balance sheet size “soon after beginning to raise the

federal funds rate.” Per the CME FedWatch Tool data, at present, there is

almost 70% chance that the Fed will raise the interest rates by 25 basis points

in March.

Thriving in a higher interest rate environment, banks are likely to remain in the spotlight.

Since March 2020, banks have been witnessing contraction of the net interest margin (NIM) due to the Fed's accommodative monetary policy and near-zero interest rates. So, the faster-than-expected interest rate hikes will come as a breather for banks and improve margins and net interest income (NII), which constitutes a major portion of the revenues.

Also, the steepening of the yield curve (the difference between short and

long-term interest rates), robust economic growth and a gradual rise in loan

demand are set to drive margins and NII. Banks are taking initiatives to

restructure operations to diversify their footprint and revenue base. Efforts

to focus more on non-interest income are likely to bolster banks’ top-line

growth.

Based on

these favorable developments, investing in bank stocks will be highly

profitable, going forward – and San Francisco-based Wells Fargo is one of the

largest financial services companies in the United States which will benefit.

WFC had more than $1.9 trillion in assets and $1.4 trillion in deposits as of

Sep 30, 2021.

Agreement To Use A Blockchain-Based Solution.....

On December 13, 2021, WFC and HSBC Bank plc announced an agreement to use a blockchain-based solution for the netting and settlement of matched foreign exchange transactions. The strategic agreement optimizes the settlement of foreign exchange transactions and reduces settlement risk, leading to increasing demand for their service.

Other Factors.....

Wells Fargo

continues to build on its deposits base, which witnessed a five-year CAGR of

(2016-2020) of nearly 2%, with the trend sustaining in the first nine months of

2021. With the solid economic recovery and resumption of business activities,

the deposit balance is likely to keep improving. This is likely to support

WFC’s liquidity position.

Wells Fargo’s prudent expense management initiatives support its financials.

The company is focused on reducing its expense base by streamlining

organizational structure, closing branches and reducing headcount by optimizing

operations and other back-office teams.

WFC’s net revenue decreased 2.5% year-over-year to $18.83 billion for the

fiscal third quarter ended September 30, 2021. However, its net income grew

59.3% year-over-year to $5.12 billion, while its EPS came in at $1.17, up 67.1%

year-over-year.

WFC’s total assets grew at a CAGR of 1.4% over the past three years. Analysts expect WFC’s revenue to decrease 2.8% for the quarter ending March 31, 2022, and 5.3% in fiscal 2022. The company’s EPS is expected to decline 22.5% for the quarter ending March 31, 2022, and 20.6% in fiscal 2022. However, its EPS is expected to grow at a rate of 115.9% per annum over the next five years.

Analyst Thoughts.....

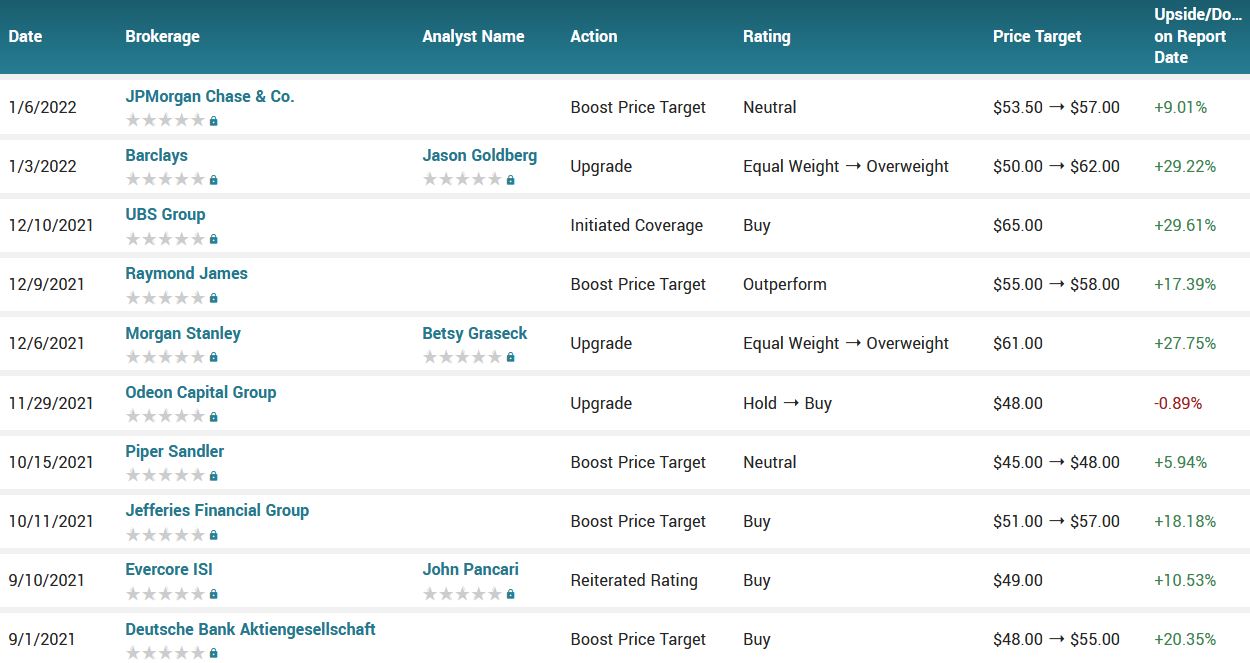

Jefferies, Raymond James and Evercore ISI are among the brokerages that named the bank among their top picks, while CFRA Research expects Wells Fargo and Bank of America Corp to benefit the most in the rising interest rate environment.

According to the issued ratings of 18 analysts in the last year, the consensus rating for Wells Fargo & Company stock is Buy based on the current 4 hold ratings and 14 buy ratings for WFC. The average twelve-month price target for Wells Fargo & Company is $52.11 with a high price target of $65.00 and a low price target of $39.00.

Summary for Wells Fargo Earnings.....

Normalizing credit quality, healthy balance sheet and investment-grade

credit ratings are other tailwinds, which will continue supporting Wells

Fargo’s financials. The company’s impressive capital deployment plans are

sustainable, driven by earnings strength.

WFC has a market capitalization of $225.48 billion, a PE ratio of 12.92, and a

P/E/G ratio of 1.01 and a beta of 1.30. The stock has a 50 day simple moving

average of $49.81 and a 200-day simple moving average of $47.84. Wells Fargo

& Company has a 1 year low of $29.68 and a 1 year high of $55.19. The

company has a quick ratio of 0.81, a current ratio of 0.82 and a debt-to-equity

ratio of 0.95.

FINALLY.....

To see what we have proposed for

Wells Fargo Earnings CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!