TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Lockheed Martin Weekly

Call Options Jump

After Topping Earnings Expectations!

Weekly Options Members

Are Up 90% Potential Profit Using A Weekly Call Option!

Recent conflicts in Europe and the Middle East make clear the vital need for strong defensive capabilities. Lockheed Martin Corporation (NYSE: LMT) helps the U.S. and its allies protect themselves from a growing list of threats

Then, on Tuesday, Lockheed Martin topped expectations for Q3 results.

This set the scene for Weekly Options USA Members to profit by 90%, using a LMT Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, October 18, 2023

by Ian Harvey

Lockheed Martin Corporation (NYSE: LMT) topped expectations for Q3 results early Tuesday.

Lockheed Martin earnings declined 1.5% to $6.77 per share adjusted on 2% revenue growth to $16.9 billion.

Analysts expected Lockheed earnings to decline 2.9% to $6.67 per share on a 0.9% revenue uptick to $16.73 billion.

Lockheed's total backlog rose to $156 billion as of September 2023 from $149.99 billion in December 2022. The company saw an increase in orders across every business segment except for aeronautics.

For the 2023 fiscal year, Lockheed Martin guided up to 25.6% earnings growth to range from $27 and $27.20 per share. The company expects 2023 sales between $66.25 billion and $66.75 billion, up to a 1.3% increase from last year.

The full-year earnings of $27.16 per share on $66.68 billion in revenue is forecast.

Lockheed Martin averaged 4.5% earnings growth the past four quarters leading up to Tuesday's results while revenue averaged 4.75% gains during the period.

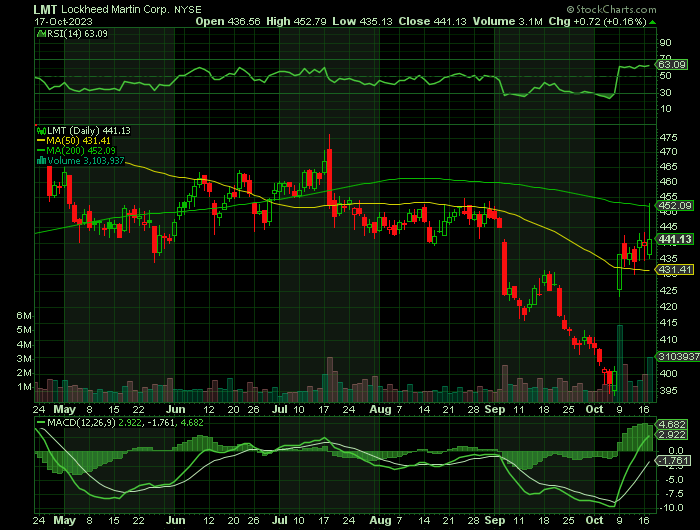

LMT stock has popped back above its 10-week moving average, after diving below that line of technical support in July.

LMT stock fell 9.3% so far in 2023.

Why the LMT Weekly Options Trade was Originally Executed!

Recent conflicts in Europe and the Middle East make clear the vital need for strong defensive capabilities. Lockheed Martin Corporation (NYSE: LMT) helps the U.S. and its allies protect themselves from a growing list of threats.

Now, there are fresh tensions once again erupting in the Middle East, owing to the ongoing violence between Palestine’s Hamas group and Israeli militants that took thousands of lives over the past couple of days. The conflict started with Hamas launching sudden missile attacks on the southern Israeli city of Ashkelon, to which Israel’s military responded with multiple airstrikes on Gaza strip.

This unprecedented assault by Hamas and the retaliatory strikes from Israel are poised to be beneficial for U.S. defense stocks, especially those that are notable weapons suppliers to Israel. Evidently, the Dow Jones U.S. Aerospace & Defense Index surged a solid 6.7%, following the outbreak of the latest Israel-Hamas conflict. This, in turn, puts the spotlight on major weapon manufacturers such as Lockheed Martin Corporation.

The LMT Weekly Options Trade Explained.....

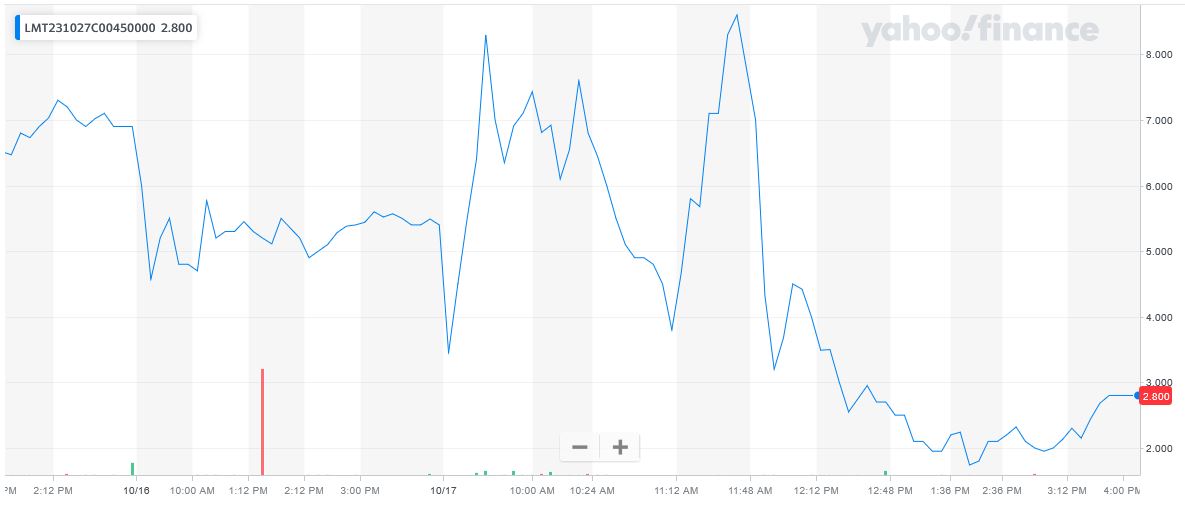

** OPTION TRADE: Buy LMT OCT 27 2023 450.000 CALLS - price at last close was $6.90 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the LMT Weekly Options (CALL) Trade on Monday, October 16, 2023, for $4.57.

Sold the LMT weekly options contracts on Tuesday, October 17, 2023 for $8.70; a potential profit of90%.

Don’t miss out on further trades – become a member today!

About Lockheed Martin.....

Lockheed Martin Corporation was formed in 1995 by the merger of Lockheed Corporation and Martin Marietta. The company is headquartered in Bethesda, Maryland, and is the No. 1 U.S. defense contractor by revenue and market cap. It is the world’s third-largest aerospace company, with 75% of its business in the defense market. Ten percent of Pentagon spending goes to Lockheed Martin, and 50% of its annual revenue comes from the Department of Defense. In 2020, it was the No. 1 recipient of Pentagon spending, at $72.9 billion, more than three times the money spent on the No. 2 U.S. defense player and more than all spent on the second through fourth positions.

Lockheed Martin Corporation’s roots date back to the Loughead (pronounced Lockheed) Aircraft Manufacturing Company, founded by the Loughead brothers in 1912. By 1920, the first venture had gone bankrupt due to a decline in post-WWI demand, but it restarted in 1926. Investors, including John Northrop of Northrop Grumman Corporation, raised the money to start the Lockheed Aircraft Manufacturing Company. They used technology developed from 1912 to 1920 to produce the Vega, a cutting-edge passenger plane that could seat up to seven passengers.

By 1928, the company made about five planes a week and brought in more than $1 million per year. The Depression cut the bottom out of the aircraft market, and the company fell on hard times. By this point, the founders were out of the business and failed to make a bid to repurchase the company when it fell into receivership. Among the many early successes were the Vega and the Model 10 Electra, both flown by Amelia Earhart, the latter to her end.

The new Lockheed Aircraft Corporation expanded its aircraft lines into World War II, including plans for potential defense aircraft. This planning had the company in an excellent position to win defense contracts when the U.S. entered World War II and helped launch it to its current status. It was also when the company launched the advanced development projects, which came to be called Skunk Works. Skunk Works is responsible for many advances in military technology, including the first kill recorded in jet-to-jet combat. Cold War advances include the C-130, the Polaris Submarine-Launched Ballistic Missile System and the iconic SR-71 Blackbird.

Martin Marietta was formed in 1961 by the merger of Glenn L. Martin Company and American Marietta Corporation. The company was an aerospace-focused manufacturer specializing in missiles and missile systems. Projects accredited to it include the Titan and Pershing Missile Systems and the MGM-51 Shillelagh Anti-Tank Guided Missile System.

Today, Lockheed Martin Corporation operates as a security and aerospace company worldwide. It researches, designs, develops and manufactures defense and security systems for government and private use. The company operates in four segments: aeronautics, missiles and fire control, rotary and mission systems and space. The company’s other projects include health, renewable energy, energy distribution and nuclear fusion research and development.

Further Catalysts for the LMT Weekly Options Trade…..

Lockheed produces the F-35 stealth fighter jet, which serves a crucial role in the national security strategies of the U.S. military and 17 allied nations. The company's diverse product portfolio also includes satellites, helicopters, cargo planes, and a wide array of other defensive systems.

LMT recently clinched a contract involving MH-60R helicopters. Valued at $379.6 million, the deal has been awarded by the Naval Air Systems Command, Patuxent River, MD.

Per the deal, LMT will manufacture and deliver eight MH-60R helicopters for the government of Spain. The contract is expected to be completed by March 2027. The majority of the work related to this deal will be carried out in Owego, NY, and Stratford, CT.

Nations are reinforcing their military capabilities to strengthen their defense structure in the growing threat environment. In this context, military helicopters that play a critical role in military missions have also witnessed a significant rise in demand.

Such augmented demand tends to benefit LMT as the company boasts an impressive portfolio of military helicopters like MH-60R, Black Hawk, Seahawk and CH-53K King Stallion heavy-lift helicopters and a few more.

The company enjoys strong demand for its fleet of combat-proven helicopters, which continues to attract customers and results in a significant order inflow for the company, like the latest one. This tends to boost Lockheed’s revenue generation prospects.

The military rotorcraft market is likely to witness a CAGR of more than 4% during the 2022-2027 period. Such a forecast suggests significant prospects for Lockheed to capitalize on growth in the military helicopter market, given its established position in this segment.

Other Catalysts.....

LMT offers its C-130 and F-16 aircraft to Israel that the Israel Air Force has been using since the 1970s and 1980s, respectively. Israel is the owner of the largest fleet of F-16 fighters outside the United States.

In light of the current situation, LMT’s shares have risen 8.6% since Oct 6, following Hamas’ latest strike on Israel. To tackle the ongoing violence in Southern Israel, U.S. Secretary of Defense Lloyd Austin recently ordered more of Lockheed-built F-35 and F-16 fighter aircraft to squadrons in the region.

Analysts.....

UBS initiated coverage of Lockheed Martin with a Neutral rating and $470 price target. The firm sees low-single digit budget growth, with the 25% trailing two-year investment increase yet to flow through to revenue.

According to the issued ratings of 16 analysts in the last year, the consensus rating for Lockheed Martin stock is Hold based on the current 1 sell rating, 10 hold ratings and 5 buy ratings for LMT. The average twelve-month price prediction for Lockheed Martin is $489.19 with a high price target of $555.00 and a low price target of $332.00.

Summary.....

Lockheed has a bountiful free cash flow -- including $6.1 billion in 2022 -- Lockheed has provided a steadily growing stream of dividend income to its shareholders. The company's stock buybacks also help to support a rising share price.

Investors can expect more dividend increases in the years ahead. Lockheed's order backlog grew to a whopping $158 billion by the end of the second quarter. This gives the defense giant excellent visibility into its future cash flow, a large portion of which it probably will pass on to shareholders.

Lockheed Martin has a quick ratio of 1.16, a current ratio of 1.36 and a debt-to-equity ratio of 1.87. Lockheed Martin has a 12-month low of $388.10 and a 12-month high of $508.10. The firm has a 50 day moving average price of $432.74 and a two-hundred day moving average price of $452.24. The company has a market capitalization of $111.07 billion, a PE ratio of 16.13, and a price-to-earnings-growth ratio of 1.92 and a beta of 0.67.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from LOCKHEED MARTIN

Recent Articles

-

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs -

Fortinet Call Option Delivers Triple-Digit Return in Just One Week!

Fortinet Call Option Delivers Triple-Digit Return in Just One Week! Fortinet is crushing it in the AI-driven cybersecurity space. -

What’s Fueling Unity’s 131% Options Spike This Week?

What’s Fueling Unity’s 131% Options Spike This Week? And Is There More Profit To Come?