TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

What’s Fueling Unity’s 131%

Options Spike This Week?

And Is There More Profit To Come?

Wednesday, March 26, 2025

by Ian Harvey

Unity

Options Skyrocket 131%!

What’s behind the surge in U options? Unity’s new AI-powered ad platform,

Unity 6 engine upgrade, and a strategic partnership with Microsoft are turning

heads. With analyst upgrades and macro tailwinds boosting momentum, traders are

cashing in—and there may be more upside ahead.

Is Unity just getting started? Dive into the full story on how this gaming giant is transforming into a next-gen tech powerhouse.

Join Us and Get the Trades!

And Is There More Profit To Come?

Unity Software Inc. (NYSE: U) has stunned options traders and investors alike with an explosive 131% spike in its call options in less than a week. So, what exactly is behind this sudden surge—and is there still time to profit?

A Perfect Storm of Catalysts

The dramatic move isn’t just a result of market noise. Unity's recent rally is fueled by a series of meaningful developments across product innovation, AI integration, strategic partnerships, and macroeconomic relief. The company’s latest updates reveal a deeper narrative of transformation and renewed investor confidence.

Let’s break down the key factors behind this powerful move.....

- Unity 6 and Product Innovation

Unity’s release of its upgraded game engine, Unity 6, is a cornerstone of its resurgence. With enhanced graphics capabilities, AI tools, and faster performance, Unity 6 has already been adopted by 38% of its user base—a strong early signal. The move aligns with Unity’s long-term vision to empower creators not just in gaming but across industries like film, automotive, and virtual reality.

This product cycle momentum is fueling investor optimism and subscription growth. With Pro and Enterprise subscription price hikes already yielding a 15% year-over-year revenue boost, Unity’s SaaS model is starting to show strength.

- AI and Adtech Power Moves

Unity’s expansion into AI is a game-changer. Its new AI-driven ad platform, Unity Vector, leverages proprietary in-engine data for smarter targeting and better analytics. With digital advertising remaining a high-margin opportunity, this could significantly improve Unity’s top line.

Additionally, a strategic partnership with Microsoft to build cloud-based 3D experiences on Azure positions Unity at the intersection of gaming, enterprise, and the future of immersive tech.

- Institutional Confidence & Analyst Upgrades

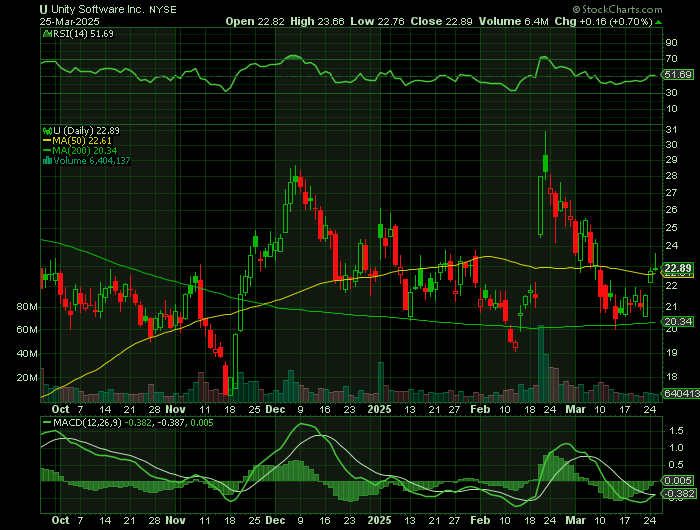

The market is noticing. Around 73.46% of Unity stock is held by institutions, highlighting strong belief in the company’s long-term potential. Analysts are also on board: recent upgrades from JMP Securities and Citigroup have placed Unity firmly in the "Buy" and "Strong Buy" camp. MarketBeat currently gives Unity a consensus rating of “Moderate Buy,” with some price targets reaching as high as $30.

- Macro Tailwinds & Tariff Relief

On the macro front, Unity got an unexpected boost from recent news that the upcoming U.S. tariffs would be narrower than feared. This eased inflation and supply chain concerns, triggering a broad tech rally—Unity included. The company’s stock jumped 5.7% in a single session, contributing to the recent spike in call option volume.

- What the Numbers Say

Unity recently closed at $22.89, beating the S&P 500’s daily return. Despite being down 7.7% year-to-date and still trading 20% below its 52-week high, short-term sentiment has flipped bullish. Analysts Rank have moved Unity to #2 (Buy) following positive EPS revisions—often a precursor to stock performance.

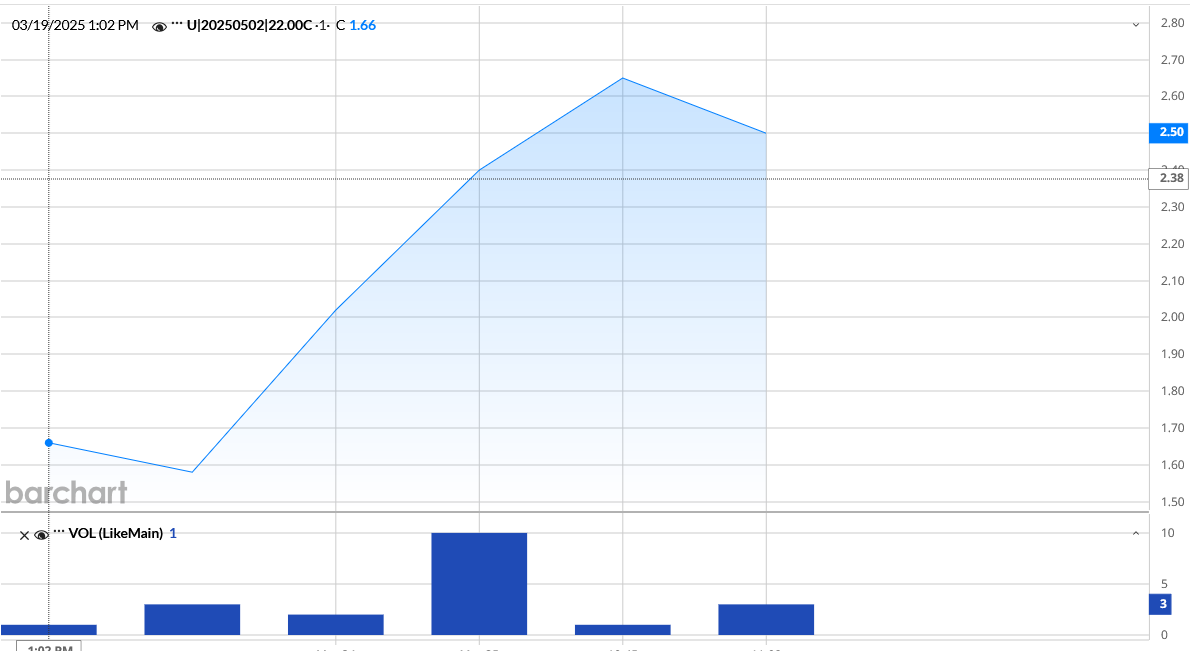

Options traders saw this shift early, and the 131% spike in May 02, 2025, $22.00 call options reflects confidence in further upside before expiration.

Is There More Profit To Come?

The short answer: potentially, yes.

Unity’s fundamentals are aligning with a powerful narrative—new leadership under Matt Bromberg, a turnaround strategy focused on cost control and monetization, and a growing total addressable market in both gaming and non-gaming verticals.

While profitability remains a hurdle, the pieces are falling into place for a sustained rally. The options trade has already paid handsomely, but for long-term investors, Unity’s transformation story is just beginning.

Final Thoughts

Unity is no longer just a game engine company—it’s becoming a multi-vertical tech innovator with strong institutional backing and growing Wall Street support. For traders who acted early, the 131% options spike is a rewarding validation. For others, the question becomes: will Unity’s next big move come from execution?

With Unity 6 adoption rising, AI-driven monetization accelerating, and analyst sentiment shifting, Unity Software might just be setting up for a breakout year.

Disclosure: Always manage options risk with protective stops and defined exit plans. As with any trade, past performance is not indicative of future results.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from

What’s Fueling Unity’s 131%

Options Spike!

Recent Articles

-

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs -

Fortinet Call Option Delivers Triple-Digit Return in Just One Week!

Fortinet Call Option Delivers Triple-Digit Return in Just One Week! Fortinet is crushing it in the AI-driven cybersecurity space. -

What’s Fueling Unity’s 131% Options Spike This Week?

What’s Fueling Unity’s 131% Options Spike This Week? And Is There More Profit To Come?