TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Fortinet Call Option Delivers Triple-Digit Return in

Just One Week!

Where to now?

Thursday, March 27, 2025

by Ian Harvey

We just locked in a 111% profit in ONE WEEK on a Fortinet (FTNT) call option!

Fortinet is crushing it in the AI-driven cybersecurity space.

This is how smart trades meet smart tech.

Join Us and Get the Trades - More

setups coming... Stay tuned!

In a shining example of strategic options trading, a recent call option on Fortinet Inc. (NASDAQ: FTNT) delivered a remarkable 111% profit in just seven days—underscoring the power of timing, insight, and a solid read on market dynamics.

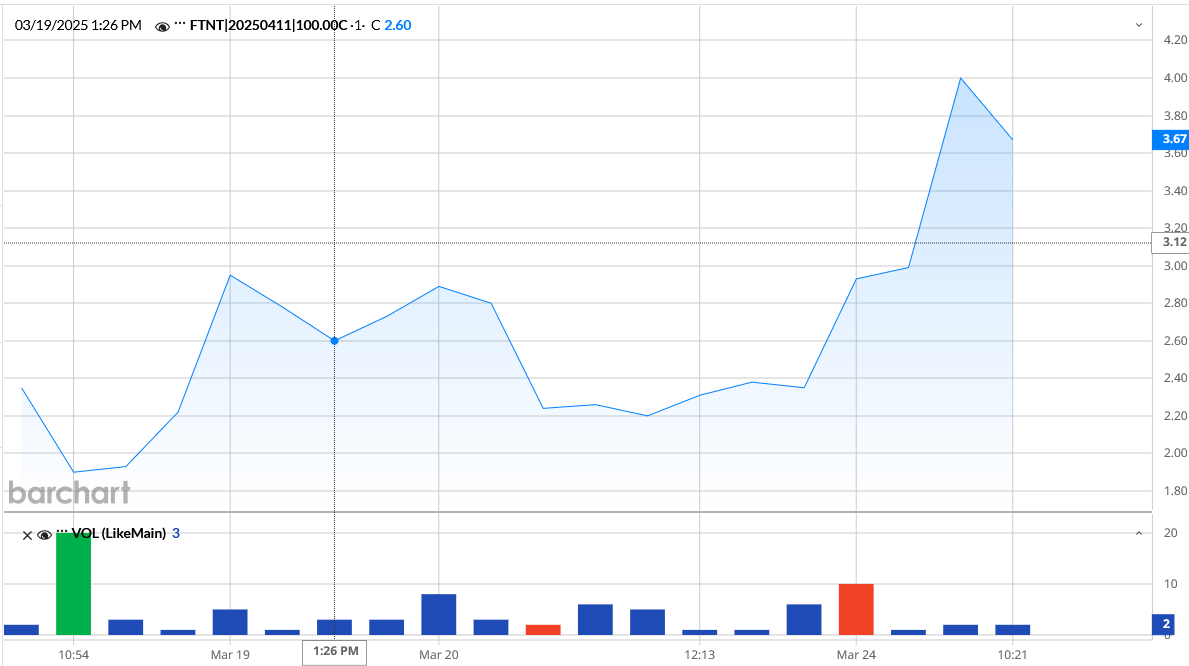

This trade, executed on March 18, 2025, involved a $100 strike call expiring April 11, purchased at a premium of $2.45. With Fortinet’s stock rebounding in anticipation of robust earnings and continued dominance in the cybersecurity space, this trade perfectly captured a wave of positive momentum—more than doubling in value within a week.

Why Fortinet? A Bullish Outlook Backed by Strength

Fortinet is no stranger to strong financials and strategic growth. Despite a recent pullback in its stock price, the company’s fundamentals remain rock-solid. With 29.3% net margins, consistent earnings beats, and year-over-year revenue growth, Fortinet continues to be a standout in the cybersecurity space.

Its recent earnings of $0.67 per share, surpassing the expected $0.60, exemplify its operational strength. Analysts project revenue growth of 13.49% and EPS growth of 3.38% over the next year—painting a picture of steady upward momentum.

Cybersecurity Demand: Fortinet’s Golden Opportunity

The surge in demand for cloud-based and AI-driven security solutions is fueling Fortinet’s rise. Its unified platform and AI-powered services are gaining traction across industries, positioning the company as a comprehensive solution provider amid growing global cyber threats.

Recent highlights include:

- Unified SASE revenues up 13%, now making up 23% of business

- Acquisition of Perception Point, expanding into email and collaboration security

- Continued growth in FortiGuard AI, FortiAI, and FortiAIOps

These innovations align with industry trends toward platform consolidation and automation—giving Fortinet a distinct edge over competitors.

Institutional Confidence & Market Positioning

With 70% of Fortinet's shares held by institutional investors, including giants like Vanguard, there’s strong validation of the company’s long-term prospects. The presence of insiders among the top shareholders further reflects confidence in Fortinet’s strategic direction.

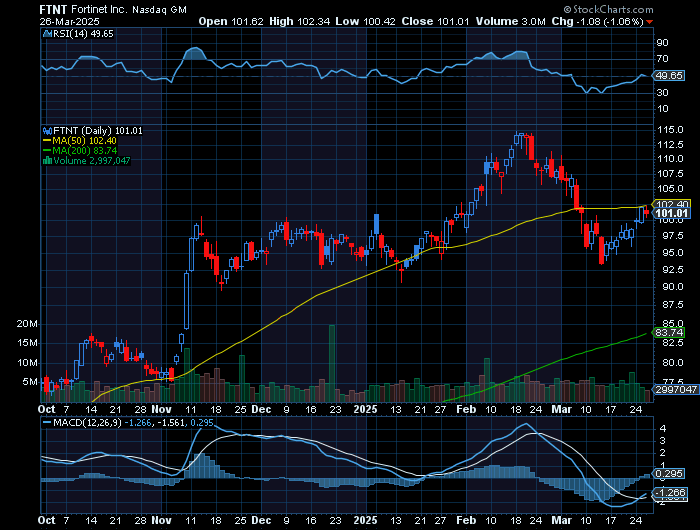

Additionally, Fortinet’s strong technical support at $92 and resistance near $114 offer a favorable setup for call option strategies. Its debt-to-equity ratio of 0.67 and P/E ratio of 42.77 underscore financial stability and attractive valuation, especially compared to industry peers.

Zooming Out: Industry Tailwinds & the Bigger Picture

The cybersecurity sector is heating up, with major tech players like Google investing $32 billion in cloud security firms. This trend is sparking talk of industry consolidation—putting spotlight on major players like Fortinet and Okta.

As threats evolve and the need for robust digital security grows, Fortinet is ideally positioned to benefit from increased enterprise and government investment. Its performance, product innovation, and strategic foresight are all aligning at the right moment.

Final Takeaway: A Trade Well Played—and More to Come?

This 111% options win on Fortinet isn’t just a story of smart timing—it’s a reflection of confidence in a company poised for continued growth. Whether you're trading short-term calls or investing long-term, Fortinet offers both momentum and stability in an increasingly critical industry.

As Fortinet continues to scale its offerings and expand market share, savvy investors may want to keep this cybersecurity leader firmly on their radar.

Disclosure: Always manage options risk with protective stops and defined exit plans. As with any trade, past performance is not indicative of future results.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs -

Fortinet Call Option Delivers Triple-Digit Return in Just One Week!

Fortinet Call Option Delivers Triple-Digit Return in Just One Week! Fortinet is crushing it in the AI-driven cybersecurity space.