TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Exiting Nike Options Trade Before Earnings!

“Weekly Options” Members

Profit Up 92% In 3 Days!

More Gains Expected?

Thursday, June 24, 2021

by Ian Harvey

Exiting options trades on Nike before earnings by using the advantage of a positive run-up can be very profitable; without relying on the unpredictable direction after the report is presented.

“Weekly Options Members,” using an options call trade on NKE, made potential profits of 92% in 3 days!

Timing exiting options trade on Nike Inc (NYSE:NKE)

Timing exiting options trade on Nike Inc (NYSE:NKE) before earnings was left to the individual member, as all traders have their own risk tolerance. We usually recommend an exit price, but due to the recent past volatility experienced by the stock market, exiting options trade on FedEx seems to be advantageous at this point.

The earnings report is due out Thursday, June 24, 2021, after the market closes.

By exiting options trade before the report means that we are not to relying on the earnings to push the options trade prices higher. As has been noticed in the past few weeks, even the companies that have presented excellent earnings reports have had pull-backs when not expected.

The Recommended Nike Options Trade.....

** Buy NKE JUN 25 2021 130.000 CALLS at approximately $2.70.

(Actually bought for $2.65)

Nike Exiting Options Trade Call Success Explained.....

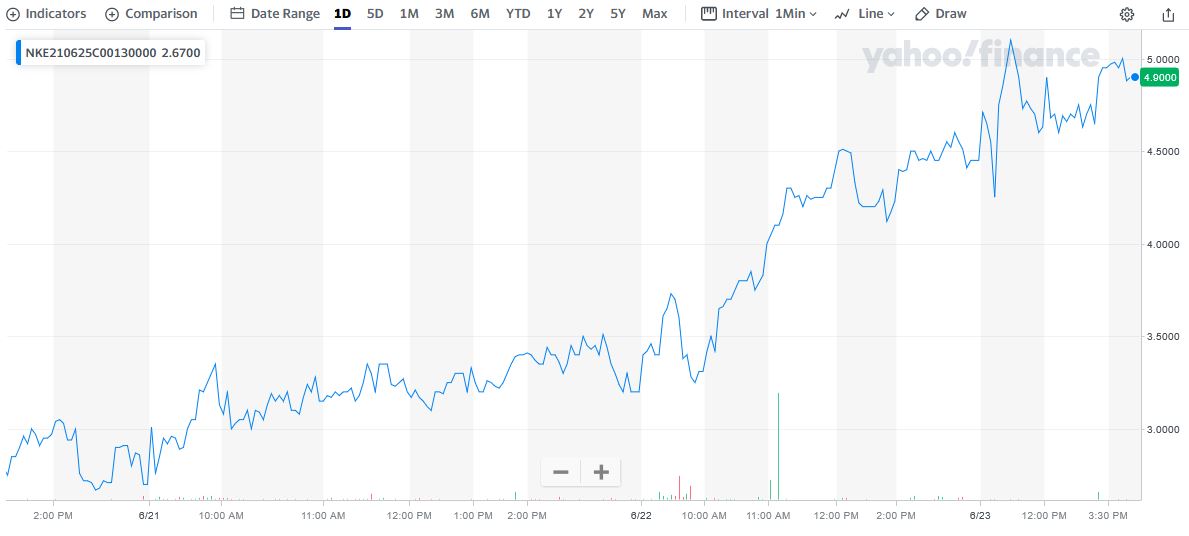

On Monday, June 21, 2021, “Weekly Options Members,” entered the trade mentioned above for $2.65.

By 9:55am the exit price of the options trade had hit $3.55 – a potential profit of 34% or $90 after subtracting the buy price – in less than half an hour.

However, for those that retained their options trade, Wednesday saw the exit price hit $5.10 – now the potential profit is up 92% or $245.

The question now is should we exit the trade or wait for more profit?

Why the Recommendation and the Reasoning behind Exiting Options Trade on Nike.

Nike is confirmed to report earnings at approximately 4:15 PM ET on Thursday, June 24, 2021.

NIKE has been benefiting from robust growth in the digital and direct businesses, lower operating expenses, and improved margins. Amid the coronavirus crisis, digital portals have quickly gained prominence, becoming the primary channel to engage and serve customers. NIKE benefited from this shift, thanks to its efficient digital ecosystem that comprises its online site as well as commercial and activity apps.

The Major Catalysts for This Trade.....

1. Earnings.....

The consensus earnings estimate is for $0.51 per share on revenue of $11.09 billion; but the Whisper number is higher at $0.64 per share.

Consensus estimates are for year-over-year earnings growth of 200.00% with revenue increasing by 75.67%.

Overall earnings estimates have been revised higher since the company's last earnings release. Nike has an Earnings ESP of +8.83% at the moment, suggesting that analysts have grown bullish on its near-term earnings potential.

In its last earnings report, Nike disappointed investors who were looking for evidence of a powerful growth rebound. Instead, sales dropped 10% in the core U.S. market and only edged up by 3% worldwide.

Management said that the early 2021 stumble was due to supply chain challenges, which means there should be much better news in Nike's upcoming report.

2. Sales.....

All the ingredients are in place for Nike to announce a head-turning growth figure on Thursday. Sales a year ago were depressed by COVID-19 shutdowns, for one. Nike also said a significant portion of its sales last quarter were pushed into the next quarter because of shipping delays.

The company has been witnessing robust digital sales growth across all regions for the past few months. In the fiscal third quarter, digital sales for the NIKE brand witnessed double-digit growth across North America, Greater China and APLA along with triple-digit growth in EMEA.

Even as stores reopen, the company continues to witness strong digital trends, which demonstrate the strength of its brands and investments made over the past several years to improve digital consumer experiences. The persistence of the digital shopping momentum is likely to have contributed meaningfully to its sales in the fourth quarter of fiscal 2021.

Additionally, higher full-price product margins, owing to the geographic mix and favorable digital mix, have been aiding gross margin. Also, lower SG&A expenses due to tight operating expense management as well as effective marketing spending are likely to have aided the bottom line in the fiscal fourth quarter.

Lastly, industry peers have painted an encouraging picture of the market as we approach the summer selling season. Foot Locker credited Nike brands for helping deliver an 80% sales spike in the first quarter. lululemon athletica (NASDAQ:LULU) doubled its revenue year over year as consumers enthusiastically shelled out for athleisure wear.

All of this good news has investors expecting Nike to report a nearly 80% sales increase to $11.1 billion. Hitting that target would put the company back into record territory following the pandemic year. Sales in the same fiscal quarter of 2019 were $10.2 billion.

3. Analysts’ Opinions.....

Morgan Stanley raised their stock price forecast on Nike to $185 from $172 and said near-term headwinds well flagged but long-term story intact.

“Revenue is a well-understood risk in 4Q, & our predictive model’s outlook has improved. Our online discount tracker suggests GM upside, & SG&A guidance appears conservative, which could drive an EPS beat. ST risk appears priced in per YTD underperformance. Stay OW & raise price target to $185 on lower WACC,” noted Kimberly Greenberger, equity analyst at Morgan Stanley.

“NKE is in the early innings of transition from a wholesaler to a DTC brand. Success would make it one of few to benefit from the shift to eComm (~15% of ‘20 sales). Its DTC business (~33% of ‘20 sales) should ignite its next phase of margin-accretive revenue growth, driving a 29% 5Y EPS CAGR. NKE also stands to benefit from advancing global consumer activewear demand (due to the WFH-induced preference for comfort-oriented apparel/footwear and increased focus on health & wellness). NKE’s strategic portfolio decisions, tech investments, and supply chain innovation also create LT competitive advantages, and are further supported by an industry-leading balance sheet.”

Morgan Stanley raised the stock price forecast to $185 from $172 with a high of $354 under a bull scenario and $97 under the worst-case scenario. The firm gave an “Overweight” rating on the footwear company’s stock.

Eighteen analysts who offered stock ratings for Nike in the last three months forecast the average price in 12 months of $166.94 with a high forecast of $192.00 and a low forecast of $140.00.

The average price target represents 28.02% from the last price of $130.40. Of those 18 analysts, 15 rated “Buy”, two rated “Hold” while one rated “Sell.”

Summary.....

Nike could be looking at surging demand in the U.S. market even as its China division soars. Both geographies will be supported by rising prices and a tilt toward digital sales and premium products. These trends suggest gross profit margin could head toward 50% of sales in 2022 under the most likely selling scenario. Lululemon's profitability jumped by 6 percentage points last quarter to 57% of sales, after all.

Therefore…..

Exiting Options Trade On Nike Before Earnings Has Been A Big Winner!

Will Nike Stock Price Continue To Climb?

Will We Recommend Further Trades On Nike After Earnings?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs -

Fortinet Call Option Delivers Triple-Digit Return in Just One Week!

Fortinet Call Option Delivers Triple-Digit Return in Just One Week! Fortinet is crushing it in the AI-driven cybersecurity space. -

What’s Fueling Unity’s 131% Options Spike This Week?

What’s Fueling Unity’s 131% Options Spike This Week? And Is There More Profit To Come?

Back to Weekly Options USA Home Page from Nike