TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Docusign Stock Continues To Climb!

“Weekly Options” Members

Profit Up 274%!

More Growth Expected!

Sunday, July 25, 2021

by Ian Harvey

Docusign stock has been on a bull-run this summer, climbing 12% higher in the month of July alone, and providing members with a potential profit of 274% with a weekly options trade.

The digital signature market is dominated by DOCU, with roughly 70% of the USD 25 billion market. Digitization is only becoming more integrated into the lives of consumers and businesses alike and could gain even more traction, which stands to benefit DOCU even further.

The stock price is likely to continue increasing for the foreseen future.

Docusign Inc (NASDAQ: DOCU)

Prelude…..

On Monday, July 06, 2021, a Docusign Weekly Options trade was recommended to our members based on several catalysts.

READ Details of the Original Docusign Weekly Options Recommendation Further Below.....

Also, Here Are Several New Catalysts Helping Docusign Stock Growth.....

1. Earnings Report.....

DocuSign, Inc. is estimated to report earnings on September 02, 2021.

DOCU is projected to report earnings of $0.39 per share, which would represent year-over-year growth of 129.41%. The most recent consensus estimate is calling for quarterly revenue of $482.48 million, up 40.99% from the year-ago period.

Looking at the full year, Consensus Estimates suggest analysts are expecting earnings of $1.68 per share and revenue of $2.03 billion. These totals would mark changes of +86.67% and +39.39%, respectively, from last year.

2. Options Buying.....

There has been some bullish buying in DocuSign options contracts. Last week saw the USD 310 calls, expiring on July 23, and volume quite high.

3. ARK Innovation ETF.....

DocuSign is one of the holdings in the ARK Innovation ETF. The stock ranks as the No. 14 holding, with a 2.75% weighting. DocuSign trades alongside high-profile companies in this fund, including the likes of Tesla, which is the top holding with a 10.14% weighting, payments platform Square with 5.12% and cryptocurrency exchange Coinbase with 4.27%.

The Recommended Docusign Weekly Options Trade.....

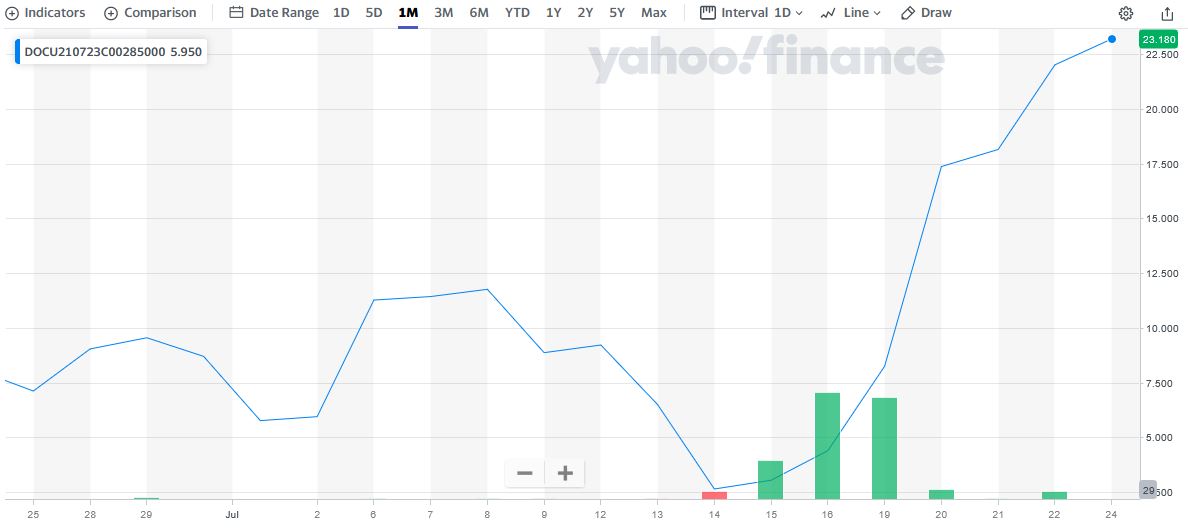

** OPTION TRADE: Buy DOCU JUL 23 2021 285.000 CALLS at approximately $5.90.

(Actually bought for $6.20)

Docusign Weekly Options Trade Call Success Explained.....

On Tuesday, July 06, 2021, “Weekly Options Members,” entered the Docusign Weekly Options trade mentioned above for $6.20, shortly after the market opened.

By expiry of the option, Friday, July 23, 2021, the price of the option hit $23.18 – up

It is very likely that a new Docusign Weekly Options trade, moving forward, as the catalysts listed below are still applicable.

Join us and see what we are proposing!

Why the Recommendation and

the Reasoning behind

the DOCUSIGN Weekly Options Trade

Prelude.....

It is inevitable that you will need to sign documents throughout your life. And Docusign Inc (NASDAQ: DOCU) is transforming this cornerstone of business by unblocking the signing bottleneck. They have opened the entire agreement process to automation and, in doing so; have become a clear leader in an area with room for massive growth.

And, the coronavirus was a big boost to Docusign's e-signature platform as businesses scrambled to continue operating in a remote environment. As the pandemic slowly becomes something in our rearview mirror, inflation has crept up above 3% for the first time in over a decade.

Understanding The Pricing of Docusign Products…..

This is really important to understand as we look at the future of DocuSign and how companies adopt this product and end up potentially paying more every year. There are really two key components. As product functionality, whether you're a single-user, a business pro, or buying the enterprise platform, there's a couple of different platforms, and this is really [about] features. What kind of features do you want, and how many users are generally going to log into the platform. That sets a base subscription fee.

Then they tag on components. There's no magic formula that they publish, but this is certainly what goes through the contract process and the pricing process for enterprises is they look at the capacity of what's called envelopes. Think of envelopes as a document that needs to get a couple of signatures, that's running around the internet to make those happen.

The Major Catalysts BEHIND THE DOCUSIGN WEEKLY OPTIONS TRADE

1. Docusign Contracts and Revenue.....

One of the other key factors about DocuSign, is 88 percent of its revenue comes from its enterprise and commercial customers. These are large corporate customers businesses that have multiple employees, probably in multiple locations. Customers close to doubled over the past couple of years.

The dollar-weighted contract average length is about 18 months. Most contracts are under 12 months or at 12 months, and then about a third of them are over 12 months. One of the things that could play out is as envelopes are used up, that's something that DocuSign knows, because this is cloud software, so that gives the salesperson an opportunity to come back a couple of months later, 3, 6, 9 months before the contract is up; which provides them an opportunity to come back and talk to them about upping their contract volume, or even upping it from a functionality standpoint.

There are many companies that are in their first contract, and their first time they've estimated the envelopes. The other thing that happens, is look at this net dollar retention, which is just going up over time and this is really impacted by larger companies signing on the DocuSign, and realizing the benefits across their organization for more use cases and more departments, and potentially even integrating it into existing infrastructure and process workflows.

2. Customer Growth.....

Enterprise and commercial revenue makes up 88% of the business.

Total customers are 988,000, almost 1 million customers. Interestingly enough, only 14% of its customers are enterprise in commercial, but they make up 88% of the revenue.

DocuSign manages contracts from beginning to end, and executing them in a corporate environment. This second act for DocuSign is really focused on its corporate customer and digitizing and making contracts like a living piece of software versus just a piece of paper. That's all about corporate customers.

Almost every single department across the enterprise has agreement as part of their doing business.

3. Inflationary Considerations.....

Inflation has crept up above 3% for the first time in over a decade.

The rolling four-quarter revenue growth year-over-year is accelerating. Inflationary periods now kick in and the salesperson comes back and says, hey, you need to renegotiate your contract and it has gone up by five percent or went up by seven percent. There is no way the company is going to say, well, we're not using the product as much as we thought we can get by on paper signatures. Nobody is going to say that; therefore, DocuSign is well set up, in any environment going forward even in an inflationary period.

4. Untapped Market.....

DocuSign has been on a roll with its flagship e-signature software as businesses scrambled to adapt to remote working environments. But this e-signature specialist has much more available to customers to enhance the overall agreement process. This is a huge untapped market opportunity for the company.

Docusign received a leader ranking from Gartner for its contract management project. This is the second year in a row that DocuSign has been ranked as a leader. This year, it placed highest among 15 vendors related on the "ability to execute axis" and it ranked highly on the "completeness of vision" axis.

Why does this matter? E-signature is really just the ticket to entry for this tech subscription company. Once customers are in doing this e-signature thing, they're looking to see what other benefits this software can bring. The market for this cloud opportunity beyond e-signature is just as big as the e-signature market. The software that it has enables companies to do more with their contracts. Think about how contracts are handled today. Almost any department can sign a contract, whether it's for their property maintenance or for legal services or development services, or even freelancers. These end up getting shared all over the company in shared drives, Word docs, PDF files, maybe even paper storage.

The e-signature market is $26 billion. This is essentially annual revenue that is there for an opportunity. Notary and identification services, $4 billion. This broader Cloud agreement, $17 billion, and then, just the contracts platform overall is $3 billion. These three on the bottom, they've not released any progress against these, partly because this e-signature business has been growing so fast for them. This company has got a ton of opportunity ahead of itself.

5. Return to Normalcy.....

The U.S. government is looking at this Independence Day weekend to largely mark the country’s return to normalcy after over a year of disruption by the Covid-19 pandemic. About 46% of the U.S. population is now fully vaccinated, per the U.S. CDC and mask mandates have also largely been lifted for vaccinated people, signaling the government’s confidence in the recovery.

Companies are likely to adopt a hybrid working model post the pandemic giving employees some flexibility to work remotely. Moreover, with the broader trend of greater digitization, those software companies which are focused on connectivity, collaboration, and cybersecurity, should stand to benefit. And, DocuSign, a company focused on e-signature solutions, has been the strongest performer, with its stock rising by 25% year-to-date.

The trend of working from home appears to be here to stay even post the pandemic, as companies look to cut costs, access a larger base of talent, and give employees more flexibility. This should ensure that demand holds up in the long-term.

5. Analysts’ Opinions.....

Wedbush raised their price objective on DocuSign from $260.00 to $290.00 and gave the stock an “outperform” rating in a research note on Friday, June 18th.

DOCU has also been the subject of a number of research reports.....

- TheStreet upgraded DocuSign from a "d" rating to a "c-" rating in a research report on Thursday, June 3rd.

- Morgan Stanley increased their price target on DocuSign from $290.00 to $295.00 and gave the company an “overweight” rating in a research note on Friday, June 4th.

- Bank of America reaffirmed a "buy" rating and issued a $250.00 target price on shares of DocuSign in a report on Wednesday, April 14th.

- Oppenheimer lowered their target price on DocuSign from $300.00 to $260.00 and set an "outperform" rating for the company in a report on Friday, June 4th.

- Finally, Royal Bank of Canada started coverage on DocuSign in a research note on Friday, June 11th. They set an “outperform” rating for the company.

20 Wall Street analysts have issued ratings and price targets for DocuSign in the last 12 months. Their average twelve-month price target is $272.29, predicting that the stock has a possible downside of 2.34%, or that analysts will be looking to re-assess their calls. The high price target for DOCU is $325.00 and the low price target for DOCU is $215.00. There are currently 3 hold ratings and 17 buy ratings for the stock, resulting in a consensus rating of "Buy."

Summary.....

With e-signature growth being the primary focus coming into the coronavirus, that has overshadowed growth for the CLM business. In a recent quarter, CEO Daniel Springer said, "Our view coming out of fiscal year '21, particularly out of Q4." This was a couple of months ago. "We're seeing that to build the pipeline of growth again. We're quite optimistic we're going to see that reacceleration we saw a little over a year ago." What they're seeing from their largest customers is, "Hang on. Let me just get e-signature in place. We've got a crisis as people broke out remotely and we didn't expect that."

As people come back into the office DocuSign has had another year to improve their software.

Conclusion.....

DocuSign boasts more than 1 million customers and more than a billion people have signed their names on documents using the platform.

There was an acceleration in the company’s growth during the COVID-19 year. Even the U.S. SEC recently paved the way for companies filing their 10-K and 10-Q documents to do so using electronic signatures.

The company is looking to increase the wide-scale adoption of e-signatures and bolster the use cases for its technology. DocuSign has also moved into the cloud with its DocuSign Cloud offering, where it handles the management, storage and security of documents in addition to signatures.

DocuSign climbed 25.8% for the first half of 2021, according to S&P Global Market Intelligence. This rally built on market-crushing gains of 200% the growth stock delivered in 2020 as DocuSign continued to dominate the electronic-signature market in the midst of a global pandemic.

Therefore…..

The Docusign Weekly Options Trade Was A Big Winner!

What Further Docusign Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs -

Fortinet Call Option Delivers Triple-Digit Return in Just One Week!

Fortinet Call Option Delivers Triple-Digit Return in Just One Week! Fortinet is crushing it in the AI-driven cybersecurity space. -

What’s Fueling Unity’s 131% Options Spike This Week?

What’s Fueling Unity’s 131% Options Spike This Week? And Is There More Profit To Come?

Back to Weekly Options USA Home Page from Docusign