TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“STATE-OF-THE-ART” Recommendations

- Week Beginning -

Monday, jUNE 07, 2021

Options Trade – Unity Software Inc (NYSE: U) Calls

Friday, June 11, 2021

** OPTION TRADE: Buy U AUG 20 2021 105.000 CALLS at approximately $6.70. (Max. $7.00)

(for those members requiring further guidance.....

Place a pre-determined sell at $13.40.

Also include a protective stop loss of $2.70.)

Unity Software Inc (NYSE: U) is not a household name and many consumers may not know of it, however, it provides a real-time development platform for gaming on the Windows, macOS, and Linux platforms.

Now, the company has created a set of development tools geared toward virtual reality. In the Q1 2021 earnings call, CEO John Riccitiello described the transition from linear 2D to real-time 3D as a "transformative theme" that will change how creators recreate and tell their stories. Virtual reality will likely become a critical component in this transformation. Its software, initially geared for gaming, has now developed applications for industries as diverse as real estate, healthcare, and energy.

Unity also remains popular with developers. When Loup Ventures surveyed Unity developers in 2020, it found that 96% of developers will either maintain or increase their subscriptions to Unity. Roughly 63% also cited ease of use as their main reason for loyalty to the platform.

This loyalty likely played a factor in the 41% year-over-year revenue increase in the latest quarter to $235 million. However, with a near doubling of research and development expenses, its quarterly loss rose to $108 million.

Still, its proportion of customers who spend over $100,000 grew by 25%. With full-year 2021 revenue expected to rise by approximately 30% from 2020 levels, the increases also appear poised to continue.

About Unity Software.....

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices.

The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide.

Earnings.....

Unity Software last issued its quarterly earnings results on Tuesday,

May 11th.

The company reported ($0.10) earnings per share for the quarter, topping

analysts’ consensus estimates of ($0.12) by $0.02.

The company had revenue of $234.80 million during the quarter, compared

to analyst estimates of $217.08 million. During the same period in the prior

year, the company posted ($0.11) earnings per share. The company’s revenue was

up 40.6% on a year-over-year basis.

Analysts forecast that Unity Software will post -1.19 earnings per share for the current year.

Therefore, Unity Software has posted an exceptional start to the year. Revenue of $235 million represented a 41% increase from last year, handily beating management's outlook for as much as $220 million provided just a few months ago. Because of the quarterly beat, the full-year outlook for sales was raised to $1 billion (compared to an expected $950 million to $970 million before).

Unity Software’s President, CEO, and Executive Chairman John Riccitiello referred to how Unity fits into the 3D Metaverse concept at its earnings call. A 3D metaverse is where people interact in 3D virtual experiences.

Riccitiello commented, “So what I think so many get wrong when they think of the metaverse is they see it as a competition as to whether Roblox or Fortnite will win. I see it very differently. There'll be millions of endpoints in the metaverse. And these will include shopping sites, games, social networks, messaging apps, 3D conferencing and job sites and constructions augmented by real-time 3D in the form of Unity Reflect.”

“We can get all these websites going, millions of endpoints or destinations are the metaverse. And it will expand in huge ways in years to come. And what we're doing is providing a lot of the underlying infrastructure to make this happen,” Riccitiello added.

Influencing Factors…..

This cloud-based platform for 3D content creation and collaboration is riding powerful trends. Video games are an early use case for Unity, but the software also powers video editing, architecture and engineering, manufacturing, marketing, and healthcare as well. As the world has gone digital, blurring the lines between the real and virtual worlds is an important way for businesses to engage with customers. Unity is well-suited for the task, and it has a massive opportunity ahead of it with its next-gen experience-creation software. To illustrate the trend, the number of customers spending more than $100,000 a year increased to 837, compared to 668 a year ago.

Along the way, there are ancillary services Unity can expand into outside of actual content creation. One such area is application distribution, helping software developers forge direct relationships with consumers -- an increasingly important competitive advantage given ongoing changes at Apple and Alphabet's Google that are eliminating device activity tracking. Unity's platform offers a workaround to app stores, providing marketing and content delivery network support for firms looking for new ways to monetize their creations.

The opportunity is massive as the world goes digital, and Unity has a stated goal to average at least 30% annual sales growth over the long term. The stock currently trades for half of its all-time high, valuing the company at just shy of 23 times expected 2021 revenue. It's still a premium price tag, but a worthy premium given the sheer breadth and depth of this cloud software's capabilities.

Analysts Thoughts.....

Unity Software has been given an average rating of “Strong Buy” by the twelve research firms that are presently covering the firm. One investment analyst has rated the stock with a sell recommendation, one has issued a hold recommendation and nine have issued a buy recommendation on the company. The average 12-month price objective among brokerages that have covered the stock in the last year is $129.78.

U has been the topic of several research analyst reports.....

- Barclays decreased their price objective on shares of Unity Software from $130.00 to $90.00 and set an “equal weight” rating on the stock in a research note on Wednesday, May 12th.

- Credit Suisse Group began coverage on shares of Unity Software in a research note on Monday, April 5th. They issued an “outperform” rating and a $170.00 price objective on the stock.

- Stifel Nicolaus raised shares of Unity Software from a “hold” rating to a “buy” rating and set a $125.00 price objective on the stock in a research note on Wednesday, May 12th.

- Wedbush decreased their price objective on shares of Unity Software from $175.00 to $125.00 and set an “outperform” rating on the stock in a research note on Wednesday, May 12th.

- Finally, Oppenheimer raised shares of Unity Software from a “market perform” rating to an “outperform” rating in a research note on Thursday, May 20th.

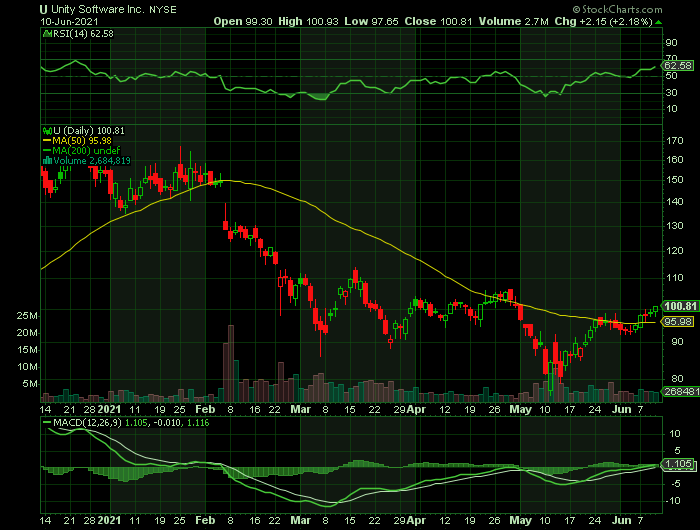

Summary…..

Unity Software’s fifty day moving average is $95.86. The company has a market capitalization of $27.57 billion and a PE ratio of -85.05. Unity Software Inc. has a fifty-two week low of $65.11 and a fifty-two week high of $174.94.

Option Trade – Veeva Systems Inc. (NYSE:VEEV) Calls

Wednesday, June 09, 2021

** OPTION TRADE: Buy VEEV JUL 16 2021 310.000 CALLS at approximately $4.50. (Max. $3.80)

(for those members requiring further guidance.....

Place a pre-determined sell at $9.00.

Also include a protective stop loss of $1.80.)

Cloud solutions provider Veeva Systems Inc. (NYSE:VEEV), a growing mid cap company within the Healthcare sector, gained 57.5% last year; and in the past three years has provided a total return of 246%, as well as 863% in just a bit over five years.

Veeva has been a solid growth play in the life sciences industry. It continues to impress investors with robust growth across its business segments last year, particularly with Veeva Commercial Cloud and Veeva Vault.

On average over the last three years, Veeva Systems Inc. has grown earnings per share (EPS) by 44% each year (using a line of best fit). Its revenue is up 26% over last year.

The company has improved itself over the last few years due to the combination of strong revenue growth with medium-term earnings per share improvement.

Why Veeva?…..

Today, Veeva serves a vital role in the entire life sciences sector. Despite its huge potential, the drug industry is filled with time-consuming and expensive headaches; and only 9.6% of drugs scientists discover ever get approved for sale.

With such daunting data, industry leaders are on the lookout for the kinds of solutions that Veeva provides. They can really drive down the cost of discovery and shorten time to market.

Veeva offers tools to help clients manage the entire clinical suite. It covers everything from collecting and verifying data to making sure clients are ready for any government inspections.

That fact alone helps explain why more than 600 firms, many top-tier firms, are now Veeva clients.

Earnings.....

Veeva Systems' stock price recently popped after the cloud services company posted solid numbers for the first quarter of fiscal 2022. Its revenue rose 29% year over year to $433.6 million, beating estimates by $23.5 million. Its adjusted net income grew 40% to $146.9 million, or $0.91 per share, which also topped expectations by $0.13.

Veeva Systems’ better-than-expected results in first-quarter fiscal 2022 instill confidence in the stock. Both segments performed impressively during the quarter. The company continues to benefit from its flagship Vault platform, which is encouraging. Strength in core CRM and the expanding market share along with customer wins look impressive. A slew of product launches over the past few months also looks impressive. Expansion of both margins bodes well too. A raised guidance for the fiscal year is a major positive as well.

Future Earnings.....

For fiscal 2022, Veeva expects its revenue to rise 24%-25% and for its adjusted EPS to grow 19%. During the conference call, CEO Peter Gassner attributed that sunny guidance -- which has been raised on both the top and bottom lines since the previous quarter -- to the "significant outperformance" of its Development Cloud, which hosts its clinical, regulatory, quality control, and safety data, and the "continued strength" of its Commercial Cloud, which hosts its core CRM platform.

Over the long term, Veeva still believes it can more than double its annual revenue, from $1.47 billion last year to $3 billion in calendar 2025 (which includes most of fiscal 2026). That ambitious goal is comparable to salesforce.com's (NYSE:CRM) target of more than doubling its annual revenue by 2026.

Influencing Factors…..

The cloud services market is crowded, but Veeva dominates its niche for life sciences customer relationship management (CRM) services. Ever since its founding 14 years ago, Veeva has helped biotech and pharmaceutical companies maintain customer relationships, store and analyze data, and track industry regulations and clinical trials on its cloud-based platform.

Its first-mover's advantage has attracted more than 1,000 customers, including Pfizer, AstraZeneca, Moderna, and Merck. Intense competition between all these drugmakers fuels constant demand for Veeva's services.

Other companies -- including IQVIA (NYSE:IQV) and Dassault Systèmes' Medidata -- also provide CRM services for life science companies, but Veeva's Fortune 500 customer base indicates it's still the dominant player in this high-growth market.

Cloud service companies like Veeva generally gauge the stickiness of their ecosystems with their net retention rates, which measure their year-over-year revenue growth per existing customer. A rate exceeding 100% indicates a company is locking in customers and cross-selling more services. Veeva ended fiscal 2021 with a net retention rate of 124%, up from 121% in 2020 and 122% in 2019.

Meanwhile, its adjusted operating margin expanded 250 basis points to 39.8% in fiscal 2021, then climbed another 330 basis points year-over-year to 41.8% in the first quarter of 2022.

Veeva benefited from lower travel expenses during the pandemic, but its high net retention rate and expanding operating margins still suggest it has plenty of pricing power and scale in its niche market.

Veeva is consistently profitable by both GAAP and non-GAAP measures. It spent less than 13% of its revenue on stock-based compensation expenses last year, and its GAAP net income increased 26% to $380 million, which was only slightly lower than its non-GAAP profit of $473 million.

Those stable profits indicate Veeva's cash flows will continue climbing, and it won't resort to dilutive secondary offerings to raise cash. It also has a clean balance sheet and isn't burdened by any term debt.

Strategic Partnerships.....

Veeva Systems has forged a slew of partnerships over the past few months, raising our optimism. The company, in May, announced a strategic partnership with Oncopeptides to support the launch of the latter’s first commercial product.

In April, Veeva Systems entered into a strategic collaboration with Parexel to accelerate clinical trials through technology and process innovation. In February, the company inked a deal with Impel NeuroPharma to expedite the pre-launch preparation for Impel’s migraine treatment INP104, which has been accepted for review by the FDA and will be marketed under the trade name TRUDHESA once approved.

Analysts Thoughts.....

Following the earnings results, Guggenheim analyst Kenneth Wong lifted the price target to $350 (from $340) implying 20.1% upside potential to current levels.

Wong maintained a Buy rating on the stock and said, “We view the consistency of Veeva’s quarterly execution to be every bit as, if not more, impressive than the magnitude of recent outperformance. VEEV delivered another robust print with F1Q22 billings, revenue, and margins all well ahead of elevated investor expectations…Billings outlook is back above the 20% growth threshold, giving us confidence that the recent momentum is sustainable.”

Veeva has been the topic of several research analyst reports.....

- Needham & Company LLC lifted their price objective on shares of Veeva Systems from $327.00 to $336.00 and gave the company a “buy” rating in a report on Wednesday, March 3rd.

- DA Davidson boosted their price objective on Veeva Systems from $325.00 to $350.00 in a report on Wednesday, March 3rd.

- Citigroup raised their target price on Veeva Systems from $335.00 to $340.00 and gave the company a “buy” rating in a report on Friday, May 28th.

- Finally, Piper Sandler raised their price objective on Veeva Systems from $350.00 to $360.00 and gave the company an “overweight” rating in a research note on Friday, May 28th.

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 13 Buys and 5 Holds. The average analyst price target of $331.22 implies 13.7% upside potential to current levels. Shares have gained 33% over the past year.

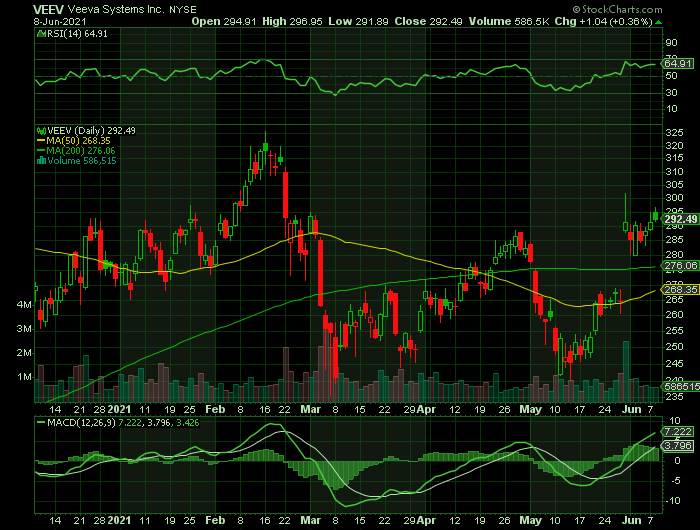

Summary…..

The renowned provider of cloud-based software applications and data solutions for the life sciences industry has a market capitalization of $44.57 billion. The company projects 15.8% growth for the next five years and expects to witness continued improvements in its business. Veeva Systems surpassed the Consensus Estimates in all the trailing four quarters, the average surprise being 14.65%.

Veeva Systems exited the first quarter of fiscal 2022 with better-than-expected results. Both the segments performed impressively during the quarter. The company continues to benefit from its flagship Vault platform, which is encouraging. Strength in core CRM and expanding market share, along with addition of new customers, look impressive.

Favorable feedback for Data Cloud and robust progress of Veeva Link raise optimism. The recent launch of modular content capabilities in Veeva Vault PromoMats is encouraging. Expansion of both margins also bodes well. A raised guidance for the fiscal year is a major positive.

Veeva Systems has a market capitalization of $44.37 billion, a price-to-earnings ratio of 123.50, and a PEG ratio of 8.26 and a beta of 0.74. The stock’s 50-day simple moving average is $268.68. Veeva Systems Inc. has a twelve month low of $201.88 and a twelve month high of $325.54.

Options Trade – Salesforce.com, inc. (NYSE:CRM) Calls

Tuesday, June 08, 2021

** OPTION TRADE: Buy CRM AUG 20 2021 250.000 CALLS at approximately $6.30. (Max. $6.80)

(for those members requiring further guidance.....

Place a pre-determined sell at $12.60.

Also include a protective stop loss of $2.60.)

Last month, the iconic Dow Jones Industrial Average celebrated its 125th anniversary. After more than a century, it remains one of the most widely followed indexes.

The reason the Dow Jones is followed so closely has to do with the 30 high-caliber companies that make up the index. These diverse companies are profitable, time-tested industry leaders. In other words, these are stocks that tend to increase in value over time.

As we move headlong into June, Salesforce.com, inc. (NYSE:CRM) stock stands out with particularly intriguing values.

Salesforce provides cloud-based customer relationship management (CRM) software. In simple terms, CRM software helps consumer-facing businesses access information in real time. It can be used for logging client information, following up on service issues, managing online marketing campaigns, and predictive analysis of customer buying habits. It’s software that makes obvious sense for retailers and hotels, for example, but is catching on big-time in the healthcare, financial, and industrial sectors.

When it comes to CRM software, Salesforce sits atop the mountain. According to research estimates from the first half of 2020, Salesforce controlled almost 20% of global CRM revenue share. This was approximately four times higher than the next-closest competitor, and it's more than the Nos. 2 through 5, combined.

With Salesforce on

track to hit $50 billion in annual sales in five years (it yielded $21.3

billion in sales last year), it remains one of the most-exciting mega-cap

growth stocks to own.

About Salesforce.com.....

Salesforce.com pioneered the software-as-service business model under the leadership of founder and CEO Marc Benioff, who founded the company in 1999. Benioff has exhibited a talent for business since he was very young; while in high school, he sold his first app to a computer magazine for $75.

When he was 15, Benioff founded Liberty Software, a one-man company making games for Atari 800. While studying at USC, Benioff took a summer internship with Apple, working as a programmer in the Macintosh division under Steve Jobs himself. This was a profoundly inspiring experience for Benioff.

After a successful career at Oracle from 1986 to 1999, Benioff launched Salesforce.com and with it a new business paradigm for the industry. Salesforce.com's key advantage was that the software was accessed through a web browser and delivered entirely online, which was truly revolutionary at the time.

The company has delivered vigorous growth rates through both organic growth and acquisitions, and management has done a great job at expanding the addressable market and producing all kinds of opportunities for cross-selling. Financial performance has been outstanding over the long term and the company still has ambitious plans for expansion going forward.

Earnings.....

Salesforce's stock recently popped after the cloud services company posted its earnings report for the first quarter of fiscal 2022. Its revenue rose 23% year-over-year to $5.96 billion, beating estimates by $70 million, and grew 20% on a constant currency basis.

Its non-GAAP earnings increased 73% to $1.21 per share, which cleared expectations by $0.33, as its GAAP earnings more than quadrupled to $0.50 per share. Gains from its strategic investments boosted its non-GAAP and GAAP earnings by $0.24 and $0.23 per share, respectively.

During the conference call, CEO Marc Benioff proclaimed it was the "best quarter Salesforce has ever had." Let's see why Benioff made such a bold statement, and whether or not it's time to buy Salesforce.

Salesforce's revenue growth accelerated from its 20% growth in the fourth quarter of fiscal 2021. It also surpassed its own guidance for about 21% growth, which had already been raised in the fourth quarter. Its revenue increased by the double digits across all four of its core businesses.

It also generated double-digit sales growth across the Americas, EMEA (Europe, Middle East, and Africa), and APAC (Asia-Pacific) regions, even as currency headwinds throttled its growth in several markets.

Salesforce's current remaining performance obligation (CRPO), which represents its expected future revenue from existing contracts over the next 12 months, rose 23% year-over-year to $17.8 billion, which indicates its revenue growth will remain comfortably above 20% for the rest of the year.

That's why Salesforce raised its full-year revenue guidance by $250 million to approximately $26 billion, which would represent 22% growth from 2021. It also reiterated its goal of generating $50 billion in annual revenue by fiscal 2026.

Salesforce's operating cash flow jumped 76% year-over-year to $3.2 billion during the first quarter, while its free cash flow soared 99% to $3.1 billion. It usually generates its strongest cash flow growth in the fourth and first quarters, since that's when it usually collects its annual fees.

Moving Forward.....

Based on the solid Q1 results, the company raised its financial outlook for the second quarter. Management now expects Q2 FY22 non-GAAP EPS to range between $0.91 and $0.92. The company has forecast second-quarter revenues to land between $6.22 billion and $6.23 billion.

For FY2022, Salesforce expects to earn revenues between $25.9 billion and $26 billion while non-GAAP earnings are likely to be in the range of $3.79 per share to $3.81 per share. It is important to note here that the FY22 revenue outlook includes $500 million from its acquisition of Slack Technologies and assumes that the acquisition will close in the second quarter.

Influencing Factors…..

Salesforce’s key product is the Customer 360 platform, an artificial intelligence (AI) powered CRM platform that helps companies to sell, service, market, and conduct business. The company also offers cloud-based solutions. Salesforce has pursued a strategy of adding new capabilities to its Customer 360 platform through acquisitions including Vlocity for $1.33 billion in July last year and Tableau for $15.7 billion in August 2019.

Salesforce is growing inorganically, too. After a number of masterful acquisitions (e.g., Tableau and Mulesoft), the company is in the midst of acquiring cloud-based enterprise communications platform Slack Technologies. Though Slack's platform will add a new channel of high-margin subscription services, the true value is in being able to cross-sell CRM solutions to Slack's small and medium-size client base.

The company’s analytical service offering, Tableau, provides analytics solutions to customers and was part of eight of Salesforce’s top 10 deals in the first quarter and more than 60% of the company’s seven-figure plus deals.

CRM’s integration services solution, MuleSoft, helps its customers unify, unlock, and secure their data and this offering was included in five of Salesforce’s top 10 deals. In Q1, CRM saw a record number of “seven-figure deals”.

Salesforce expects to close its takeover of Slack (NYSE:WORK) in the second quarter. That $27.7 billion acquisition, which includes $26.79 in cash and 0.0776 shares of Salesforce's common stock for each share of Slack, will temporarily reduce its cash flows and earnings this year.

However, integrating Slack's enterprise communication platform into its CRM (customer relationship management) services will likely lock in more users, break down the barriers between its cloud services, and enhance its Customer 360 platform for digitizing customer experiences.

Slack will feed more data into Salesforce's data-crunching Einstein AI platform, and complement its prior acquisitions of the application network provider MuleSoft and the data visualization platform Tableau.

Salesforce controls about a fifth of the global CRM market, according to

IDC, while its closest rivals all hold single-digit shares. That market-leading

position, along with its expanding ecosystem of services, gives the company

tremendous scale and plenty of pricing power.

Analysts Thoughts.....

Following the earnings, Oppenheimer analyst Brian Schwartz reiterated a Buy and a price target of $265 on the stock. Schwartz said in a research note to investors, “Salesforce.com reported bullish F1Q results and guidance well ahead of expectations on both top and bottom lines. CRPO, which we view as the best leading indicator, accelerated to 32% growth in F1Q, and combined with the higher outlook implies results across the four clouds well-ahead of expectations too.”

“Additionally, Salesforce is generating a record number of big deals and magnitude of upside for the backlog and billings this quarter, which can support long-term growth. We believe the recovery and strength in the customer software market this year is driving a material benefit to the company's bookings. On balance, the F2Q CRPO guidance implies a deceleration from this quarter, but could prove conservative given the strength in the end-market demand and execution,” Schwartz added.

In the past year, the stock has jumped 33.9%.

CRM has been the topic of several research analyst reports.....

- Royal Bank of Canada reiterated their buy rating on shares of salesforce.com in a research note released on Thursday morning. The firm currently has a $290.00 price target on the CRM provider’s stock.

- The Goldman Sachs Group reiterated a buy rating and issued a $320.00 target price on shares of salesforce.com in a research note on Thursday.

- Credit Suisse Group set a $260.00 price target on shares of salesforce.com and gave the stock a buy rating in a research note on Friday, May 28th.

- Finally, Jefferies Financial Group set a $300.00 price target on shares of salesforce.com and gave the stock a buy rating in a research note on Monday, May 31st.

One investment analyst has rated the stock with a sell rating, seven have given a hold rating, twenty-six have assigned a buy rating and one has given a strong buy rating to the stock. The stock presently has a consensus rating of Buy and a consensus target price of $275.33.

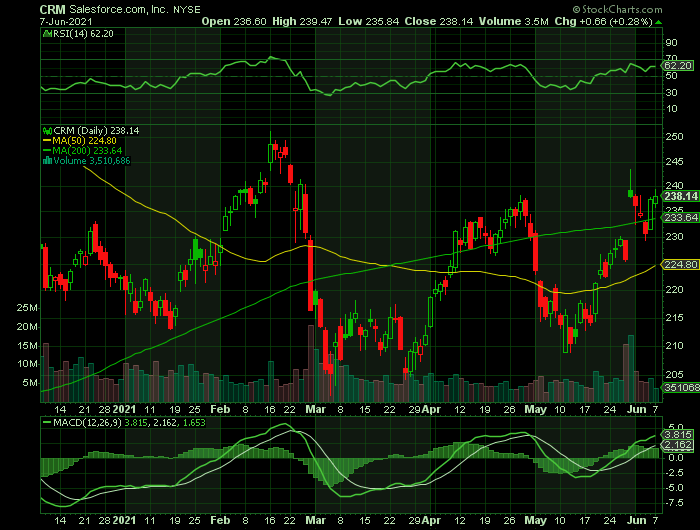

Summary…..

CRM has a current ratio of 1.33, a quick ratio of 1.23 and a debt-to-equity ratio of 0.06. The company has a 50-day moving average of $225.00. salesforce.com has a twelve month low of $167.00 and a twelve month high of $284.50. The company has a market capitalization of $219.91 billion, a PE ratio of 49.68, a PEG ratio of 7.82 and a beta of 1.09.

Option Trade – Pinterest Inc (NYSE: PINS) Calls

Monday, June 07, 2021

** OPTION TRADE: Buy PINS JUL 16 2021 65.000 CALLS at approximately $2.90. (Max. $3.50)

(for those members requiring further guidance.....

Place a pre-determined sell at $5.80.

Also include a protective stop loss of $1.20.)

The past several weeks of trading were dominated by inflation fears that heated up following April’s 4.2% CPI jump. The largest 12-month climb since 2008 came on the back of ramped upped spending, government checks, supply chain setbacks, and comparisons against the coronavirus lows.

Wall Street has, however, seen buyers step in when they felt things were overdone, with the S&P 500 finding support above its 50-day moving average. The Nasdaq, which already suffered a correction in 2021 (down 10% from its highs), has regained its footing after its pullback. The tech-heavy index is once again trading above its 50-day moving average, while the benchmark index pushes back within around 1% of its records.

There appear to be multiple reasons behind the bullishness amid inflation worries. The overall earnings picture for Q1 was impressive and estimates for the second quarter and beyond keep going up. This positive bottom-line outlook helps support the possibility that U.S. GDP grows by 6.5% or more in 2021—its strongest in roughly 35 years.

Along with a booming U.S. economy, driven by the vaccine rollout, some Wall Street bulls might be focused on the likelihood that there is no alternative investing continues even if the central bank is forced to raise rates sooner than originally expected to tamp down rising prices.

But, it is important to consider adding strong, growth-focused stocks as we head into June that are still trading below their highs as the market bounces back…and, one such stock is Pinterest Inc (NYSE: PINS).

PINS is essentially a visual discovery platform. The firm allows users to find and search for products, services, and more, from planning trips and coordinating an outfit to making home-cooked meals, learnings how to remodel or decorate a room, and beyond.

PINS has become a hit with advertisers, small businesses, entrepreneurs,

and do-it-yourself enthusiasts. The company has thrived in the e-commerce and

digital media age as fewer people flip through magazines or catalogs for

purchasing inspiration. Plus, paid content and ads fit seamlessly into

Pinterest, which is vital in our digital-heavy ad world where people pay to

avoid ads on Netflix NFLX and largely ignore more traditional banner ads.

Pinterest is a prime example of a growth-focused technology firm that thrived during the tough early coronavirus environment. PINS was the beneficiary of its own strengths and gained on the back of wider market exuberance off the virus lows.

The stock is up 230% in the last year.

Luckily, the stock has cooled off and closed regular hours Wednesday at roughly $63 a share, or 30% below its mid-February highs.

The stock had recouped nearly all of its losses following its February pullback, but it fell again in early April.

About Pinterest…..

The company was founded in 2010 by Ben Silbermann, a former employee of Alphabet's (GOOGL) Google unit. He was joined by former Facebook (FB) product designer Evan Sharp.

They created an internet application where users can browse millions of images posted by Pinterest users.

Pinterest is not a social media experience like Facebook, Snap (SNAP) and Twitter (TWTR). It's considered more of a personal experience. When users come to Pinterest, often they are trying to find or accomplish something. The site can help with generating ideas or inspiration on a wide range of activities.

The company held its initial public offering in April 2019 that priced PINS stock at 19, raising $1.4 billion with a valuation above $12 billion. Its valuation today is $42 billion.

Earnings.....The company’s FY20 revenue surge 48% to $1.69 billion to nearly match FY19’s 51% sales growth. PINS also added over 100 million new users last year to close 2020 with 459 million. It then topped Q1 estimates at the end of April, with global MAUs up 30% to roughly 480 million. PINS executives also provided strong guidance that sent its consensus earnings estimates soaring, with its adjusted FY21 EPS figure 34% higher and FY22’s up 27%.

Estimates now call for its FY21 revenue to climb another 52% from $1.69 billion to $2.57 billion, with FY22 expected to surge higher 36% (adding nearly another $1 billion) to come in at $3.50 billion. Alongside its impressive top-line growth outlook, PINS adjusted EPS figures are projected to soar 117% this year and 39% in FY22.

Pinterest has blown away earnings estimates in the trailing four quarters.

Influencing Factors…..

Pinterest has tremendous prospects. Its international monthly average users number continues to grow at a brisk pace. The company has significant opportunities in attracting men to its site. Pinterest has been more popular with women so far.

What makes Pinterest unstoppable though, is its ability to increase the monetization of its users. The company's average revenue per user (ARPU) is barely over one-tenth that of Facebook. And its international ARPU is only a fraction of its U.S. ARPU. Pinterest will make significant progress on the monetization front over the next few years, driving its share price much higher.

Pinterest is exceptional at is bringing in new users from outside the United States. On one hand, advertisers will pay top dollar for U.S. MAUs. This means the new users Pinterest is adding generate considerably lower average revenue than U.S. MAUs. But here's the catch: There's the potential to double international average revenue per user many times over this decade. As the company adds 100 million or more international MAUs annually, its ad-pricing power with merchants is bound to move higher.

Social media company Pinterest continues to deliver astonishing balance sheet growth quarter after quarter. Its visual search business model has made the platform an increasingly instrumental advertising tool for companies to market their products and services to Pinterest's vast user base. And for the millions of individuals around the world who use Pinterest on a regular basis - the platform makes it fun and easy to find everything from the latest recipes, craft ideas, and fashion trends to "pinnable" quotes and travel inspiration.

In the first quarter of 2021, Pinterest's revenue surged by a robust 78% from the year-ago period. In addition, the company's monthly active user count soared by 30%, and the average revenue per user increased 34% year over year. Pinterest is also continuing to ramp up its available liquidity. It closed the three-month period with total assets of approximately $2.7 billion (about $914 million of which are cash and cash equivalents) and a far lesser $363.5 million in total liabilities.

Don't overlook Pinterest's potential as a major e-commerce destination.

Its platform might be about sharing the products, places, and services people

like with others, but what it really does is give Pinterest the most targeted

audience of shoppers on the planet. If it can connect merchants that meet these

interests with its users, the sky is the limit for Pinterest as an e-commerce

platform.

Analysts Thoughts.....

Analysts are expecting great things from Pinterest over the next few years. They project that the company can deliver an average earnings growth rate of more than 240% per annum over the next five-year period alone.

PINS has been the topic of several research analyst reports.....

- KeyCorp dropped their price objective on shares of Pinterest from $92.00 to $89.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 28th.

- TheStreet downgraded shares of Pinterest from a "c-" rating to a "d+" rating in a research note on Wednesday, April 28th.

- Susquehanna upped their price target on shares of Pinterest from $67.00 to $90.00 and gave the company a "neutral" rating in a research note on Friday, February 5th.

- JPMorgan Chase & Co. decreased their price target on shares of Pinterest from $102.00 to $95.00 and set an "overweight" rating on the stock in a research note on Wednesday, April 28th.

- Finally, Deutsche Bank Aktiengesellschaft upped their price target on shares of Pinterest from $75.00 to $100.00 and gave the company a "buy" rating in a research note on Friday, February 5th.

Shares of Pinterest have been given an average rating of "Buy" by the thirty-three analysts that are covering the stock. Ten equities research analysts have rated the stock with a hold rating and seventeen have issued a buy rating on the company. The average 1-year target price among brokers that have updated their coverage on the stock in the last year is $80.58.

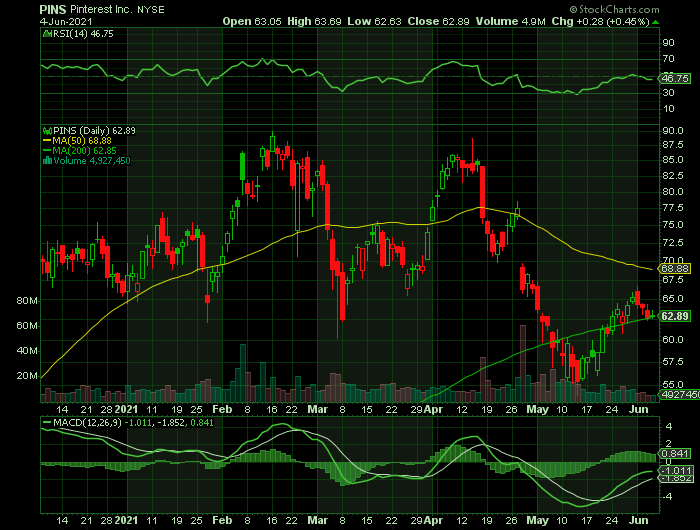

Summary…..

Pinterest is ready to remain a hit with advertisers and users as people disconnect from traditional media. And a recent Wall Street Journal article highlighted the company’s successful use of artificial intelligence to boost “its user and ad-revenue numbers at a much faster pace than most of its social-media peers.” The company is also improving its video capabilities.

Pinterest has a market capitalization of $40.05 billion, a price-to-earnings ratio of -1,048.17 and a beta of 1.24. The company has a 50-day moving average of $68.99. Pinterest has a fifty-two week low of $20.07 and a fifty-two week high of $89.90.

Recent Articles

-

Tariffs and the Stock Market: Positive and Negative Impacts in 2025

Tariffs and the Stock Market: Positive and Negative Impacts in 2025. This article explores both the positive and negative effects of tariffs on the stock market based on recent data, forecasts, and ma… -

SMCI’s Wild Ride: Options Traders Are Profiting From the Ups and Downs

SMCI’s Wild Ride: How Options Traders Are Profiting From the Ups and Downs -

Fortinet Call Option Delivers Triple-Digit Return in Just One Week!

Fortinet Call Option Delivers Triple-Digit Return in Just One Week! Fortinet is crushing it in the AI-driven cybersecurity space.