TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Zoom Video

Communications Earnings

Exceeds Wall Street Estimates!

Weekly Options Members

Are Up 195% Potential Profit, In 3 Hours,

Using A Weekly CALL Option!

Zoom Video Communications Inc (NASDAQ: ZM) reported third-quarter financial results after the close on Monday.

Zoom said third-quarter revenue increased 3.2% year-over-year to $1.14 billion, which beat the consensus estimate of $1.12 billion. The company reported quarterly earnings of $1.29 per share, which beat analyst estimates of $1.08 per share, marking the 18th consecutive EPS beat for Zoom.

This set the scene for Weekly Options USA Members to profit by 195%, using a ZM Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, November 21, 2023

by Ian Harvey

Zoom Video Communications Inc (NASDAQ: ZM) topped third-quarter expectations and lifted its 2024 outlook Monday, fueled partly by strong customer loyalty and expanding usage of tools beyond the company's standard video meetings.

Zoom said third-quarter revenue increased 3.2% year-over-year to $1.14 billion, which beat the consensus estimate of $1.12 billion. The company reported quarterly earnings of $1.29 per share, which beat analyst estimates of $1.08 per share, marking the 18th consecutive EPS beat for Zoom.

CFO Kelly Steckelberg said that additional services like Zoom Scheduler, Contact Center, and Whiteboard have increased consumer "retention rates." As well, by growing beyond core video, Steckelberg notes Zoom has been able to cross-sell additional capabilities that users now rely on for broader productivity -- something she's expects will continue to help expand margins.

Steckelberg also touched on Zoom's approach to AI with the recent launch of the Zoom AI companion, which she notes has been added by over 200,000 accounts in just a two-month span. Steckelberg says the company has been testing various vendors’ technologies rather than relying solely on one company, such as OpenAI, in the wake of its leadership turmoil.

Why the Zoom Video Communications Weekly Options Trade was Originally Executed!

Zoom Video Communications Inc (NASDAQ: ZM) reported third-quarter financial results after the close on Monday.

Zoom said third-quarter revenue increased 3.2% year-over-year to $1.14 billion, which beat the consensus estimate of $1.12 billion. The company reported quarterly earnings of $1.29 per share, which beat analyst estimates of $1.08 per share, marking the 18th consecutive EPS beat for Zoom.

Enterprise revenue was up 7.5% year-over-year. Operating margin came in at 14.9% in the quarter. Operating cash flow totaled $493.2 million, up 67% year-over-year.

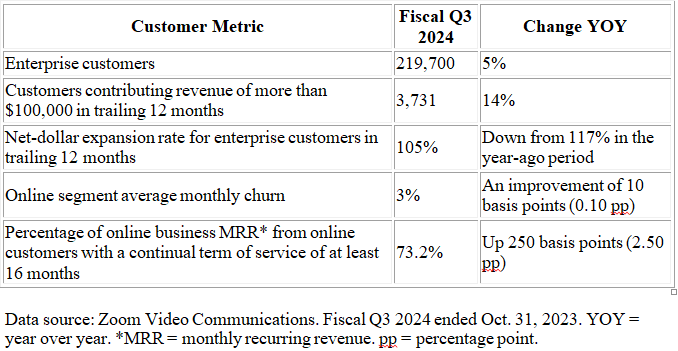

Zoom ended the quarter with approximately 219,700 enterprise customers, up 5% year-over-year. 3,731 of those customers are contributing more than $100,000 in trailing 12 months revenue, up approximately 13.5%.

"In Q3, revenue came in ahead of guidance as we bolstered Zoom's all-in-one intelligent collaboration platform with advanced new capabilities like Zoom AI Companion and continued to evolve our customer and employee engagement solutions," said Eric Yuan, founder and CEO of Zoom.

The Zoom Video Communications Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy ZM DEC 08 2023 66.000 CALLS - price at last close was $3.65 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

After the opening bell the stock dropped from the previous close of $66.00 to a low of $61.83.

This was extremely beneficial for our options trade!

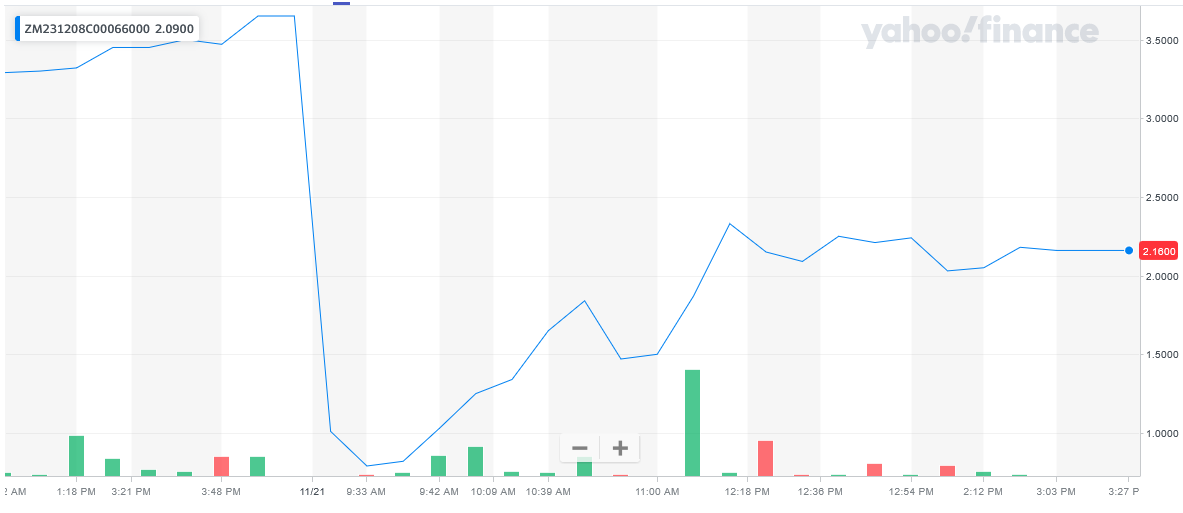

Entered the ZM Weekly Options (CALL) Trade on Tuesday, November 21, 2023, at 9:33, for $0.79.

The ZM weekly options contracts hit a high Tuesday, November 21, at 12:10, at $2.33; a potential profit of195%.

Don’t miss out on further trades – become a member today!

About Zoom Video Communications.....

Zoom Video Communications, Inc. provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

The company offers Zoom Meetings that offers HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices.

It also provides Zoom Rooms, a software-based conference room system; Zoom Hardware-as-a-Service allows users to access video communication technology from third party equipment; Zoom Conference Room Connector, a gateway for SIP/H.323 endpoints to join Zoom meetings; Zoom Events, which enables users to manage and host internal and external virtual events; OnZoom, a prosumer-focused virtual event platform and marketplace for Zoom users to create, host, and monetize online events; and Zoom Webinars to provide video presentations to large audiences from many devices.

In addition, the company offers Zoom Developer Platform that enables developers, platform integrators, service providers, and customers to build apps and integrations using Zoom's video-based communications solutions, as well as integrate Zoom's technology into their products and services; Zoom App Marketplace, which helps developers to publish their apps, as well as third-party integrations of Zoom; and Zoom Contact Center, an omnichannel contact center solution.

It serves individuals; and education, entertainment/media, enterprise infrastructure, finance, government, healthcare, manufacturing, non-profit/not for profit and social impact, retail/consumer products, and software/Internet industries.

The company was formerly known as Zoom Communications, Inc. and changed its name to Zoom Video Communications, Inc. in May 2012. The company was incorporated in 2011 and is headquartered in San Jose, California.

Further Catalysts for the ZM Weekly Options Trade…..

The company, whose signature video software became the essential communications tool for homebound Americans during the pandemic, has turned its focus to business customers. Zoom has added features for those clients, including word processing, and stepped up the use of artificial intelligence to buttress its main videoconferencing service, which competes fiercely with Microsoft Corp.’s Teams product.

Enterprise revenue from 219,700 customers rose 7.5% to $661 million in the quarter ended Oct. 31, topping analysts’ average estimate. Zoom said it had 3,731 clients that contribute more than $100,000 in trailing 12-month revenue — an increase of almost 14% from the period a year earlier.

“We bolstered Zoom’s all-in-one intelligent collaboration platform with advanced new capabilities like Zoom AI Companion and continued to evolve our customer and employee engagement solutions,” Chief Executive Officer Eric Yuan said in the statement.

The results “are encouraging to us amid the company’s need to offset a slowdown in its consumer unit with higher sales to business customers,” wrote John Butler, an analyst at Bloomberg Intelligence, adding that Zoom’s focus on expanding profitability “also appears clearly on track.“

Other Catalysts.....

The stock's modest rise is attributable to the quarter's revenue and earnings exceeding Wall Street's consensus estimates and management increasing annual guidance on the top and bottom lines.

Revenue.....

For fiscal Q3, Zoom's revenue rose 3.2% year over year (and 3.5% in constant currency) to $1.14 billion. This result was higher than the $1.12 billion analysts were expecting and the company's guidance range of $1.115 billion to $1.120 billion.

Growth was driven by Zoom's enterprise business, whose revenue grew 7.5% year over year to $660.6 million. The online segment's revenue was down 2.4% to $476.1 million.

The enterprise business's year-over-year revenue growth continued its deceleration. In Q1 and Q2 of the current fiscal year, this metric was 13% and 10%, respectively. For the full fiscal year of 2023, it was 24%.

Operating Income.....

Income from operations under generally accepted accounting principles (GAAP) was $169.4 million, up 194% from the year-ago period. Adjusted for one-time items, operating income landed at $447.1 million, up 17% year over year.

EPS.....

GAAP net income was $141.2 million, or $0.45 per share, up 181% from the year-ago period. Adjusted net income came in at $401.2 million, or $1.29 per share, up 21% year over year.

Wall Street had been looking for adjusted earnings per share (EPS) of $1.00, so the company zoomed by this profit expectation. It also sped by its own guidance of $1.07 to $1.09 per share.

Operating Cash Flow.....

The quarter's operating cash flow surged 67% year over year to $493.2 million. Free cash flow jumped 66% to $453.2 million.

Zoom's balance sheet remains robust. The company ended the quarter with $6.5 billion in available cash, cash equivalents, and marketable securities, and no long-term debt.

Zoom Phone.....

Zoom Phone, one of the company’s most important secondary bets, hit 7 million paid users in the quarter, Steckelberg said. Its contact center product reached 700 customers, she added. Sales declined outside of the Americas in the quarter, Steckelberg said, with the European and Asian regions declining 2%. Sales in the Americas were up 5%.

Moving Forward.....

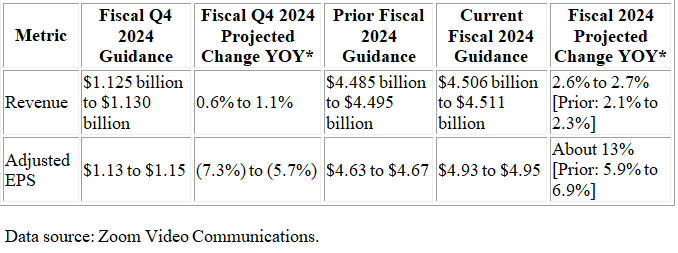

Zoom said it expects fourth-quarter revenue to be between $1.125 billion and $1.13 billion versus estimates of $1.13 billion. The company expects fourth-quarter earnings to be between $1.13 and $1.15 per share versus estimates of $1.00 per share.

Full-year revenue is expected to be between $4.506 billion and $4.511 billion versus estimates of $4.5 billion. Full-year earnings are expected to be between $4.93 and $4.95 per share versus estimates of $4.27 per share.

Management issued Q4 guidance and raised its annual outlook.

Analysts.....

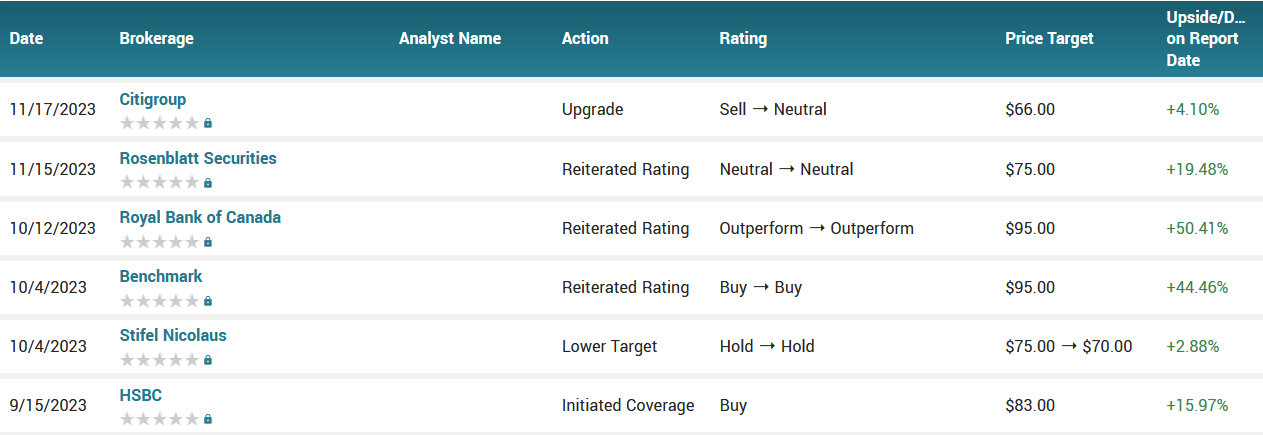

According to the issued ratings of 22 analysts in the last year, the consensus rating for Zoom Video Communications stock is Hold based on the current 17 hold ratings and 5 buy ratings for ZM. The average twelve-month price prediction for Zoom Video Communications is $81.55 with a high price target of $100.00 and a low price target of $66.00.

Summary.....

Shares appear to be reacting favorably to the company's better-than-expected quarterly results and upbeat forward outlook.

With a market capitalization of $19.3 billion, a $6.49 billion cash balance, and positive free cash flow over the last 12 months, it appears that Zoom has the resources needed to pursue a high-growth business strategy.

It was encouraging to see Zoom narrowly top analysts' revenue expectations this quarter, driven by more new customer wins than projected. Its free cash flow also beat Wall Street's estimates significantly. On the other hand, its net revenue retention of 105% missed. Overall, the results could have been better, but the market is rewarding the company for its robust cash generation.

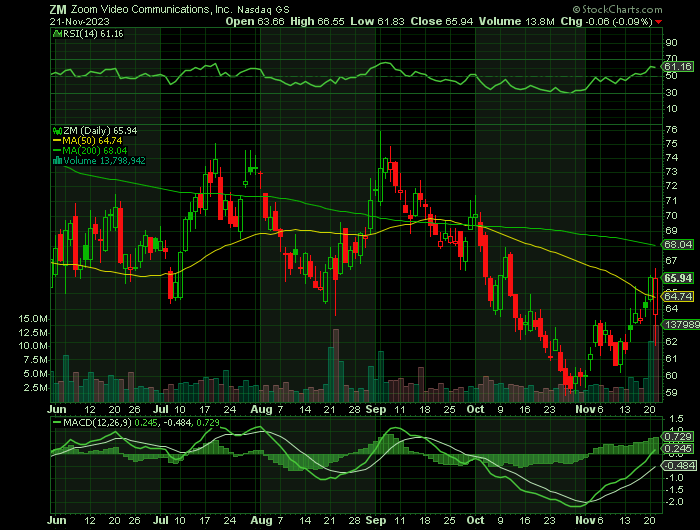

Zoom Video Communications traded up $1.88 on Monday, reaching $66.00. The stock had a trading volume of 9,367,157 shares, compared to its average volume of 3,726,619. The company has a market capitalization of $19.86 billion, a price-to-earnings ratio of 150.00, and a price-to-earnings-growth ratio of 1.07 and a beta of -0.16. Zoom Video Communications has a fifty-two week low of $58.87 and a fifty-two week high of $85.13. The firm has a 50-day moving average of $64.94 and a 200-day moving average of $67.12.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Zoom

Video Communications

Recent Articles

-

972% Profit: Super Micro Computer Options Trade - $285 into $3,054!

In the world of options trading, high-reward opportunities don’t come often—but when they do, they can be game-changers. That’s exactly what happened with this Super Micro Computer (SMCI) options trad… -

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Broadcom: A Rising Star in the AI-Driven Tech Revolution!

Broadcom: A Rising Star in the AI-Driven Tech Revolution! Weekly Options Members Profit Up 1,125%!